- Belgium

- /

- Construction

- /

- ENXTBR:MOUR

Is There More To The Story Than Moury Construct's (EBR:MOUR) Earnings Growth?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. In this article, we'll look at how useful this year's statutory profit is, when analysing Moury Construct (EBR:MOUR).

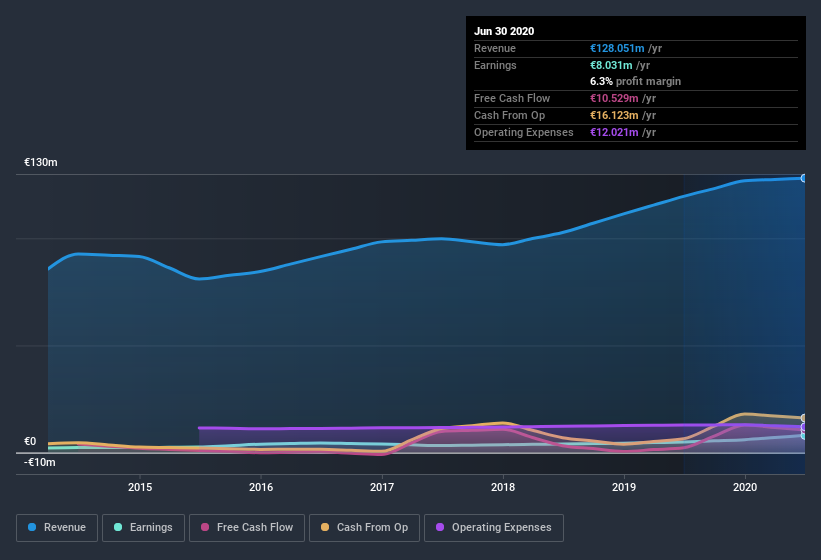

It's good to see that over the last twelve months Moury Construct made a profit of €8.03m on revenue of €128.1m. One positive is that it has grown both its profit and its revenue, over the last few years.

Check out our latest analysis for Moury Construct

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Therefore, we think it's worth taking a closer look at Moury Construct's cashflow, as well as examining the impact that unusual items have had on its reported profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Moury Construct.

Examining Cashflow Against Moury Construct's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Moury Construct has an accrual ratio of -0.31 for the year to June 2020. That indicates that its free cash flow quite significantly exceeded its statutory profit. To wit, it produced free cash flow of €11m during the period, dwarfing its reported profit of €8.03m. Moury Construct's free cash flow improved over the last year, which is generally good to see. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

The Impact Of Unusual Items On Profit

While the accrual ratio might bode well, we also note that Moury Construct's profit was boosted by unusual items worth €1.9m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Moury Construct's Profit Performance

In conclusion, Moury Construct's accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Considering all the aforementioned, we'd venture that Moury Construct's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example - Moury Construct has 3 warning signs we think you should be aware of.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Moury Construct, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTBR:MOUR

Moury Construct

Engages in the construction and renovation of residential and non-residential buildings for private and public markets in Belgium.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026