- Belgium

- /

- Food and Staples Retail

- /

- ENXTBR:COLR

Colruyt (ENXTBR:COLR) Margin Decline Challenges Bullish Valuation Narrative Heading Into H1 2026

Reviewed by Simply Wall St

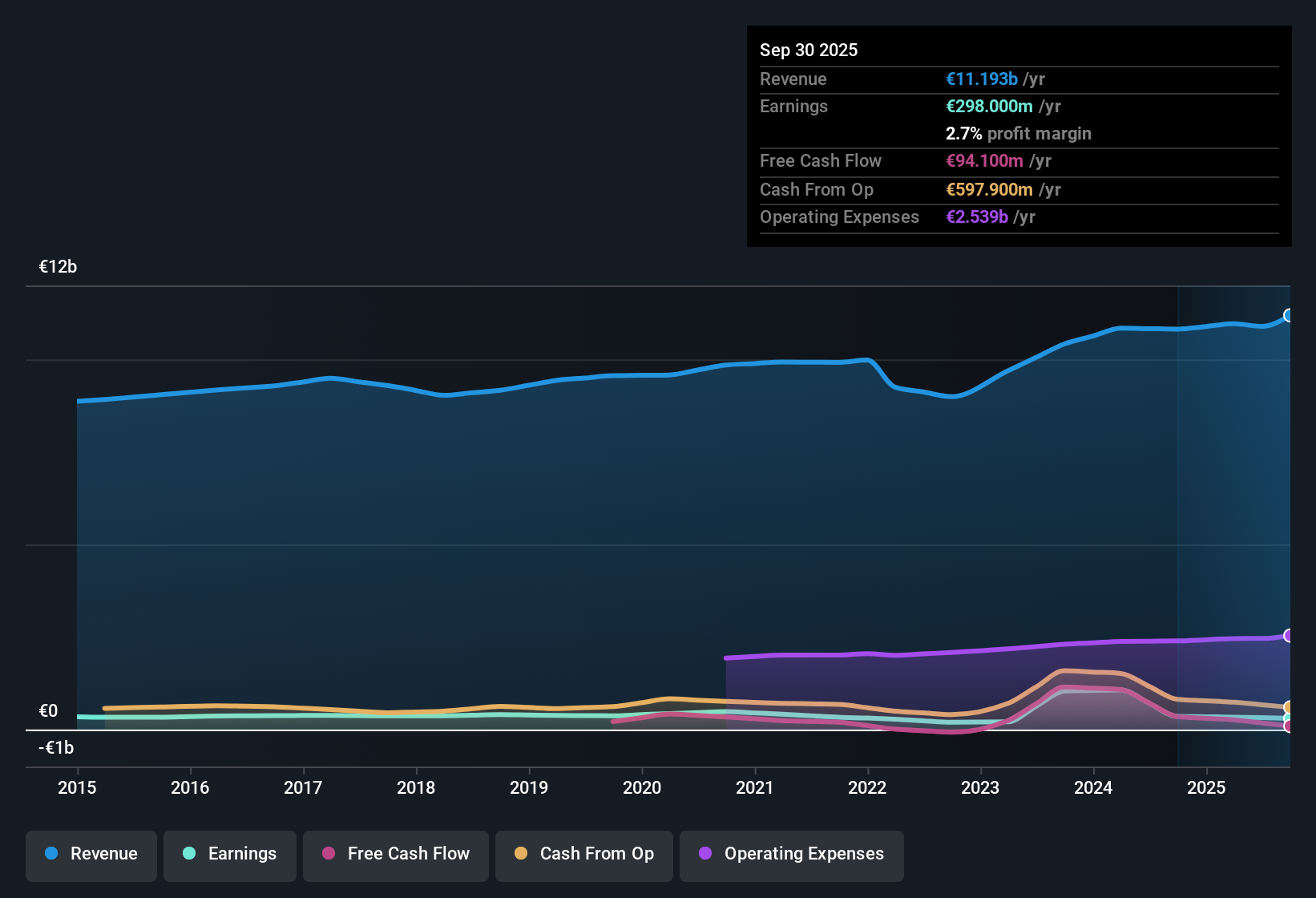

Colruyt Group (ENXTBR:COLR) has opened H1 2026 with total revenue of €5.5 billion and basic EPS of €1.17, setting the stage for investors to weigh modest top-line progress against earnings power. The group has seen revenue move from €5.39 billion in H2 2024 to €5.43 billion in H1 2025 and now €5.54 billion in H2 2025, while basic EPS shifted from €1.29 to €1.54 and then €1.17 over the same periods. With trailing net profit margin at 2.7% and earnings forecast to grow faster than revenue, the latest numbers put profitability and margin resilience firmly in focus for this earnings season.

See our full analysis for Colruyt Group.With the headline figures on the table, the next step is to see how they line up against the prevailing market and community narratives around Colruyt Group, highlighting where the story is reinforced and where it might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Slip from 3.3% to 2.7%

- The trailing net profit margin has eased from 3.3% to 2.7% over the last year while trailing net income stands at €298 million on roughly €11.2 billion of revenue.

- Critics highlight this margin compression as a bearish signal for a low margin retailer, yet the figures also show that:

- Earnings have still compounded at 6.4% per year over the past five years, pointing to a history of steady profit growth despite recent pressure.

- Forecast earnings growth of about 7.4% per year suggests profitability is still expected to trend up, even if the latest margin level is lower than before.

TTM EPS Softens from €2.83

- On a trailing basis, Basic EPS has moved from €2.83 to €2.71 and now €2.45 as net income excluding extra items declined from €353.5 million to €298 million while revenue still grew from €10.8 billion to €11.2 billion.

- Bears argue that this step down in EPS undermines the growth story, but the numbers present a more nuanced picture:

- H1 2025 net income excluding extra items was €191.3 million versus €143.4 million in H2 2025, showing that semiannual profitability can swing even when annual growth is positive.

- Earnings from discontinued operations also flipped between negative €5.7 million, positive €2.6 million and negative €4.8 million, which can distort the trend investors see when they focus only on the latest EPS print.

P/E of 12.8x and 47% Discount

- The stock trades at a trailing P/E of 12.8 times with a share price of €31.50, compared with peer and industry averages of 20.8 times and 18 times, and sits about 47.4% below a DCF fair value of roughly €59.91.

- Supporters see this valuation gap as a bullish opportunity, and the figures strongly frame that debate:

- Forecast earnings growth of around 7.4% per year, while slower than the 15.3% expected for the Belgian market, still adds up to steady compounding if delivered against today’s discounted multiple.

- The 4.38% dividend yield comes with weak free cash flow coverage, so income focused bulls need the underlying earnings strength to translate into better cash generation for the valuation case to fully play out.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Colruyt Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Colruyt’s slipping margins, softer EPS trend and weak free cash flow coverage against its dividend highlight vulnerabilities in the reliability of its shareholder payouts.

If that makes you cautious about income risk, use our these 1920 dividend stocks with yields > 3% today to quickly focus on companies offering more sustainable, higher yielding dividends backed by stronger fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:COLR

Colruyt Group

Engages in the retail, wholesale, food service, and other activities in Belgium, France, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion