- Belgium

- /

- Oil and Gas

- /

- ENXTBR:CMBT

How Fleet Renewal and Vessel Sales Will Impact Cmb.Tech's (ENXTBR:CMBT) Long-Term Competitiveness

Reviewed by Sasha Jovanovic

- In recent announcements, Cmb.Tech NV reported the delivery of five newbuilding vessels across several categories and revealed the sale of multiple ships, generating significant capital gains set for the third and fourth quarters of 2025.

- These developments highlight how Cmb.Tech is actively renewing its fleet and managing assets to support operational improvements and future revenue stability.

- To understand the impact on Cmb.Tech's investment narrative, we will examine how these fleet updates and vessel sales strengthen long-term competitiveness.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Cmb.Tech's Investment Narrative?

If there’s one key conviction that underpins the case for being a shareholder of Cmb.Tech, it’s the belief in the company’s ability to modernize its fleet and redeploy assets for resilient long-term growth in a cyclical sector. The latest round of vessel deliveries and ship sales is meaningful for two reasons: it generates significant capital gains in the short term and accelerates the transition toward a younger, more technologically advanced fleet. This helps to address some of the pressing concerns from recent analyses, such as volatile earnings and a historically high level of non-cash profits. However, these moves also introduce some uncertainty around capital allocation and whether future earnings will prove as robust. Near-term catalysts could include improved balance sheet flexibility and investor sentiment, given that much-needed gains are being realized, but risks remain around the sustainability of profit margins and board turnover, as the business continues to evolve post-news.

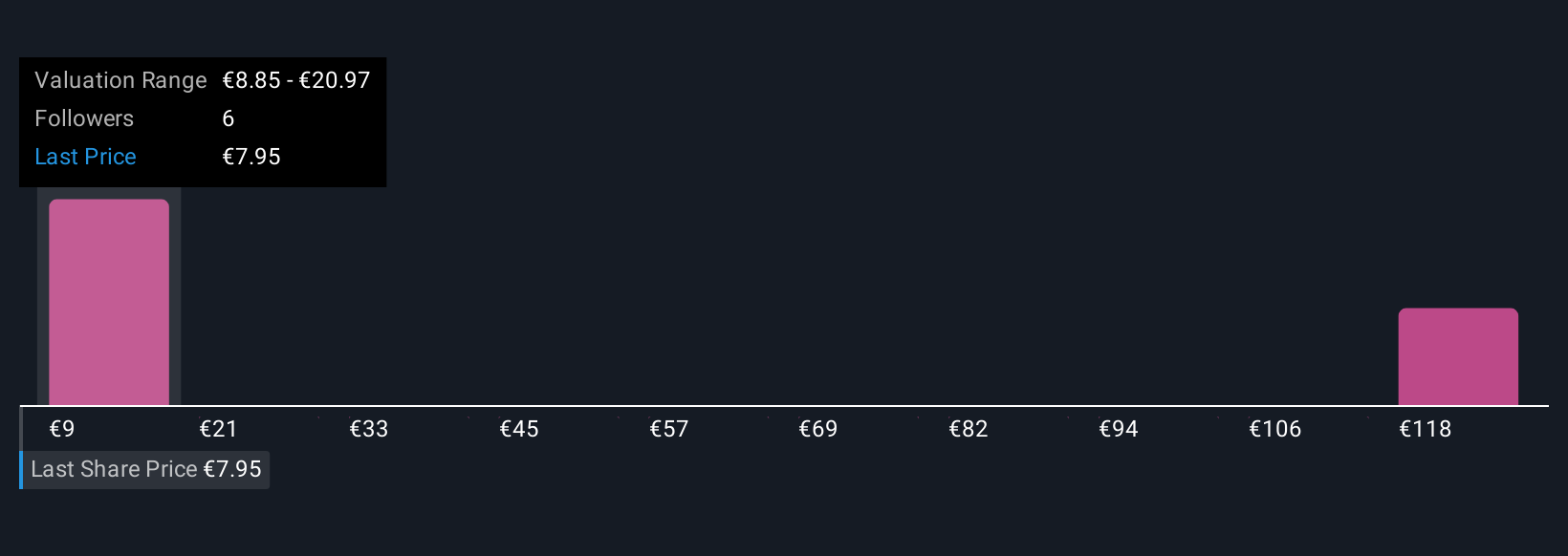

But there’s also the question of whether profit margins will recover as quickly as investors hope. Despite retreating, Cmb.Tech's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 5 other fair value estimates on Cmb.Tech - why the stock might be a potential multi-bagger!

Build Your Own Cmb.Tech Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cmb.Tech research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Cmb.Tech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cmb.Tech's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:CMBT

Medium-low risk with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives