- Belgium

- /

- Medical Equipment

- /

- ENXTBR:IBAB

Here's Why Shareholders May Want To Be Cautious With Increasing Ion Beam Applications SA's (EBR:IBAB) CEO Pay Packet

In the past three years, the share price of Ion Beam Applications SA (EBR:IBAB) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 09 June 2021. They could also influence management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Ion Beam Applications

How Does Total Compensation For Olivier Legrain Compare With Other Companies In The Industry?

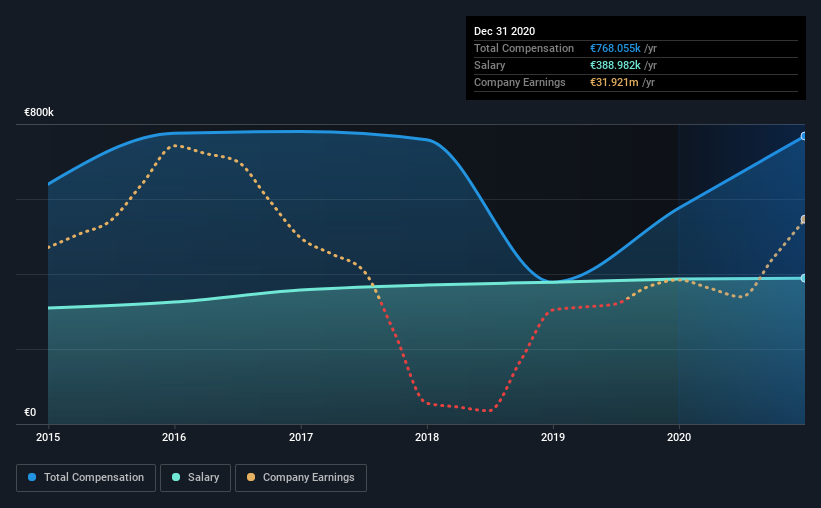

According to our data, Ion Beam Applications SA has a market capitalization of €488m, and paid its CEO total annual compensation worth €768k over the year to December 2020. Notably, that's an increase of 33% over the year before. In particular, the salary of €389.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from €163m to €653m, we found that the median CEO total compensation was €480k. This suggests that Olivier Legrain is paid more than the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €389k | €386k | 51% |

| Other | €379k | €189k | 49% |

| Total Compensation | €768k | €575k | 100% |

Talking in terms of the industry, salary represented approximately 62% of total compensation out of all the companies we analyzed, while other remuneration made up 38% of the pie. In Ion Beam Applications' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Ion Beam Applications SA's Growth

Ion Beam Applications SA's earnings per share (EPS) grew 134% per year over the last three years. It achieved revenue growth of 10% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Ion Beam Applications SA Been A Good Investment?

Given the total shareholder loss of 26% over three years, many shareholders in Ion Beam Applications SA are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Ion Beam Applications that investors should be aware of in a dynamic business environment.

Important note: Ion Beam Applications is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Ion Beam Applications or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTBR:IBAB

Ion Beam Applications

Designs, produces, and markets solutions for cancer diagnosis and treatments in Belgium, the United States, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion