As we step into January 2025, global markets are reflecting a mixed bag of economic signals, with U.S. consumer confidence dipping and major stock indexes experiencing moderate gains amidst holiday trading fluctuations. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration for those seeking to navigate the current market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Colruyt Group (ENXTBR:COLR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Colruyt Group N.V., with a market cap of €4.46 billion, operates in retail, wholesale, food service, and other activities across Belgium, France, and internationally through its subsidiaries.

Operations: Colruyt Group N.V. generates revenue through its diverse operations in retail, wholesale, and food service across Belgium, France, and international markets.

Dividend Yield: 3.8%

Colruyt Group's dividend payments have increased over the past decade, but they have been volatile and unreliable, with significant annual drops. Despite a low payout ratio of 48.8%, indicating dividends are well-covered by earnings and cash flows, the yield is relatively low compared to top Belgian dividend payers. Recent earnings reveal a sharp decline in net income to €193.9 million from €897 million year-on-year, potentially impacting future dividend stability and growth prospects.

- Unlock comprehensive insights into our analysis of Colruyt Group stock in this dividend report.

- Upon reviewing our latest valuation report, Colruyt Group's share price might be too pessimistic.

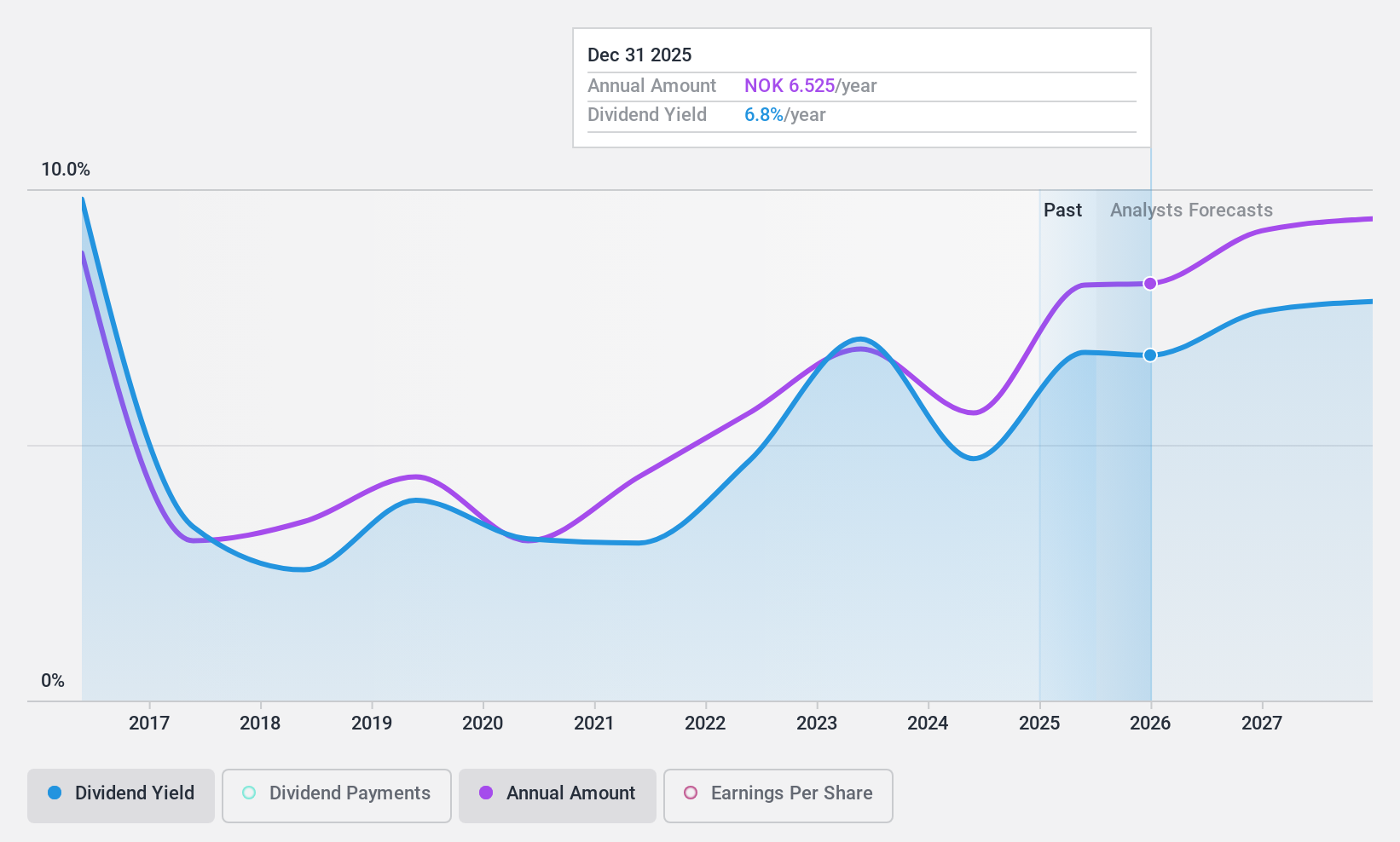

Austevoll Seafood (OB:AUSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Austevoll Seafood ASA is a seafood company involved in the production of salmon, trout, white fish, and pelagic species across various global markets, with a market cap of NOK19.74 billion.

Operations: Austevoll Seafood ASA's revenue segments include NOK2.26 billion from Austral Group SAA, NOK954 million from Foodcorp Chile SA, NOK953 million from Br.Birkeland Farming AS, NOK30.87 billion from Lerøy Seafood Group ASA, and NOK2.19 billion from Br.Birkeland (excluding Br.Birkeland Farming).

Dividend Yield: 4.6%

Austevoll Seafood's dividend payments have increased over the past decade but remain volatile and unreliable, with significant annual drops. Despite this, dividends are well-covered by earnings and cash flows, with a payout ratio of 41.2% and a cash payout ratio of 49.4%. The current yield is lower than top Norwegian dividend payers. Recent earnings show substantial improvement, with net income rising to NOK 265 million from a previous loss, suggesting potential for future stability.

- Delve into the full analysis dividend report here for a deeper understanding of Austevoll Seafood.

- According our valuation report, there's an indication that Austevoll Seafood's share price might be on the cheaper side.

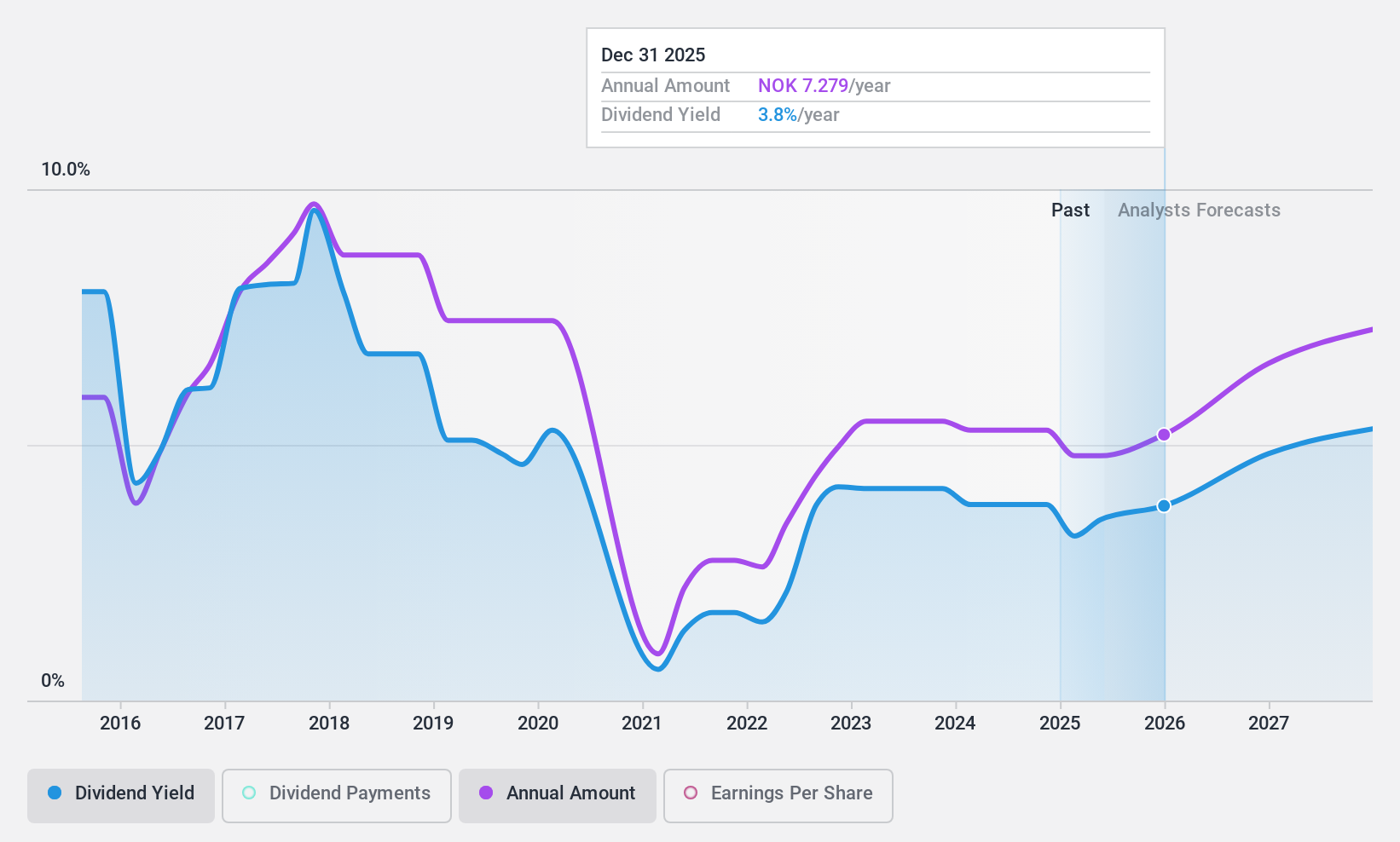

Mowi (OB:MOWI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally, with a market capitalization of NOK100.71 billion.

Operations: Mowi ASA's revenue segments include Feed (€1.11 billion), Farming (€3.46 billion), Sales & Marketing - Markets (€3.90 billion), and Sales and Marketing - Consumer Products (€3.68 billion).

Dividend Yield: 3.6%

Mowi's dividend payments have been volatile over the past decade, with periods of significant annual drops. Despite this instability, dividends are covered by earnings and cash flows, with payout ratios of 69.1% and 59.7%, respectively. The dividend yield is lower than top-tier Norwegian payers. Recent results show a decline in net income to EUR 48.9 million for Q3 2024 from EUR 110.6 million a year ago, amidst ongoing executive changes on the board.

- Navigate through the intricacies of Mowi with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Mowi is priced lower than what may be justified by its financials.

Key Takeaways

- Click through to start exploring the rest of the 1955 Top Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MOWI

Mowi

A seafood company, produces and sells Atlantic salmon products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives