As the European markets navigate a landscape marked by mixed performances among major indices and economic indicators, investors are keenly observing the pan-European STOXX Europe 600 Index, which has remained relatively flat amid ongoing trade discussions with the U.S. Despite challenges such as rising inflation in the UK and fluctuating industrial output across the Eurozone, opportunities abound for discerning investors who can identify stocks with robust fundamentals and growth potential in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Value Rating: ★★★★★★

Overview: CNTEE Transelectrica SA functions as the transmission and system operator for the national power system, with a market capitalization of RON4.31 billion.

Operations: The primary revenue stream for CNTEE Transelectrica comes from its transmission and dispatch services, generating RON7.33 billion. The company's net profit margin has shown a notable trend in recent periods.

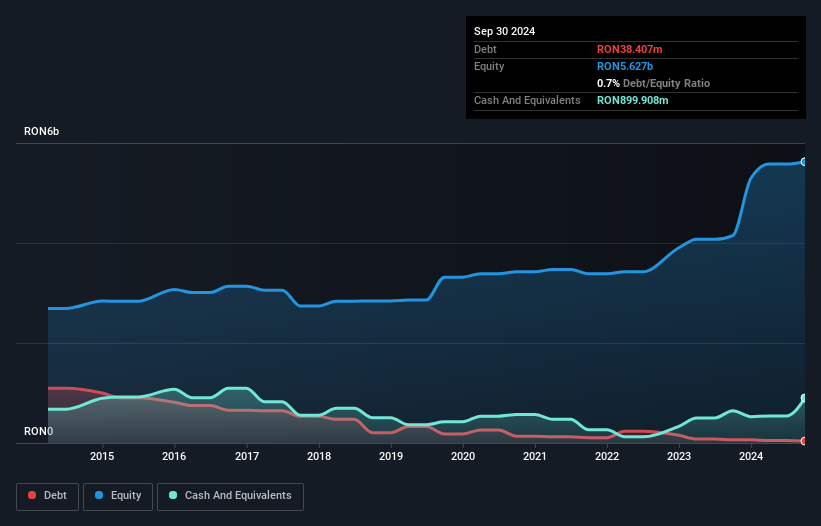

Transelectrica, a notable player in the European electric utilities sector, has shown impressive financial resilience. Over the last five years, its debt to equity ratio plummeted from 7.7% to just 0.6%, reflecting a robust balance sheet. The company reported a remarkable earnings growth of 163%, outpacing the industry's -4% downturn. Trading at 23% below its estimated fair value suggests potential undervaluation in the market. Recent figures reveal net income surged to RON 153 million from RON 104 million year-on-year, with basic earnings per share climbing to RON 2.09 from RON 1.42, painting a promising picture for future prospects.

Spadel (ENXTBR:SPA)

Simply Wall St Value Rating: ★★★★★★

Overview: Spadel SA is a company focused on the production and marketing of natural mineral water in Belgium, with a market capitalization of €838.37 million.

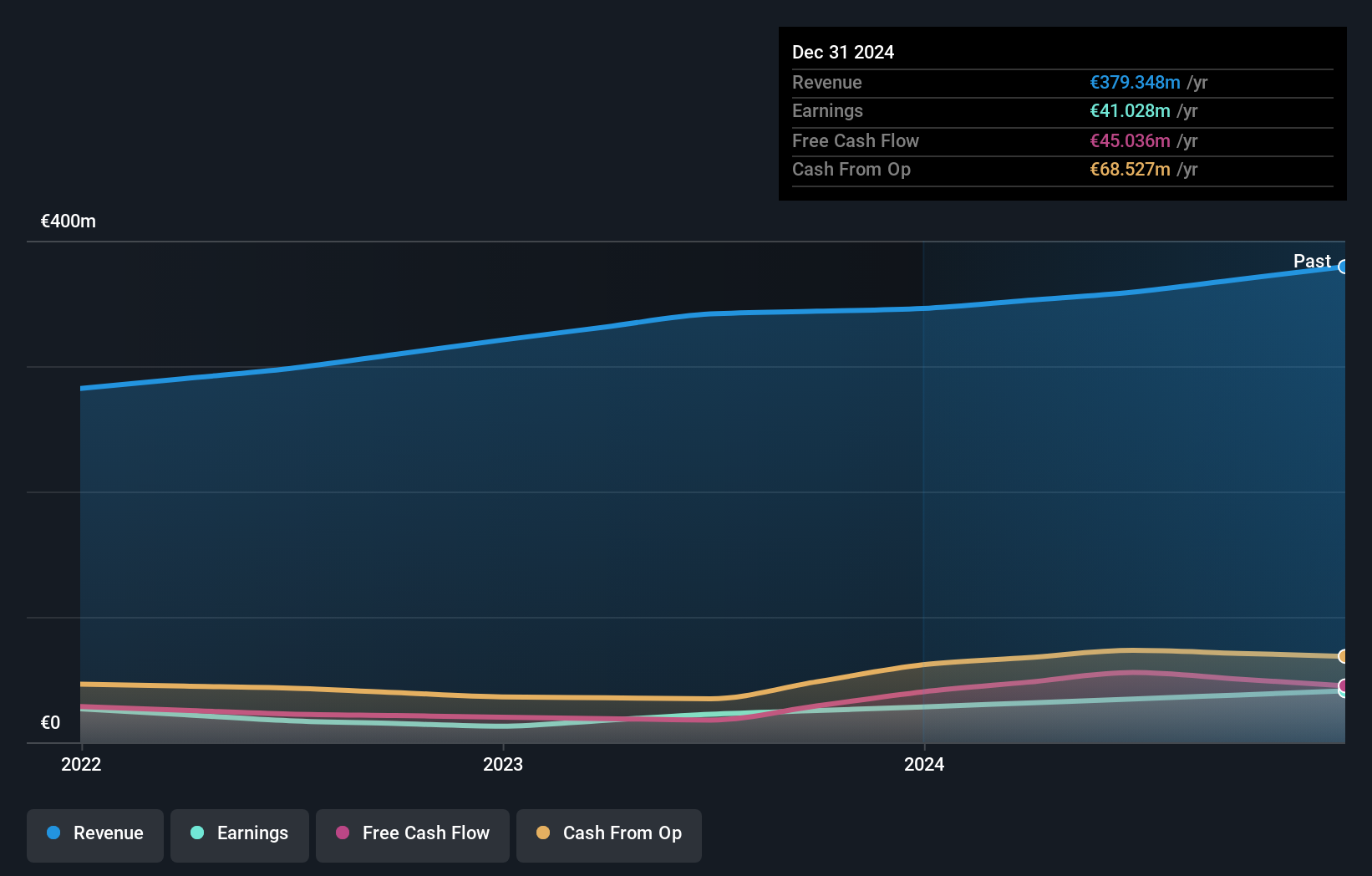

Operations: Spadel generates revenue primarily from its non-alcoholic beverages segment, amounting to €379.35 million.

Spadel, a notable player in the European beverage scene, is currently trading at 38.2% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings surged by 45.3%, outpacing the broader beverage industry's growth of 0.7%. This performance is bolstered by Spadel's high-quality earnings and positive free cash flow. The company has effectively reduced its debt to zero from a debt-to-equity ratio of 18.2% five years ago, eliminating concerns over interest coverage or debt levels. Recently, Spadel announced an annual dividend increase to €2.24 per share, signaling confidence in its financial health and future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Spadel.

Examine Spadel's past performance report to understand how it has performed in the past.

Mikron Holding (SWX:MIKN)

Simply Wall St Value Rating: ★★★★★★

Overview: Mikron Holding AG specializes in the development, production, and marketing of automation solutions, machining systems, and cutting tools across Switzerland, Europe, North America, the Asia Pacific, and globally with a market capitalization of CHF300.93 million.

Operations: Mikron Holding AG generates revenue through its automation solutions, machining systems, and cutting tools. The company's market capitalization stands at CHF300.93 million.

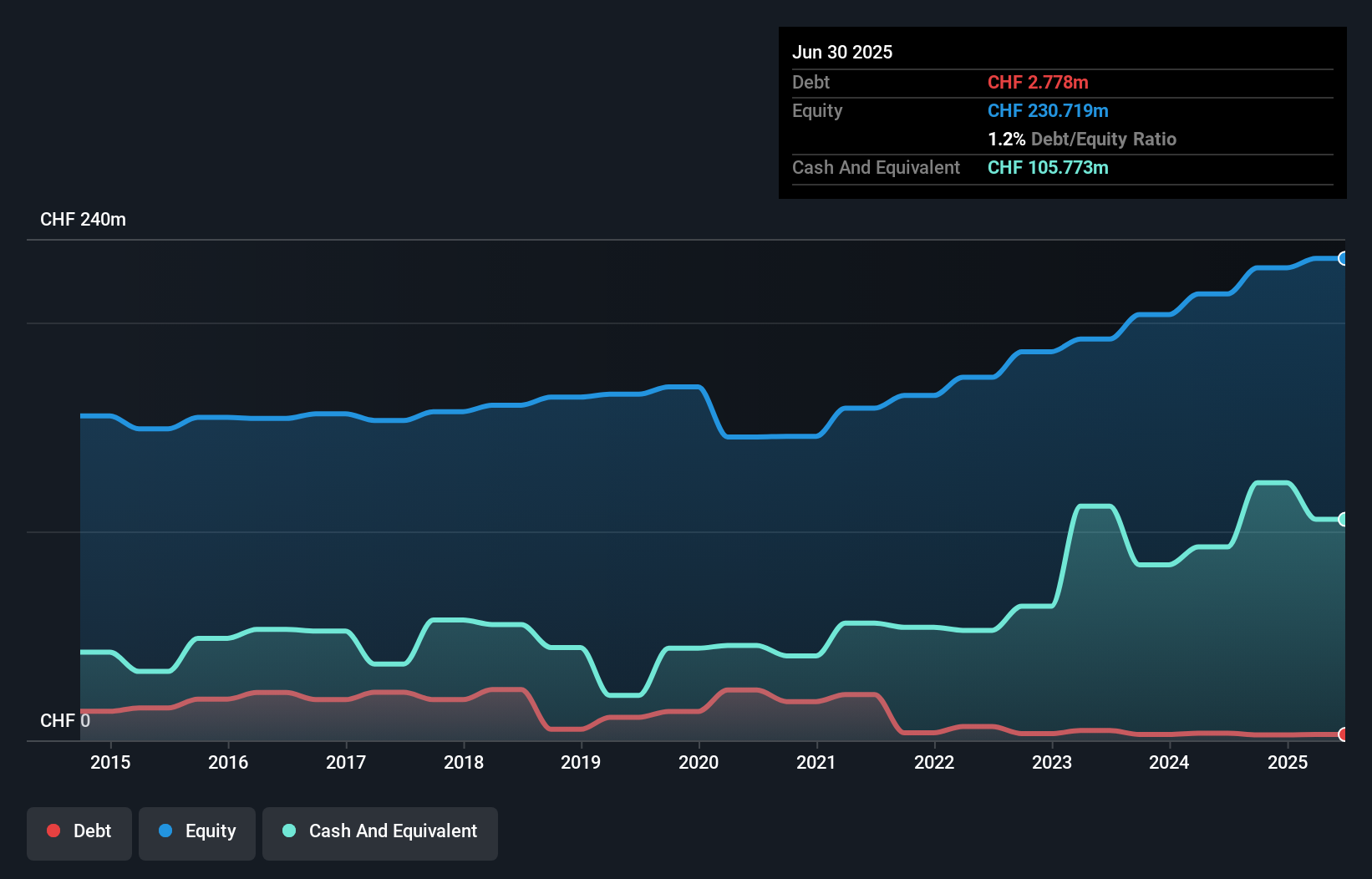

Mikron Holding, a nimble player in the machinery sector, showcases impressive financial health with earnings growth of 7% over the past year, outpacing the industry's -6%. The company's debt to equity ratio has significantly improved from 16.6% to just 1% over five years. With a price-to-earnings ratio of 9.5x, it stands as an attractive option compared to the Swiss market's average of 20.4x. Recent half-year results highlight robust performance with sales reaching CHF191.88 million and net income climbing to CHF18.28 million from CHF14.6 million last year, reflecting strong operational efficiency and profitability gains.

- Unlock comprehensive insights into our analysis of Mikron Holding stock in this health report.

Gain insights into Mikron Holding's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Access the full spectrum of 321 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SPA

Flawless balance sheet with solid track record.

Market Insights

Community Narratives