- Australia

- /

- Renewable Energy

- /

- ASX:LGI

3 ASX Penny Stocks With Market Caps Over A$10M To Watch

Reviewed by Simply Wall St

The Australian market is currently navigating a period of uncertainty, with the ASX 200 futures fluctuating and recent economic developments like the RBA's rate cut adding to the mixed signals. For investors looking beyond well-known stocks, penny stocks—typically smaller or newer companies—continue to offer intriguing opportunities despite being considered an outdated term. These stocks can present a unique blend of value and growth potential, especially when backed by strong financials, making them worth watching in today's complex market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.97 | A$92.93M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.99 | A$250.39M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.22 | A$346.95M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.08 | A$340.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.81 | A$101.78M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$2.11 | A$226.38M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Galileo Mining (ASX:GAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Galileo Mining Ltd is involved in the exploration of mineral deposits in Western Australia and has a market cap of A$26.68 million.

Operations: There are no reported revenue segments for this company.

Market Cap: A$26.68M

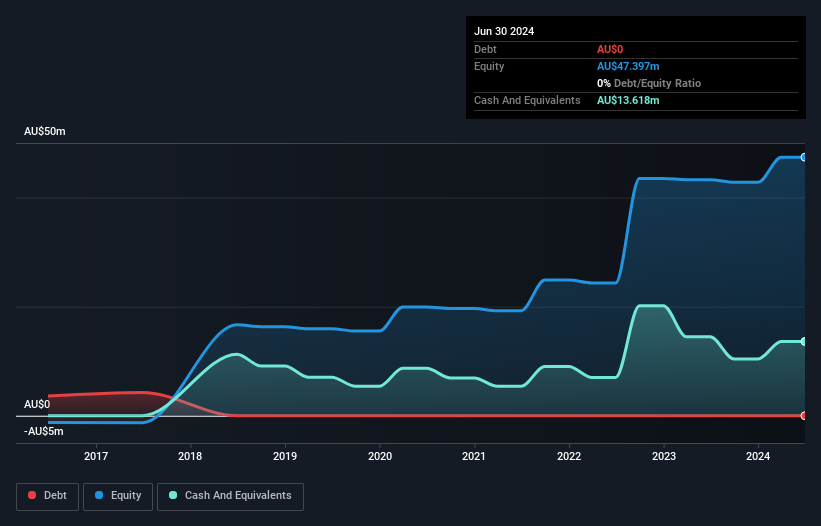

Galileo Mining, with a market cap of A$26.68 million, is a pre-revenue company involved in mineral exploration in Western Australia. Recently becoming profitable, it has shown an 18% annual earnings growth over the past five years, although this was impacted by a significant one-off gain of A$5 million. The company is debt-free with short-term assets of A$13.7 million comfortably covering its liabilities. Despite high volatility and low return on equity at 7.1%, Galileo's price-to-earnings ratio of 8.8x suggests it may be undervalued compared to the broader Australian market average of 19.8x.

- Click here to discover the nuances of Galileo Mining with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Galileo Mining's track record.

LGI (ASX:LGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LGI Limited focuses on carbon abatement and renewable energy solutions using biogas from landfill, with a market cap of A$266.43 million.

Operations: The company's revenue is derived from Carbon Abatement (A$17.03 million), Renewable Energy (A$15.05 million), and Infrastructure Construction and Management (A$2.21 million).

