- Belgium

- /

- Medical Equipment

- /

- ENXTBR:IBAB

Ion Beam Applications' (EBR:IBAB) Shareholders Are Down 64% On Their Shares

It is doubtless a positive to see that the Ion Beam Applications SA (EBR:IBAB) share price has gained some 43% in the last three months. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. Indeed, the share price is down 64% in the period. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

See our latest analysis for Ion Beam Applications

We don't think that Ion Beam Applications' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over half a decade Ion Beam Applications reduced its trailing twelve month revenue by 0.7% for each year. That's not what investors generally want to see. With neither profit nor revenue growth, the loss of 10% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

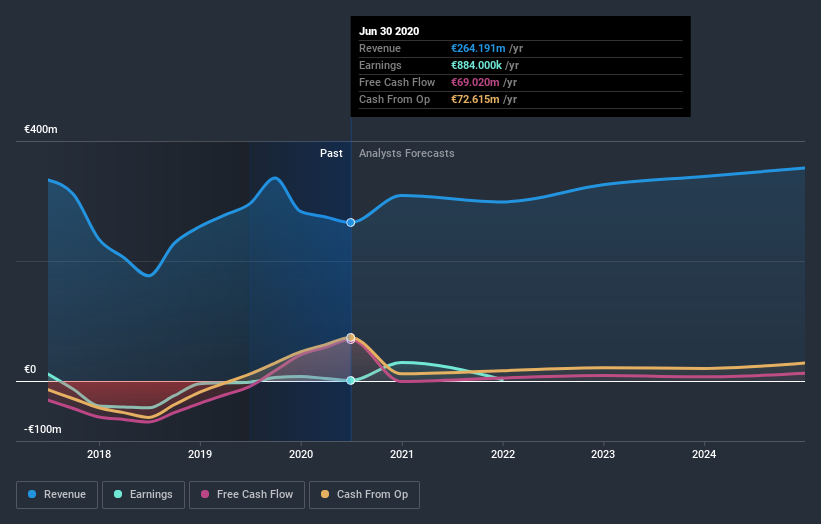

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Ion Beam Applications has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market lost about 10% in the twelve months, Ion Beam Applications shareholders did even worse, losing 18% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Ion Beam Applications is showing 4 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

If you decide to trade Ion Beam Applications, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTBR:IBAB

Ion Beam Applications

Designs, produces, and markets solutions for cancer diagnosis and treatments in Belgium, the United States, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion