In the wake of recent market shifts, where U.S. small-cap stocks have shown notable resilience with the Russell 2000 Index leading gains, investors are increasingly attentive to potential opportunities in underexplored areas. In this dynamic environment, identifying a promising stock often involves looking for companies with strong fundamentals and growth potential that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.20% | 16.85% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Exmar (ENXTBR:EXM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Exmar NV is a company that offers shipping and energy supply chain solutions on a global scale, with a market capitalization of €458.63 million.

Operations: Exmar NV generates revenue primarily through its shipping and energy supply chain solutions. The company's financial performance is highlighted by a net profit margin of 18.5%.

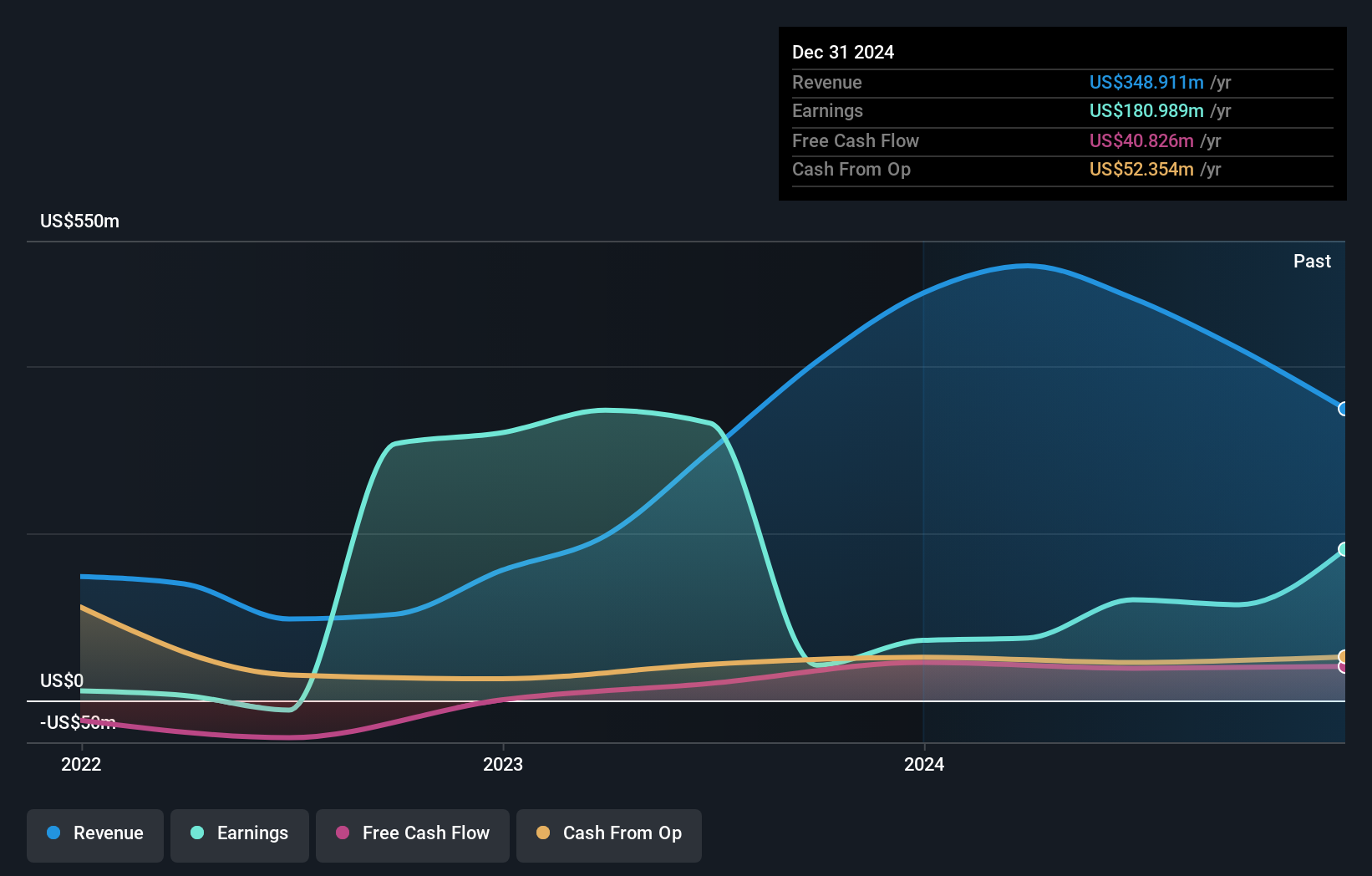

Exmar's recent performance showcases a compelling narrative within the energy sector. The company has seen its debt to equity ratio improve from 80.2% to 45.8% over five years, indicating a stronger financial footing. Despite a volatile share price recently, Exmar's earnings grew by an impressive 170.5% last year, outpacing the industry average of -15.2%. Its price-to-earnings ratio stands at 4.3x, significantly lower than Belgium's market average of 13.1x, suggesting potential undervaluation. Recent earnings announcements revealed net income of US$81.9 million for nine months ending September 2024, compared to US$39.4 million previously, signaling robust profitability despite sales dipping from US$345 million to US$279 million in the same period.

- Get an in-depth perspective on Exmar's performance by reading our health report here.

Evaluate Exmar's historical performance by accessing our past performance report.

m-up holdings (TSE:3661)

Simply Wall St Value Rating: ★★★★★★

Overview: M-up Holdings, Inc. focuses on developing and distributing mobile and PC content alongside e-commerce operations in Japan, with a market cap of ¥53.42 billion.

Operations: The company generates revenue primarily through its mobile and PC content distribution and e-commerce operations. It has a market cap of ¥53.42 billion, indicating significant market presence in Japan.

