Will Anheuser-Busch InBev’s (ENXTBR:ABI) US Expansion Strengthen Michelob ULTRA’s Competitive Edge?

Reviewed by Sasha Jovanovic

- Anheuser-Busch InBev recently announced a US$7.4 million investment to upgrade brewing and packaging equipment at its Los Angeles brewery, aiming to expand production capacity for Michelob ULTRA in response to strong consumer demand.

- This latest expansion builds on nearly US$2 billion of U.S. investments over the past five years and leverages the brand’s partnerships with major upcoming sporting events in Los Angeles to further fuel Michelob ULTRA’s momentum.

- To assess how this new boost to Michelob ULTRA production could influence Anheuser-Busch InBev's long-term outlook, we'll review the investment narrative in light of expanding U.S. operations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Anheuser-Busch InBev Investment Narrative Recap

To own shares of Anheuser-Busch InBev, you generally need to believe that ongoing investments in production, premiumization, and brand expansion can offset headwinds from shifting consumer preferences and market pressures. The recent US$7.4 million Los Angeles brewery investment aims to address surging Michelob ULTRA demand; however, it does not materially change the near-term picture, the brand’s U.S. momentum remains a key catalyst, while volume softness in emerging markets and margin sustainability still present the main risks to watch.

Among recent announcements, the global partnership with Netflix stands out. Connecting iconic beer brands, such as Michelob ULTRA, with major entertainment events extends AB InBev’s reach and may amplify the effects of production and marketing investments, which is particularly important as consumer trends and brand relevance evolve.

By contrast, investors should also be aware of ongoing volume declines in key emerging markets and how these might impact...

Read the full narrative on Anheuser-Busch InBev (it's free!)

Anheuser-Busch InBev's narrative projects $67.7 billion revenue and $9.7 billion earnings by 2028. This requires 5.0% yearly revenue growth and a $2.6 billion earnings increase from $7.1 billion currently.

Uncover how Anheuser-Busch InBev's forecasts yield a €67.44 fair value, a 31% upside to its current price.

Exploring Other Perspectives

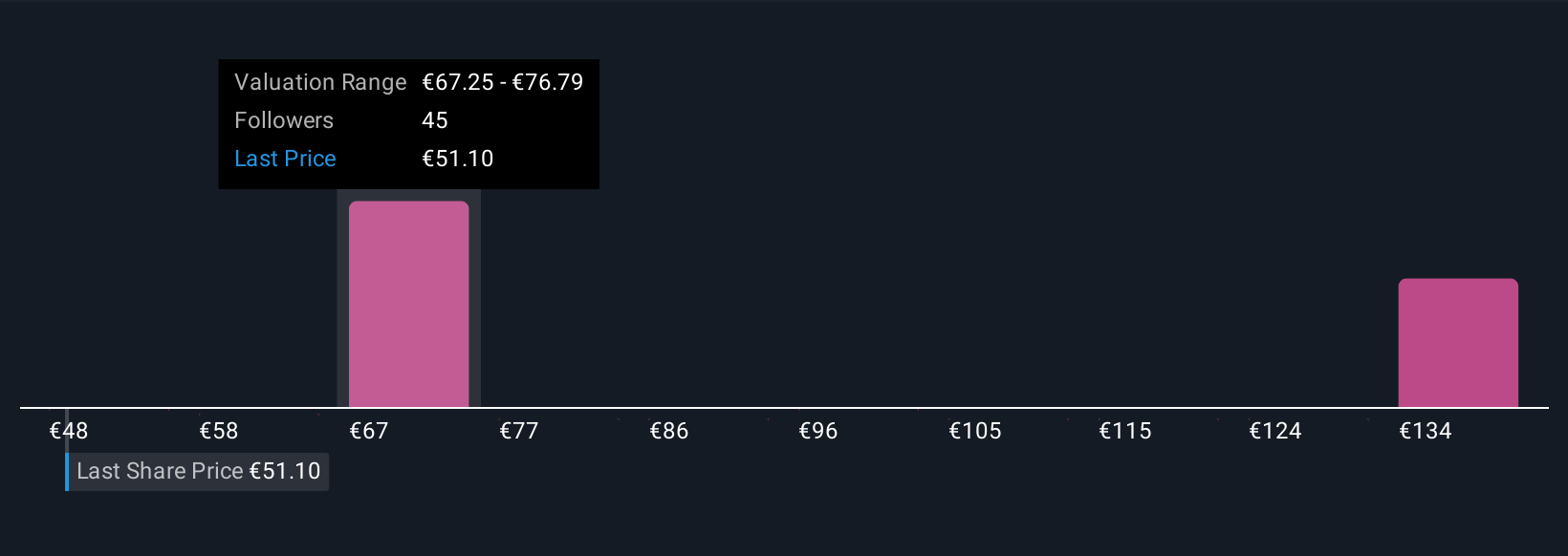

Simply Wall St Community members provided 11 fair value estimates for AB InBev, ranging widely from €48.18 to €143.24 per share. With premiumization highlighted as a major catalyst, it is clear that expectations for revenue growth potential vary, a reminder to consider multiple viewpoints in forming your own outlook.

Explore 11 other fair value estimates on Anheuser-Busch InBev - why the stock might be worth 6% less than the current price!

Build Your Own Anheuser-Busch InBev Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Anheuser-Busch InBev research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Anheuser-Busch InBev research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Anheuser-Busch InBev's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:ABI

Anheuser-Busch InBev

Produces, distributes, exports, markets, and sells beer in North America, Middle Americas, South America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with proven track record.

Market Insights

Community Narratives