Could Duxton Water Limited (ASX:D2O) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

In this case, Duxton Water pays a decent-sized 4.2% dividend yield, and has been distributing cash to shareholders for the past three years. A 4.2% yield does look good. Could the short payment history hint at future dividend growth? The company also bought back stock during the year, equivalent to approximately 2.0% of the company's market capitalisation at the time. Some simple analysis can reduce the risk of holding Duxton Water for its dividend, and we'll focus on the most important aspects below.

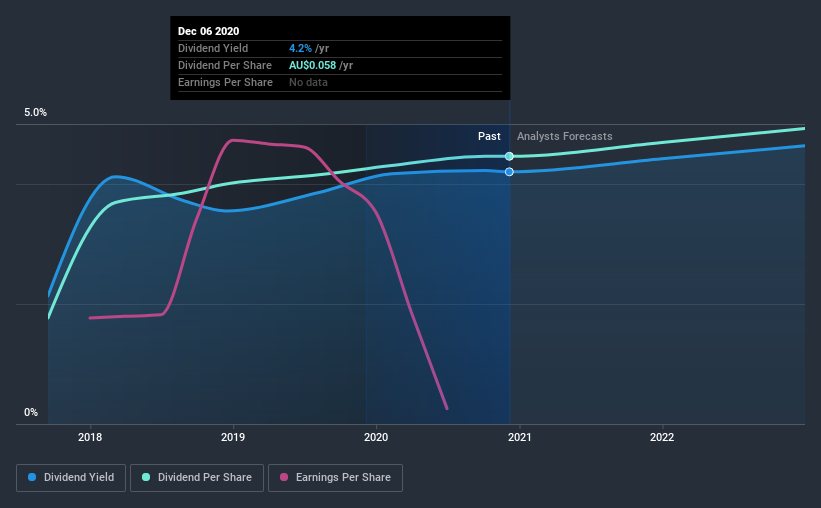

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Duxton Water paid out 1,238% of its profit as dividends, over the trailing twelve month period. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Unfortunately, while Duxton Water pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

Remember, you can always get a snapshot of Duxton Water's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past three-year period, the first annual payment was AU$0.02 in 2017, compared to AU$0.06 last year. Dividends per share have grown at approximately 36% per year over this time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Duxton Water's earnings per share have fallen -94% over the past year. This is a pretty serious concern, and it would be worth investigating whether something fundamental in the business has changed - or broken. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Duxton Water paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Earnings per share are down, and to our mind Duxton Water has not been paying a dividend long enough to demonstrate its resilience across economic cycles. There are a few too many issues for us to get comfortable with Duxton Water from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 4 warning signs for Duxton Water (2 don't sit too well with us!) that you should be aware of before investing.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Duxton Water or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:RIV

Rivco Australia

Provides water supply solutions to Australian irrigators.

Undervalued with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026