- Belgium

- /

- Personal Products

- /

- ENXTBR:ONTEX

Investors Can Find Comfort In Ontex Group's (EBR:ONTEX) Earnings Quality

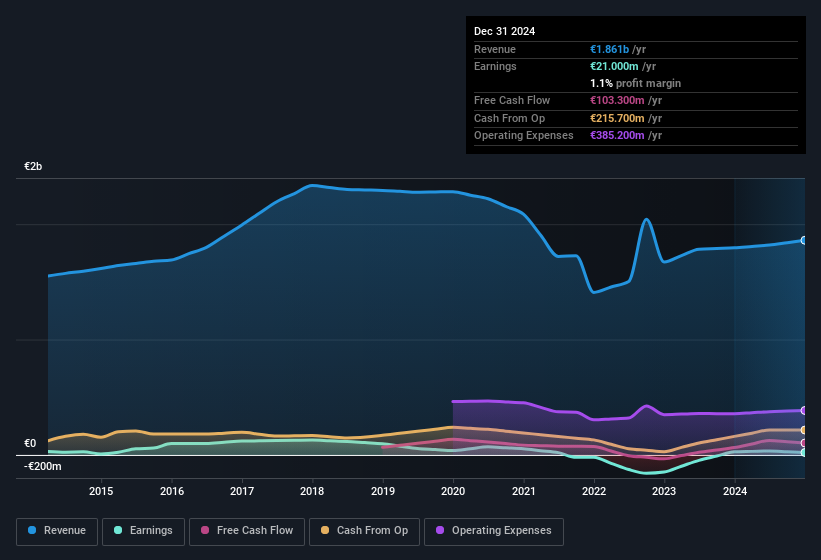

Soft earnings didn't appear to concern Ontex Group NV's (EBR:ONTEX) shareholders over the last week. We did some digging, and we believe the earnings are stronger than they seem.

View our latest analysis for Ontex Group

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Ontex Group's profit was reduced by €73m, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. In the twelve months to December 2024, Ontex Group had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Ontex Group's Profit Performance

As we mentioned previously, the Ontex Group's profit was hampered by unusual items in the last year. Based on this observation, we consider it possible that Ontex Group's statutory profit actually understates its earnings potential! Unfortunately, though, its earnings per share actually fell back over the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. In terms of investment risks, we've identified 2 warning signs with Ontex Group, and understanding these bad boys should be part of your investment process.

This note has only looked at a single factor that sheds light on the nature of Ontex Group's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:ONTEX

Ontex Group

Develops, produces, and supplies personal hygiene products and solutions for baby, feminine, and adult care in Belgium, the United Kingdom, Italy, the United States, France, Poland, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives