- Australia

- /

- Water Utilities

- /

- ASX:RIV

Duxton Water's (ASX:D2O) Upcoming Dividend Will Be Larger Than Last Year's

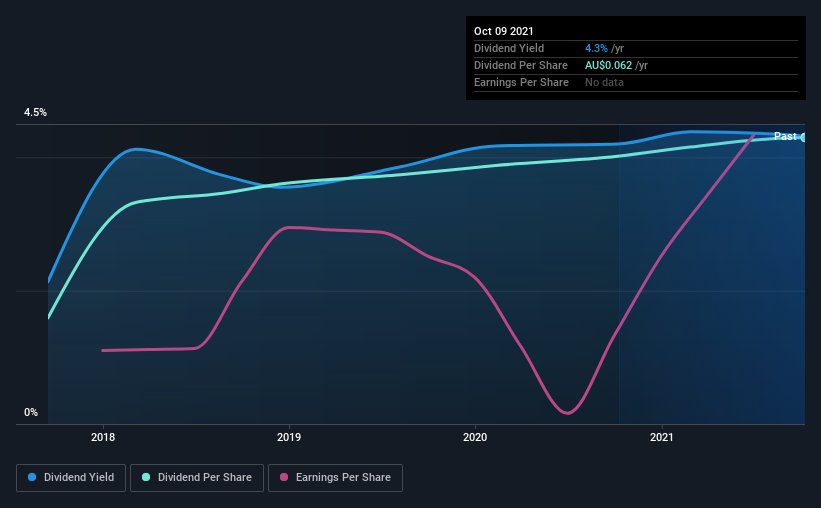

The board of Duxton Water Limited (ASX:D2O) has announced that the dividend on 29th of October will be increased to AU$0.031, which will be 6.9% higher than last year. This will take the annual payment to 4.2% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for Duxton Water

Duxton Water's Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. The last dividend was quite comfortably covered by Duxton Water's earnings, but it was a bit tighter on the cash flow front. The business is earning enough to make the dividend feasible, but the cash payout ratio of 78% indicates it is more focused on returning cash to shareholders than growing the business.

If the trend of the last few years continues, EPS will grow by 56.7% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio will be 33%, which is in the range that makes us comfortable with the sustainability of the dividend.

Duxton Water Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 4 years, which isn't that long in the grand scheme of things. The first annual payment during the last 4 years was AU$0.023 in 2017, and the most recent fiscal year payment was AU$0.062. This means that it has been growing its distributions at 28% per annum over that time. Duxton Water has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see Duxton Water has been growing its earnings per share at 57% a year over the past three years. Duxton Water is clearly able to grow rapidly while still returning cash to shareholders, positioning it to become a strong dividend payer in the future.

Our Thoughts On Duxton Water's Dividend

In summary, while it's always good to see the dividend being raised, we don't think Duxton Water's payments are rock solid. While Duxton Water is earning enough to cover the dividend, we are generally unimpressed with its future prospects. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 3 warning signs for Duxton Water (of which 1 shouldn't be ignored!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:RIV

Rivco Australia

Provides water supply solutions to Australian irrigators.

Solid track record and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success