- Australia

- /

- Electric Utilities

- /

- ASX:LPE

Shareholders Will Probably Hold Off On Increasing Locality Planning Energy Holdings Limited's (ASX:LPE) CEO Compensation For The Time Being

The underwhelming share price performance of Locality Planning Energy Holdings Limited (ASX:LPE) in the past three years would have disappointed many shareholders. Per share earnings growth is also poor, despite revenues growing. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 19 October 2021, where they can impact on future company performance by voting on resolutions, including executive compensation. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

Check out our latest analysis for Locality Planning Energy Holdings

Comparing Locality Planning Energy Holdings Limited's CEO Compensation With the industry

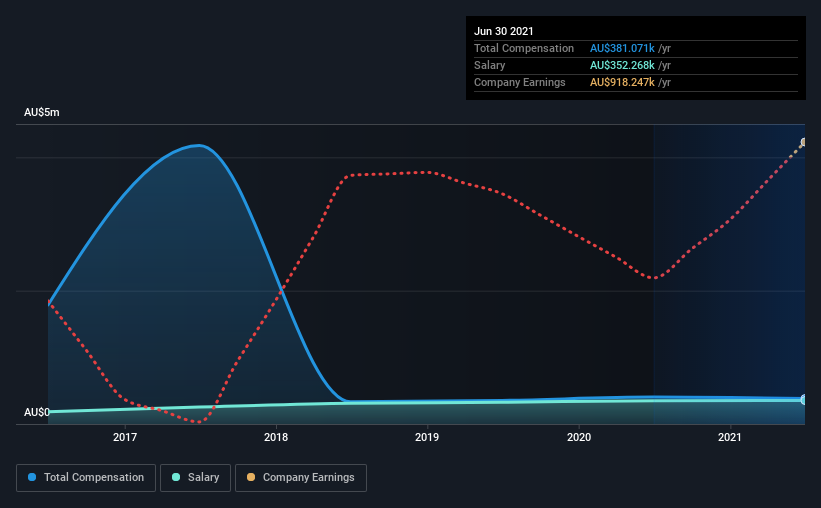

At the time of writing, our data shows that Locality Planning Energy Holdings Limited has a market capitalization of AU$13m, and reported total annual CEO compensation of AU$381k for the year to June 2021. That's a slight decrease of 5.5% on the prior year. We note that the salary portion, which stands at AU$352.3k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$272m, we found that the median total CEO compensation was AU$137k. Hence, we can conclude that Damien Glanville is remunerated higher than the industry median. Moreover, Damien Glanville also holds AU$1.4m worth of Locality Planning Energy Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$352k | AU$350k | 92% |

| Other | AU$29k | AU$53k | 8% |

| Total Compensation | AU$381k | AU$403k | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. According to our research, Locality Planning Energy Holdings has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Locality Planning Energy Holdings Limited's Growth Numbers

Over the last three years, Locality Planning Energy Holdings Limited has shrunk its earnings per share by 18% per year. In the last year, its revenue is up 28%.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Locality Planning Energy Holdings Limited Been A Good Investment?

The return of -83% over three years would not have pleased Locality Planning Energy Holdings Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 6 warning signs for Locality Planning Energy Holdings (of which 4 don't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Locality Planning Energy Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:LPE

Locality Planning Energy Holdings

Provides energy solutions throughout Queensland and Northern New South Wales.

Flawless balance sheet and good value.

Market Insights

Community Narratives