- Belgium

- /

- Commercial Services

- /

- ENXTBR:SMAR

Revenues Not Telling The Story For Smartphoto Group NV (EBR:SMAR) After Shares Rise 37%

Smartphoto Group NV (EBR:SMAR) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

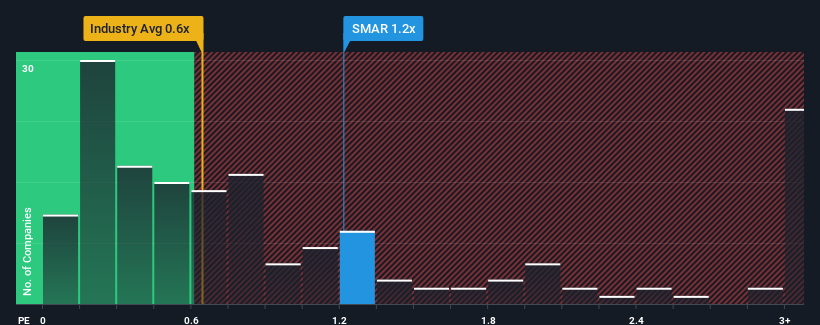

Following the firm bounce in price, given close to half the companies operating in Belgium's Commercial Services industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Smartphoto Group as a stock to potentially avoid with its 1.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Smartphoto Group

How Smartphoto Group Has Been Performing

Recent times haven't been great for Smartphoto Group as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Smartphoto Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Smartphoto Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Smartphoto Group's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.0%. Revenue has also lifted 28% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 6.0% each year during the coming three years according to the sole analyst following the company. With the industry predicted to deliver 34% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Smartphoto Group's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Smartphoto Group's P/S Mean For Investors?

Smartphoto Group's P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that Smartphoto Group currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Smartphoto Group that you should be aware of.

If you're unsure about the strength of Smartphoto Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:SMAR

Flawless balance sheet and good value.

Market Insights

Community Narratives