- Belgium

- /

- Healthtech

- /

- ENXTBR:AGFB

Agfa-Gevaert NV (EBR:AGFB) Held Back By Insufficient Growth Even After Shares Climb 27%

Agfa-Gevaert NV (EBR:AGFB) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 51% share price drop in the last twelve months.

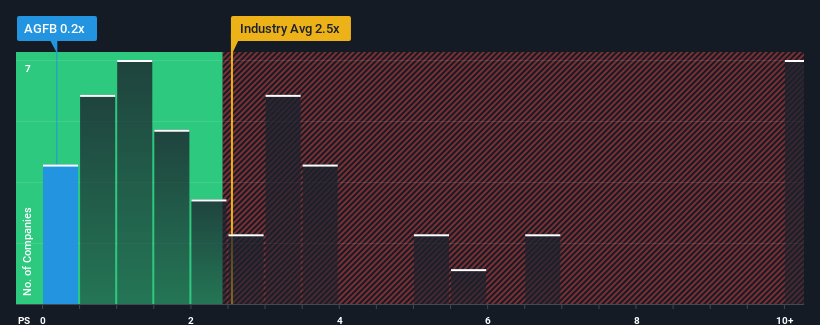

Although its price has surged higher, Agfa-Gevaert may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Healthcare Services industry in Belgium have P/S ratios greater than 2.5x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Agfa-Gevaert

What Does Agfa-Gevaert's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Agfa-Gevaert's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Agfa-Gevaert will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Agfa-Gevaert's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 33% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.8% each year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 10.0% per annum, which is noticeably more attractive.

With this in consideration, its clear as to why Agfa-Gevaert's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Agfa-Gevaert's P/S

Even after such a strong price move, Agfa-Gevaert's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Agfa-Gevaert's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware Agfa-Gevaert is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:AGFB

Agfa-Gevaert

Develops, manufactures, and markets various analog and digital systems worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives