- Taiwan

- /

- Auto Components

- /

- TPEX:8255

3 Growth Stocks Insiders Are Banking On

Reviewed by Simply Wall St

As global markets navigate the challenges of rising Treasury yields and tepid economic growth, investors are keenly focused on sectors that show resilience and potential for expansion. In this environment, growth stocks with high insider ownership often attract attention due to the confidence insiders demonstrate in their companies' long-term prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

Floridienne (ENXTBR:FLOB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Floridienne S.A. operates through its subsidiaries in the chemicals, gourmet food, and life sciences sectors both in Belgium and internationally, with a market cap of €607.29 million.

Operations: The company generates its revenue from three main segments: €150.05 million from Food, €39.25 million from the Chemicals Division, and €409.99 million from the Life Sciences Division.

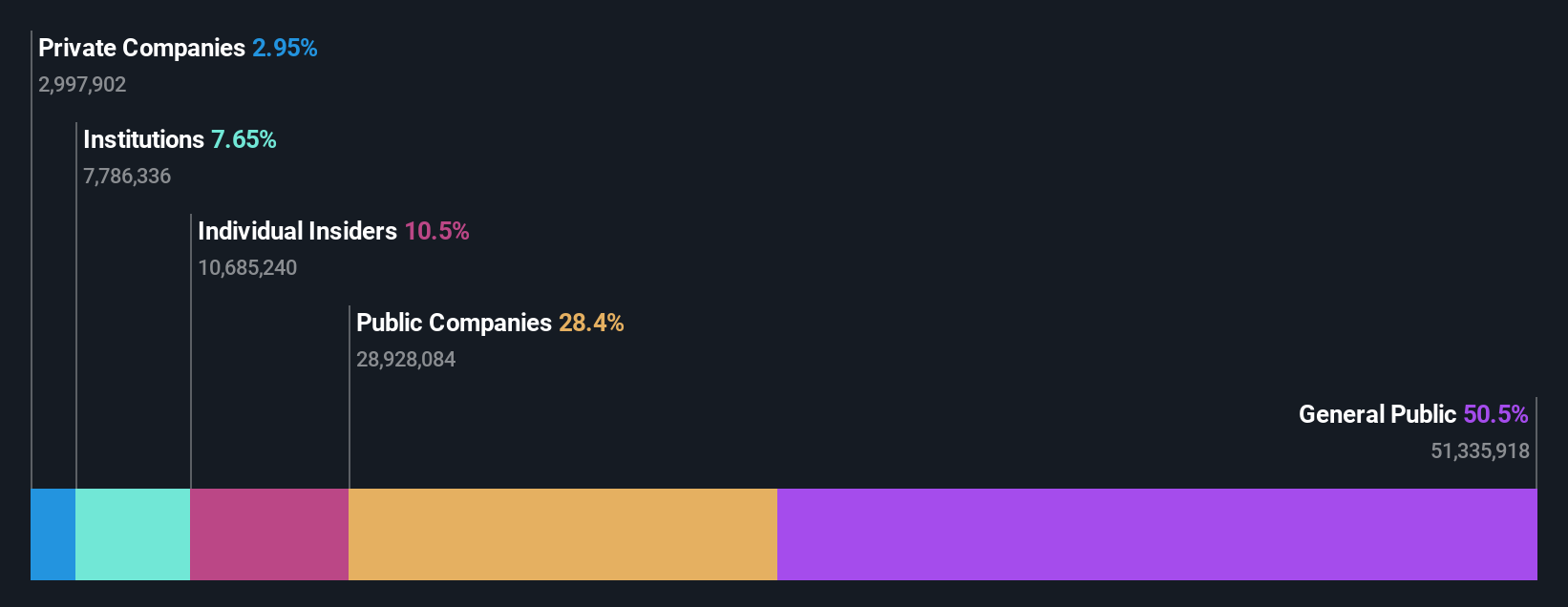

Insider Ownership: 19.3%

Revenue Growth Forecast: 11.7% p.a.

Floridienne S.A. demonstrates characteristics of a growth company with high insider ownership, despite some challenges. The company's earnings are forecast to grow significantly at 44.8% annually, outpacing the Belgian market's average. However, profit margins have declined from last year and revenue growth is expected to be moderate compared to higher benchmarks. Recent earnings reports show increased sales but decreased net income due to large one-off items impacting results, highlighting mixed financial quality.

- Delve into the full analysis future growth report here for a deeper understanding of Floridienne.

- Our valuation report here indicates Floridienne may be undervalued.

Gstarsoft (SHSE:688657)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gstarsoft Co., Ltd. is involved in the research, development, design, and sale of 2D/3D CAD software and cloud solutions globally, with a market cap of approximately CN¥2.61 billion.

Operations: The company's revenue is primarily derived from its global activities in developing and selling 2D/3D CAD software and cloud solutions.

Insider Ownership: 34.1%

Revenue Growth Forecast: 24% p.a.

Gstarsoft shows elements of a growth-focused company with substantial insider ownership. Despite recent earnings reports indicating a slight increase in sales to CNY 197.77 million, net income has decreased to CNY 34.69 million, reflecting tighter profit margins compared to last year. The company's revenue is expected to grow at a robust 24% annually, surpassing the CN market average. However, its earnings growth forecast slightly lags behind the market, and share price volatility remains high.

- Dive into the specifics of Gstarsoft here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Gstarsoft's current price could be inflated.

Actron Technology (TPEX:8255)

Simply Wall St Growth Rating: ★★★★☆☆

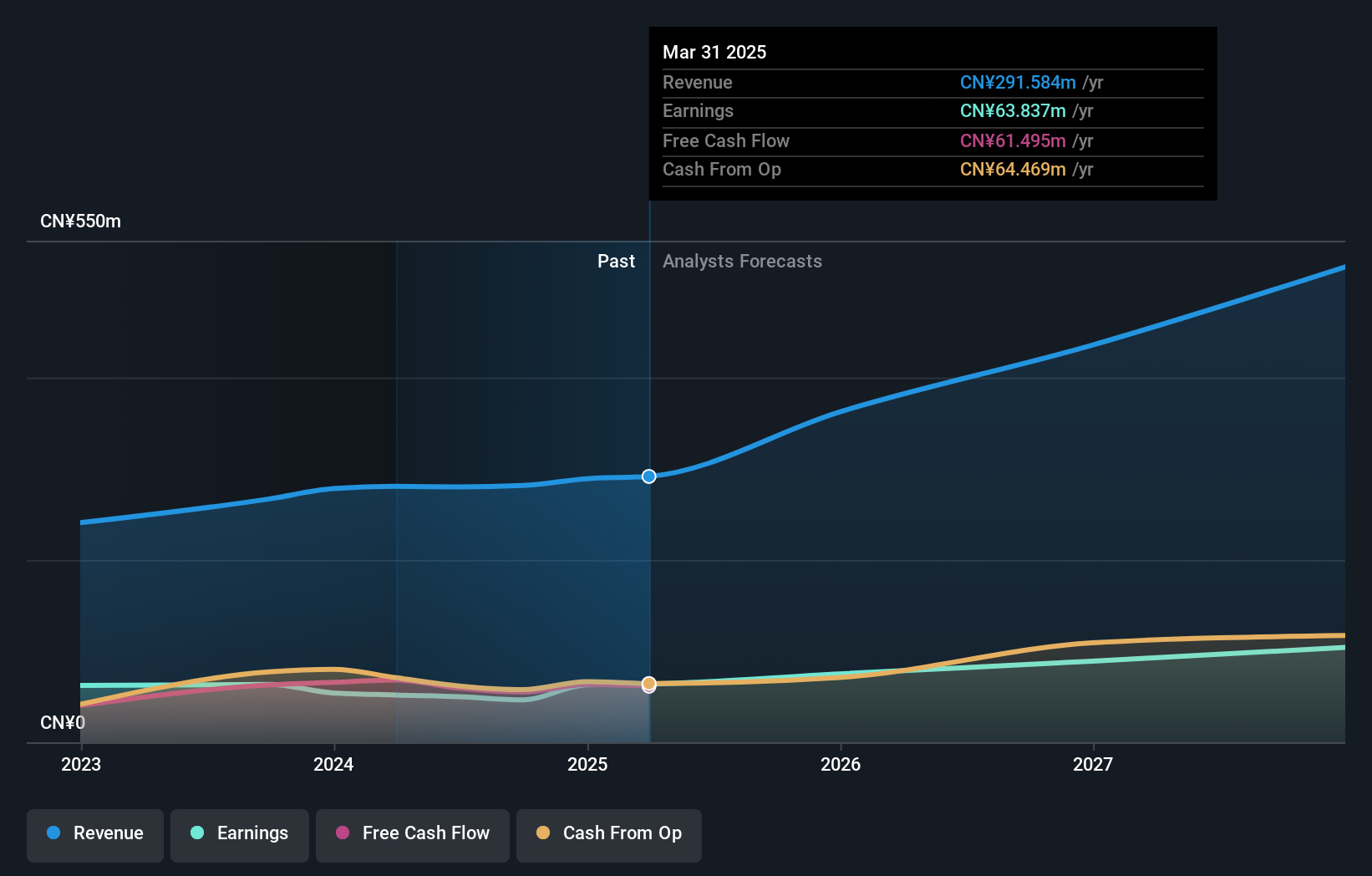

Overview: Actron Technology Corporation, with a market cap of NT$17.35 billion, designs, develops, and sells electronic components for vehicles to automakers globally.

Operations: The company's revenue segments include NT$209.27 million from the China Business Segment, NT$6.12 billion from the Taiwan Business Segment, and NT$1.55 billion from the Taiwan Mosel Business Division.

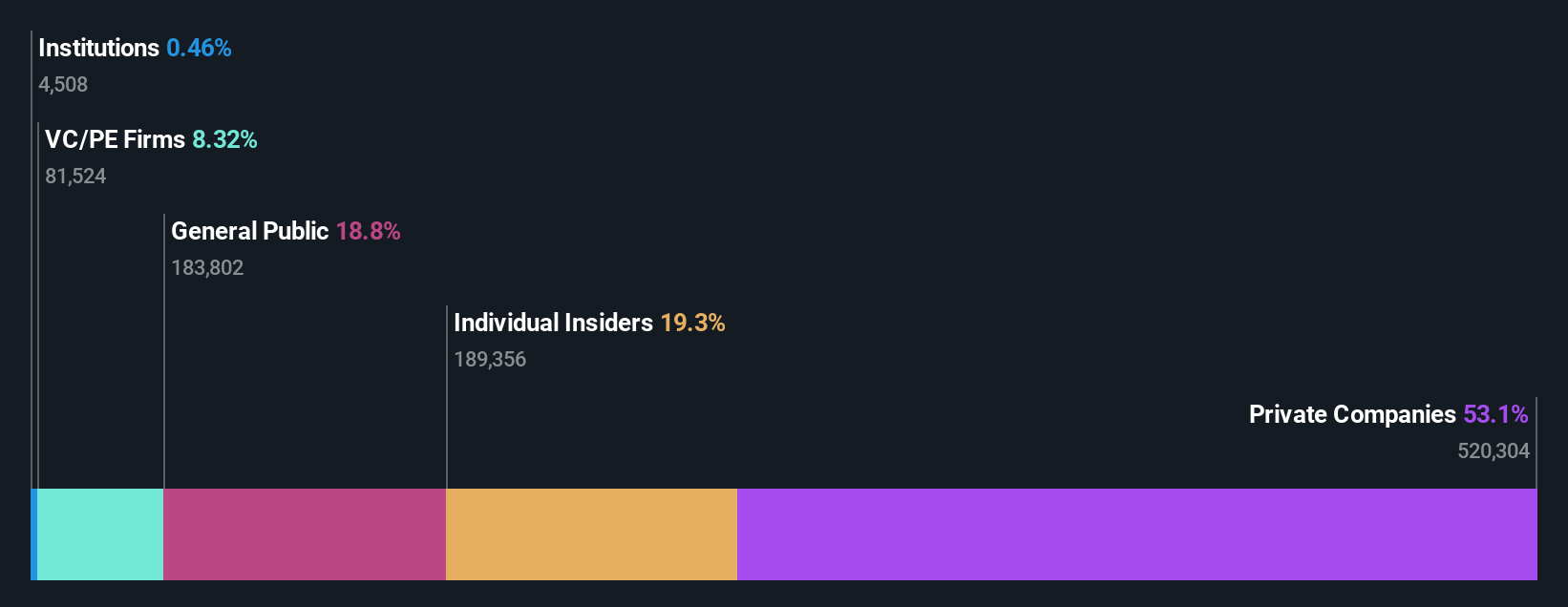

Insider Ownership: 10.4%

Revenue Growth Forecast: 16.9% p.a.

Actron Technology demonstrates characteristics of a growth-oriented company with significant insider ownership. Its earnings are forecast to grow at 29.3% annually, outpacing the Taiwan market, although recent reports show declining net income and profit margins compared to last year. The stock trades significantly below its fair value estimate, with analysts predicting a 35.2% price increase. Despite these prospects, the company's dividend coverage remains weak relative to free cash flows.

- Unlock comprehensive insights into our analysis of Actron Technology stock in this growth report.

- The analysis detailed in our Actron Technology valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Reveal the 1517 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8255

Actron Technology

Engages in the designing, developing, and selling electronic components of vehicles for automakers worldwide.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives