- Belgium

- /

- Oil and Gas

- /

- ENXTBR:CMBT

How Cmb.Tech’s Dividend Decision Amid Lower Earnings at ENXTBR:CMBT Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Cmb.Tech NV recently reported earnings for the nine months ended September 30, 2025, with sales of US$1,077.1 million and net income of US$71.64 million, both showing changes compared to the previous year.

- Despite a very large year-over-year decrease in net income, the company plans to propose an interim dividend payment to shareholders in January 2026.

- We’ll explore how the decision to maintain a dividend amid lower earnings could shift Cmb.Tech’s investment narrative for investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Cmb.Tech's Investment Narrative?

For investors considering a stake in Cmb.Tech NV, the current narrative centers around weighing strong sales growth against a significant drop in earnings and profit margins over the last year. The company’s recent decision to propose another interim dividend despite net income falling sharply suggests a desire to signal stability or confidence, but it also raises questions about sustainability if weaker earnings persist. The loss of index inclusion and high share price volatility add uncertainty on the sentiment and liquidity fronts. At the same time, a series of business expansions and capital gains from vessel sales have strengthened the balance sheet in the past quarter, which may partially offset the risks. However, with earnings now well below prior levels, the risk profile has shifted and short-term catalysts may depend more on management’s ability to restore profitability and control costs in coming quarters. The recent news appears material as it complicates the income picture and makes the interim dividend a focal point for assessing near-term business resilience.

In contrast, many might overlook the company’s high dividend payout relative to its free cash flow sustainability, which could matter later.

Exploring Other Perspectives

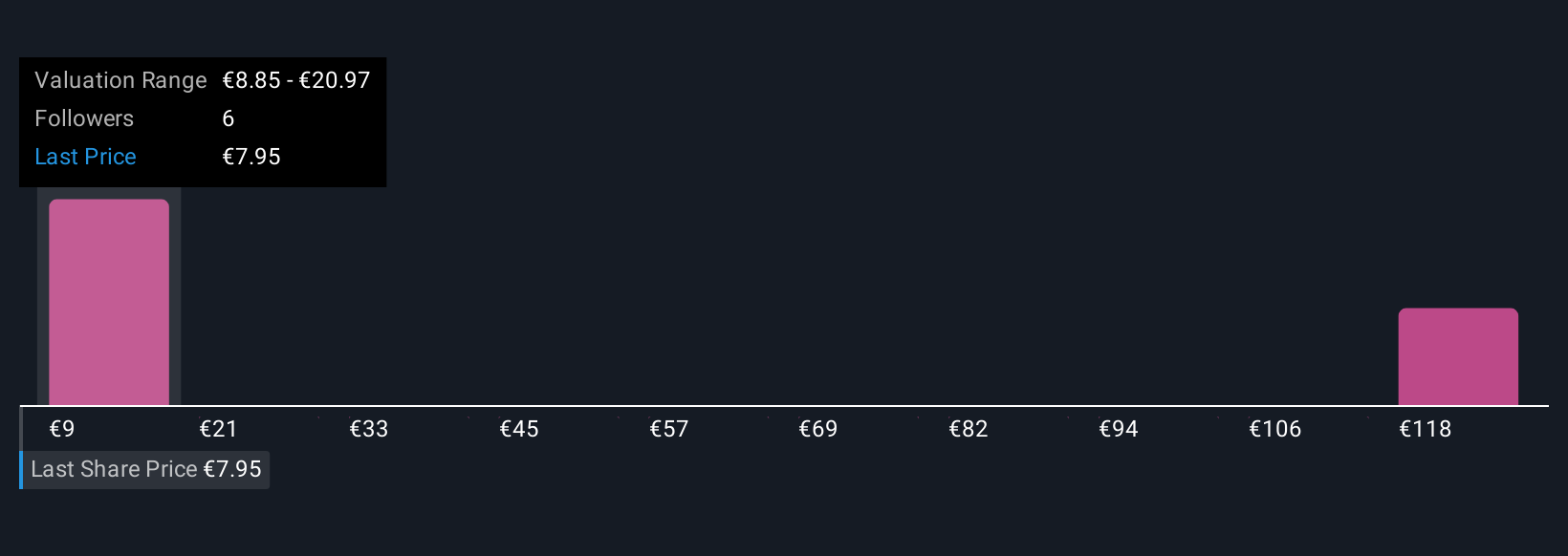

Explore 5 other fair value estimates on Cmb.Tech - why the stock might be a potential multi-bagger!

Build Your Own Cmb.Tech Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cmb.Tech research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Cmb.Tech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cmb.Tech's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:CMBT

Medium-low risk with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success