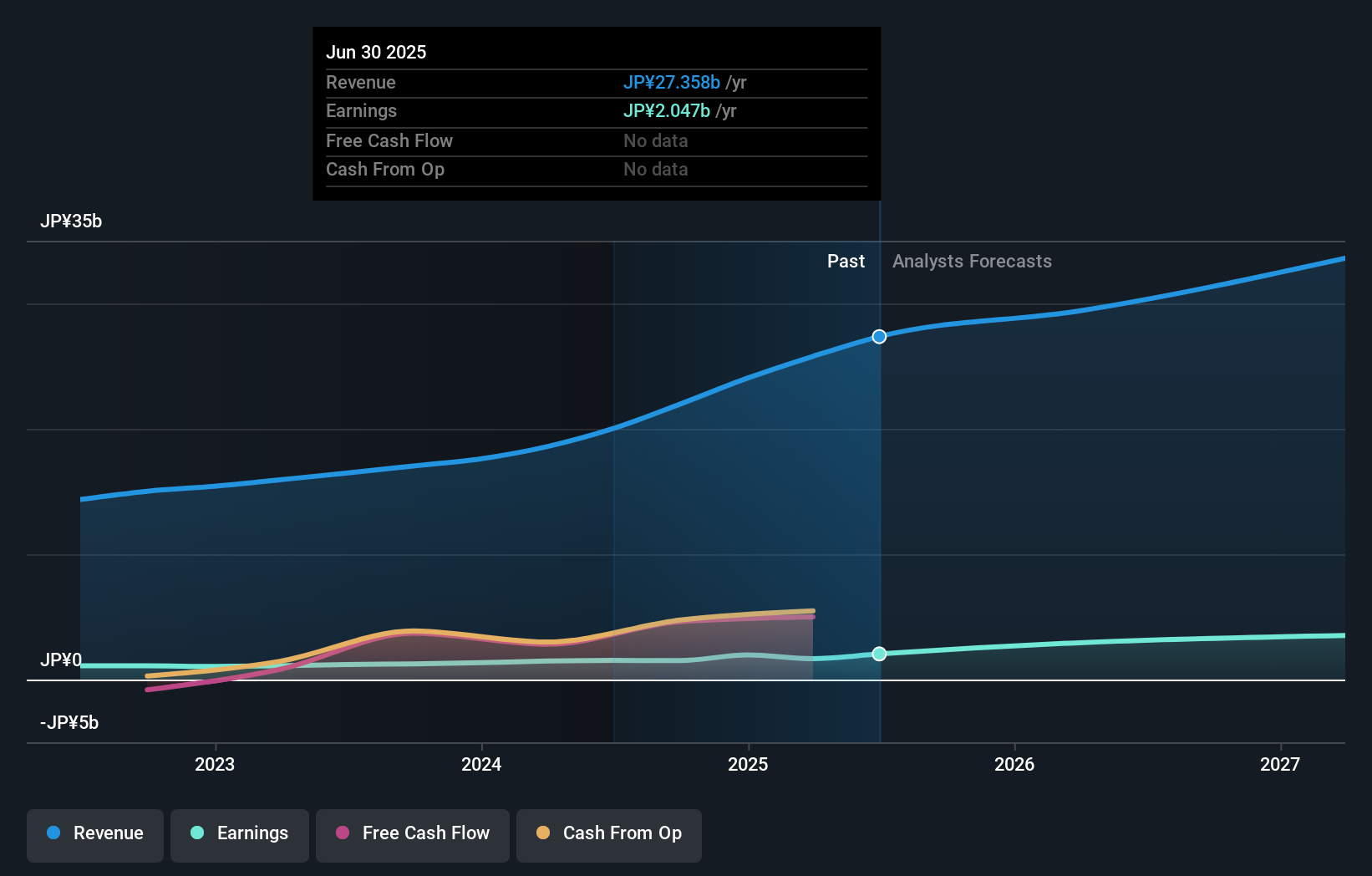

M-up Holdings, a nimble player in the software sector, has shown impressive earnings growth of 26.6% over the past year, outpacing the industry average of 15.4%. Currently trading at 12.5% below its estimated fair value, it seems to offer good value for investors. The company is debt-free and has demonstrated high-quality earnings over time. Recently, M-up completed a share repurchase program worth ¥157.74 million for 134,000 shares to enhance capital efficiency and shareholder returns. With no interest payment concerns due to zero debt levels and positive free cash flow reported consistently, M-up appears financially robust amidst market volatility.

- Take a closer look at m-up holdings' potential here in our health report.

Examine m-up holdings' past performance report to understand how it has performed in the past.

AnyMind Group (TSE:5027)

Simply Wall St Value Rating: ★★★★★☆

Overview: AnyMind Group Inc. operates a platform offering comprehensive support for brand design, planning, production, e-commerce enablement, marketing, and logistics with a market cap of ¥67.25 billion.

Operations: The company generates revenue primarily from its Internet-related business, amounting to ¥41.69 billion.

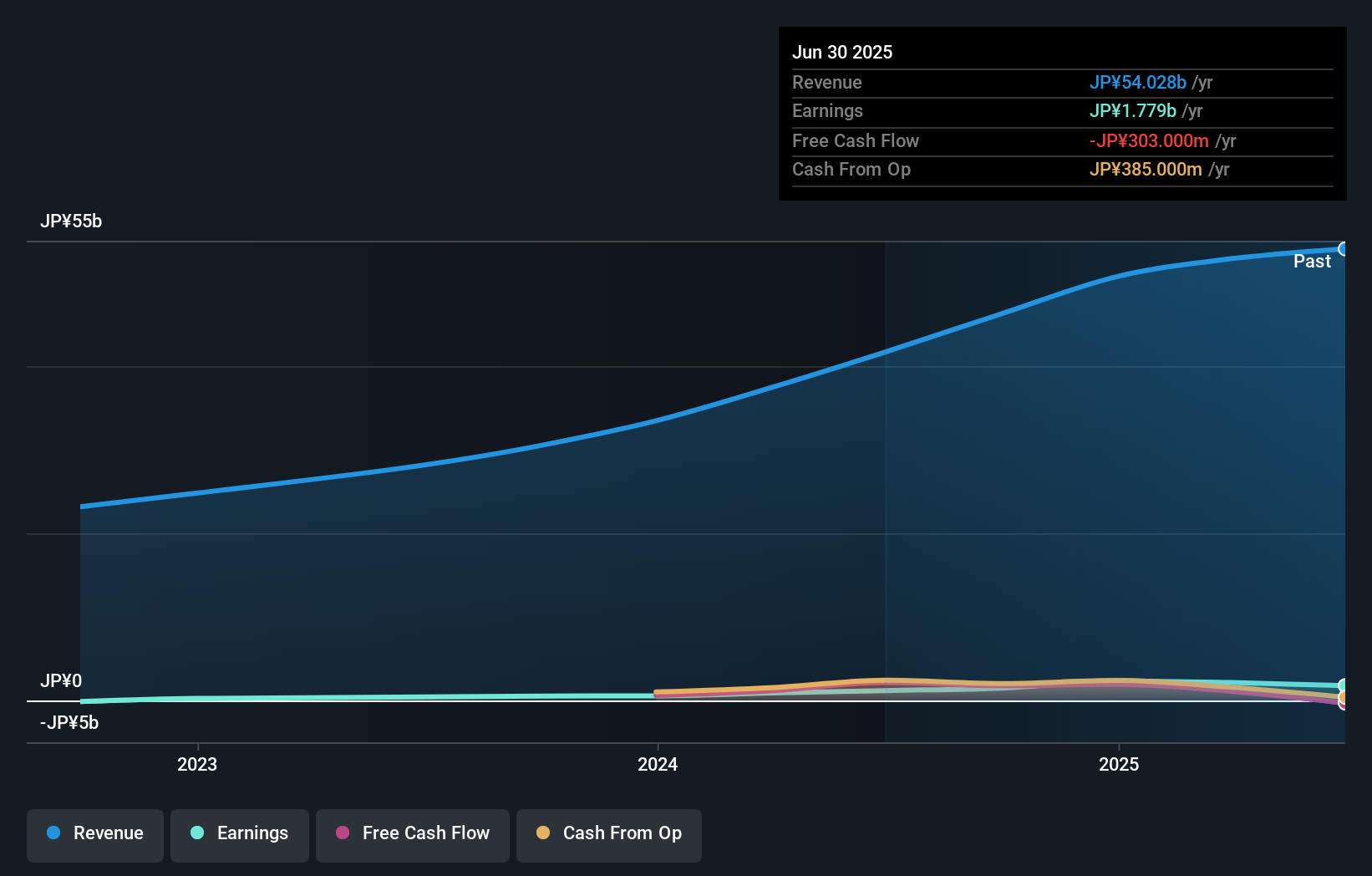

AnyMind Group, a dynamic player in the tech space, has been making waves with its innovative use of generative AI. Over the past year, earnings surged by 174%, outpacing industry growth significantly. The company repurchased shares in 2024, indicating confidence in its financial health. Its recent launch of GenAI-powered modules for e-commerce and live commerce platforms highlights a strategic push into Southeast Asia's burgeoning market, estimated to grow to US$186 billion by 2025. Additionally, AnyMind's expansion into Hangzhou strengthens its cross-border commerce capabilities across China and beyond. However, share price volatility remains a concern for potential investors.

- Delve into the full analysis health report here for a deeper understanding of AnyMind Group.

Gain insights into AnyMind Group's past trends and performance with our Past report.

Key Takeaways

- Dive into all 4658 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5027

AnyMind Group

Engages in the development and the provision of a platform that provides one-stop support for brand design and planning, production, e-commerce enablement, marketing, and logistics.

Solid track record with excellent balance sheet.