Market Cap: A$266.43M

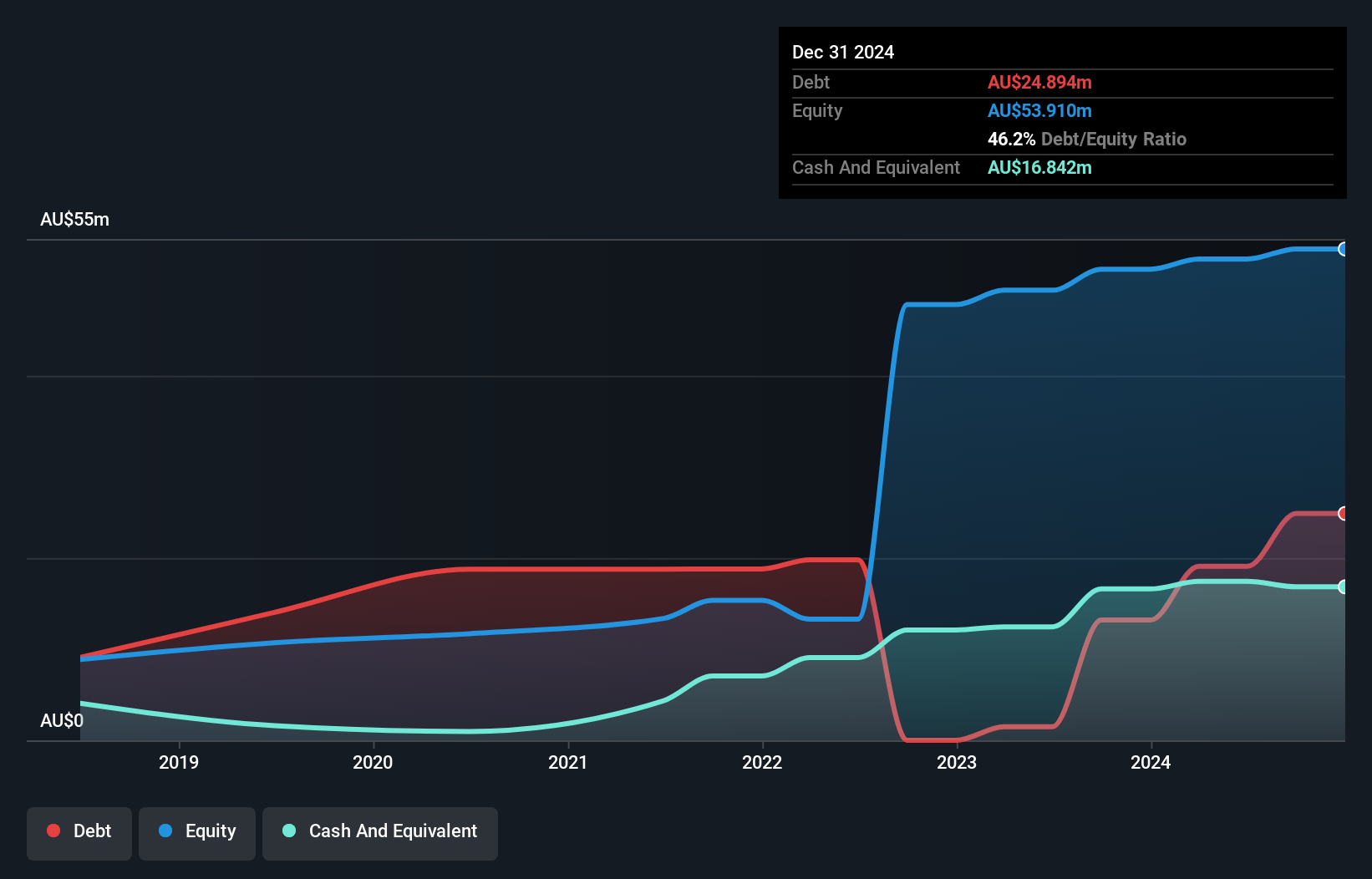

LGI Limited, with a market cap of A$266.43 million, focuses on carbon abatement and renewable energy. The company has shown stable weekly volatility and satisfactory net debt to equity ratio at 14.9%, indicating financial prudence despite negative earnings growth over the past year. While its short-term assets exceed short-term liabilities, they fall short of covering long-term obligations. Recent financials reveal a slight increase in sales to A$16.9 million for H1 2025 but a decrease in net income to A$2.4 million compared to the previous year, reflecting challenges in maintaining profit margins amid industry pressures.

- Click here and access our complete financial health analysis report to understand the dynamics of LGI.

- Gain insights into LGI's future direction by reviewing our growth report.

Solstice Minerals (ASX:SLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solstice Minerals Limited is an Australian company focused on gold and base metal exploration, with a market cap of A$18.06 million.

Operations: Solstice Minerals Limited does not currently report any revenue segments.

Market Cap: A$18.06M

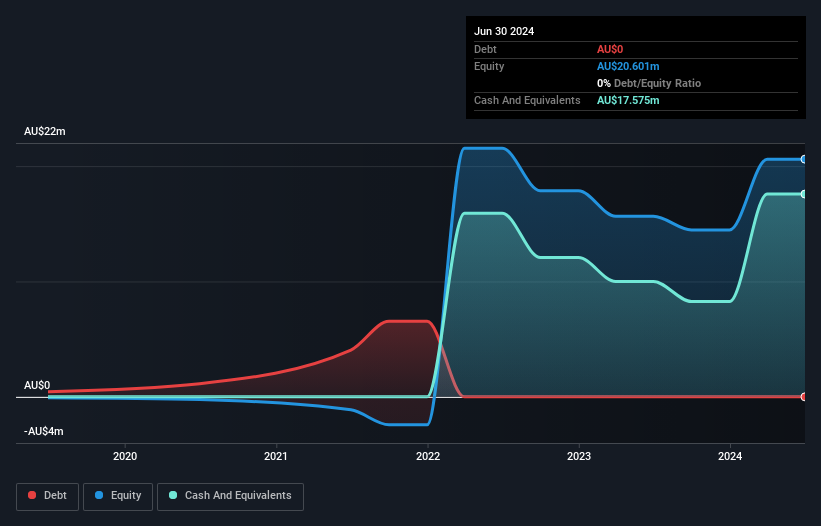

Solstice Minerals, with a market cap of A$18.06 million, is pre-revenue and has recently become profitable, though it generates less than US$1m in revenue. The company has no debt and its short-term assets significantly exceed both long-term and short-term liabilities, indicating strong financial health. Its Return on Equity is high at 22.4%, suggesting efficient use of equity capital. Recent strategic developments include acquiring the Nanadie Copper-Gold Project from Cyprium Metals Limited, potentially enhancing its resource base. Despite a relatively inexperienced board with an average tenure of 2.8 years, the management team shows seasoned leadership with two years' experience on average.

- Unlock comprehensive insights into our analysis of Solstice Minerals stock in this financial health report.

- Examine Solstice Minerals' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Embark on your investment journey to our 1,033 ASX Penny Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LGI

LGI

Provides carbon abatement and renewable energy solutions with biogas from landfill.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives