3 European Penny Stocks With Market Caps Under €2B To Consider

Reviewed by Simply Wall St

As European markets continue to navigate mixed performances, with the STOXX Europe 600 Index rising for a fourth consecutive week amid easing trade tensions, investors are increasingly looking at diverse opportunities. Penny stocks, often representing smaller or newer companies, remain a relevant investment area due to their affordability and potential for growth. Despite being considered an outdated term by some, these stocks can offer compelling opportunities when backed by strong financials and resilience.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.31 | SEK2.21B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK3.39 | SEK306.93M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.68 | SEK275.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.48 | SEK211.72M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.66 | PLN124.05M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.454 | NOK104.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.64 | €55.68M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €1.00 | €33.49M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.65 | €17.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.275 | €314.1M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 440 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

illimity Bank (BIT:ILTY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: illimity Bank S.p.A. offers private banking, investment, and trading services in Italy with a market cap of €299.51 million.

Operations: The company's revenue segments include Corporate Banking (€115.6 million), Specialised Credit (€104.2 million), Digital services (€62.7 million), Investment Banking (€23.5 million), B-Ilty services (€22.6 million), and SGR activities (€6.5 million).

Market Cap: €299.51M

illimity Bank S.p.A. presents a mixed picture for investors interested in penny stocks. Despite being unprofitable, the bank has managed to reduce its losses by 21% annually over the past five years. Trading at 50.4% below its estimated fair value, it may attract value-focused investors. However, challenges include a high bad loans ratio of 13.9% and a negative return on equity of -6.66%. The company's loans to deposits ratio is appropriate at 123%, and it benefits from low-risk funding sources comprising 63% customer deposits, offering some stability amidst volatility concerns.

- Jump into the full analysis health report here for a deeper understanding of illimity Bank.

- Learn about illimity Bank's future growth trajectory here.

Deceuninck (ENXTBR:DECB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deceuninck NV is involved in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions across Europe, North America, Turkey, and other international markets with a market cap of €314.10 million.

Operations: The company's revenue is primarily derived from its Window and Door Systems segment, contributing €759.81 million, followed by Home Protection at €40.48 million and Outdoor Living at €26.70 million.

Market Cap: €314.1M

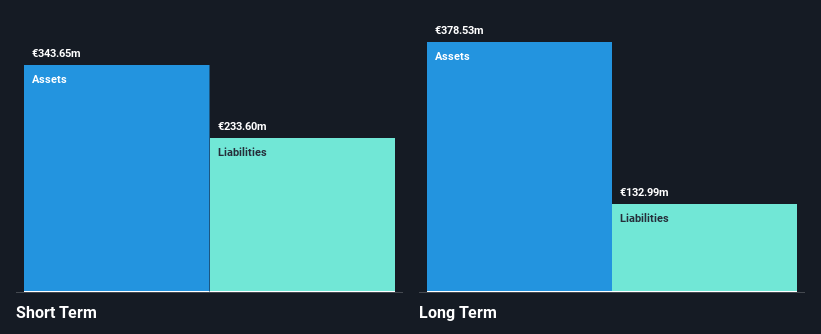

Deceuninck NV offers a compelling yet cautious opportunity within the penny stock landscape. The company has shown robust earnings growth of 46.6% over the past year, surpassing industry averages, and maintains a satisfactory net debt to equity ratio of 16.7%. Its operating cash flow comfortably covers its debt, and interest payments are well managed with EBIT coverage of 9.8 times. However, challenges include a low return on equity at 4.5% and an unstable dividend track record, while trading at 22.8% below estimated fair value may attract value investors despite these concerns.

- Get an in-depth perspective on Deceuninck's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Deceuninck's future.

Metsä Board Oyj (HLSE:METSB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp sectors both in Finland and internationally, with a market capitalization of approximately €1.33 billion.

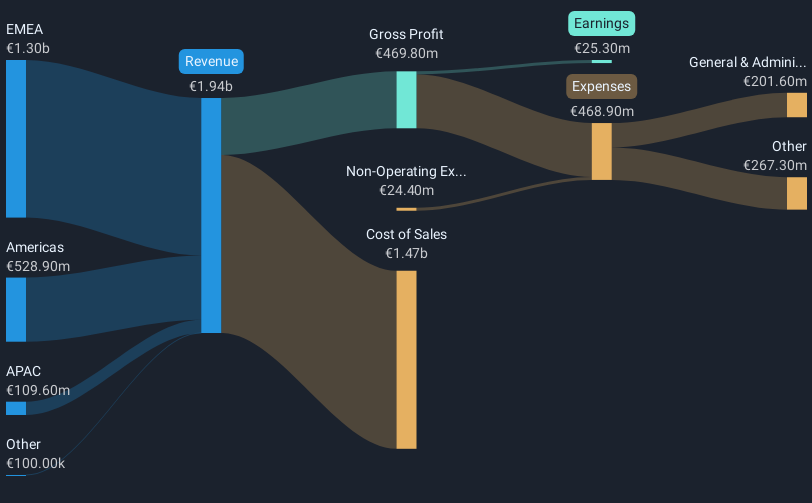

Operations: The company generates €1.94 billion in revenue from its operations in folding boxboard, fresh fibre linerboard, and market pulp businesses.

Market Cap: €1.33B

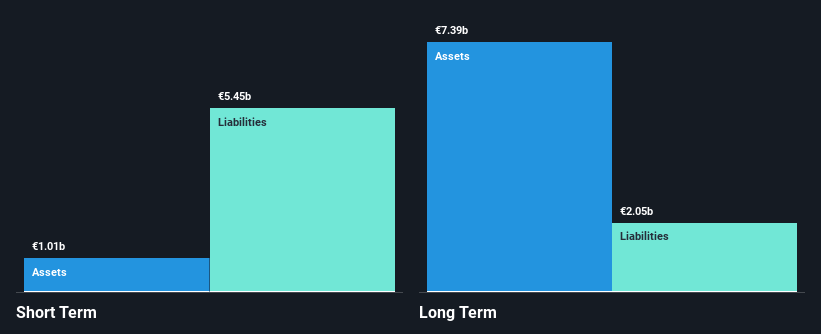

Metsä Board Oyj presents a nuanced picture in the penny stock arena. The company's short-term assets exceed both its short and long-term liabilities, indicating a stable financial position. Despite trading significantly below estimated fair value, recent performance shows challenges with declining profit margins and negative earnings growth over the past year. The company reported a net loss of €7 million for Q1 2025 compared to a profit previously, reflecting current operational difficulties. However, strategic initiatives like product advancements and leadership changes may offer potential upside if effectively executed amidst industry volatility.

- Dive into the specifics of Metsä Board Oyj here with our thorough balance sheet health report.

- Assess Metsä Board Oyj's future earnings estimates with our detailed growth reports.

Taking Advantage

- Unlock our comprehensive list of 440 European Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:DECB

Deceuninck

Engages in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions in Europe, North America, Turkey, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives