- Australia

- /

- Capital Markets

- /

- ASX:BTI

Bailador Technology Investments And 2 Other ASX Penny Stocks Worth Watching

Reviewed by Simply Wall St

The Australian market is poised for a dynamic week, with key rate decisions and influential elections on the horizon, potentially shaping investor sentiment. In this context, penny stocks—though often considered niche investments—continue to offer intriguing opportunities for those seeking growth in smaller or newer companies. These stocks can be particularly appealing when backed by strong financial health, presenting potential value and growth that might not be as readily available in larger firms.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.85 | A$102.34M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.81 | A$291.55M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$815.98M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.165 | A$1.08B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.33 | A$127.72M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.12 | A$328.36M | ★★★★☆☆ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bailador Technology Investments (ASX:BTI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bailador Technology Investments Limited is a venture capital firm focusing on mid venture, growth capital, late venture and PIPESs and expansion capital investments in companies beyond the start-up phase, with a market cap of A$185.90 million.

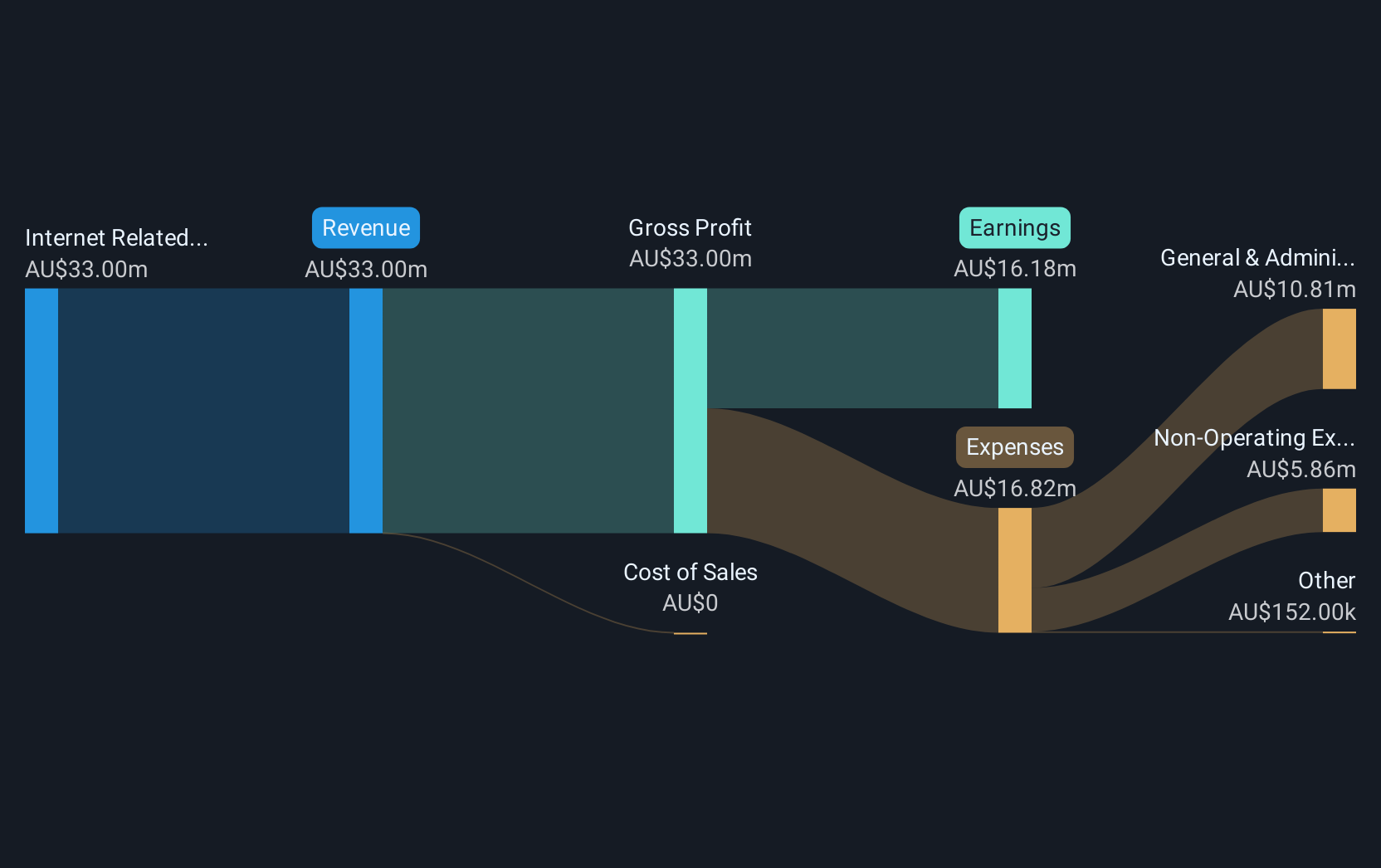

Operations: The company generates revenue primarily from its internet-related businesses, amounting to A$40.55 million.

Market Cap: A$185.9M

Bailador Technology Investments has demonstrated significant earnings growth, reporting a net income of A$20.67 million for the year ended June 30, 2024, compared to A$5.42 million the previous year. This growth is largely driven by high-quality non-cash earnings and improved profit margins, now at 51%. The company is debt-free and trades at a substantial discount to its estimated fair value. However, its dividend yield of 5.48% is not well covered by free cash flows. Bailador's seasoned board and management team contribute to its robust operational framework amidst stable volatility levels.

- Jump into the full analysis health report here for a deeper understanding of Bailador Technology Investments.

- Review our historical performance report to gain insights into Bailador Technology Investments' track record.

Next Science (ASX:NXS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Next Science Limited focuses on the research, development, and commercialization of technologies targeting biofilms and infections in human health across North America, Australia, and New Zealand, with a market cap of A$42.36 million.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, amounting to $23.31 million.

Market Cap: A$42.36M

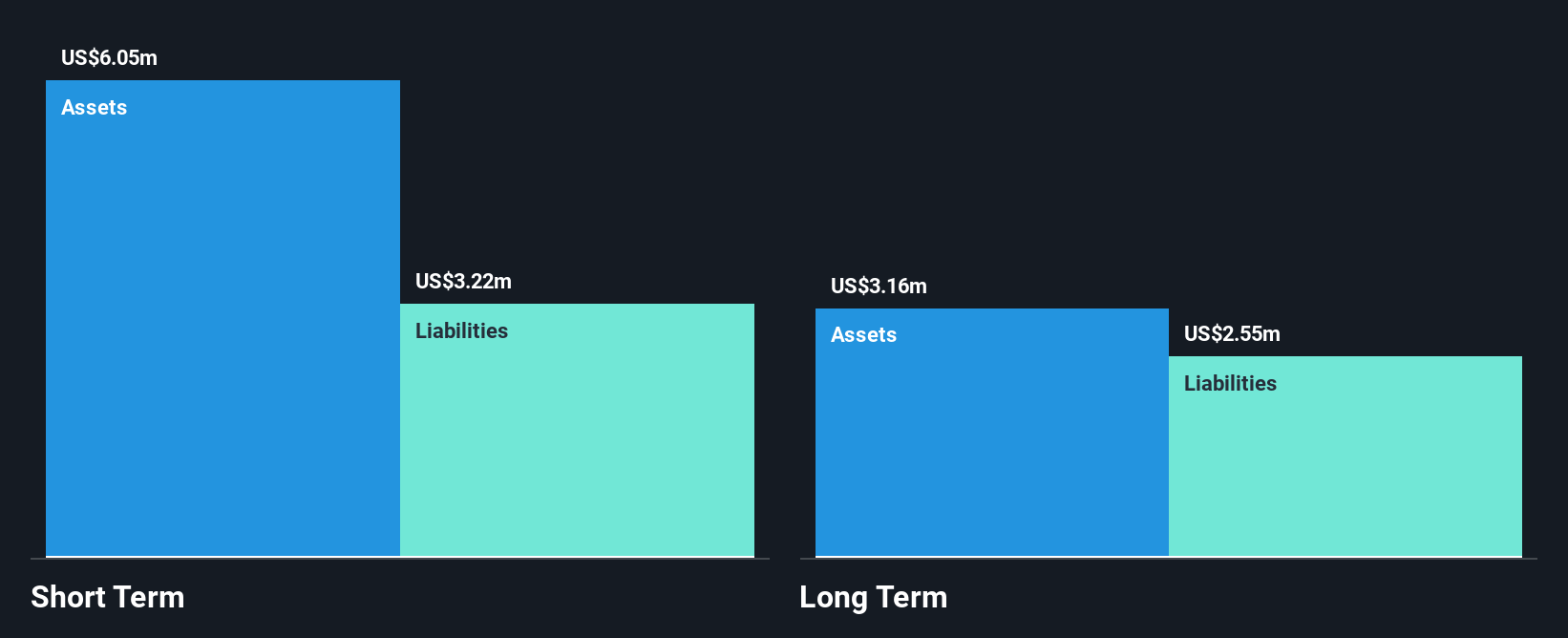

Next Science Limited operates in the biofilm and infection technology sector, with a market cap of A$42.36 million and revenue of US$11.24 million for the first half of 2024, showing growth from the previous year. Despite this revenue increase, the company remains unprofitable with a net loss of US$5.84 million for the same period. The share price is highly volatile, and shareholders have experienced dilution over the past year with a 7.6% increase in shares outstanding. Although debt-free, Next Science faces challenges with less than one year of cash runway based on current free cash flow trends.

- Get an in-depth perspective on Next Science's performance by reading our balance sheet health report here.

- Assess Next Science's future earnings estimates with our detailed growth reports.

Wiseway Group (ASX:WWG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wiseway Group Limited, with a market cap of A$21.75 million, operates logistics and freight forwarding services across Australia, New Zealand, China, Singapore, and the United States.

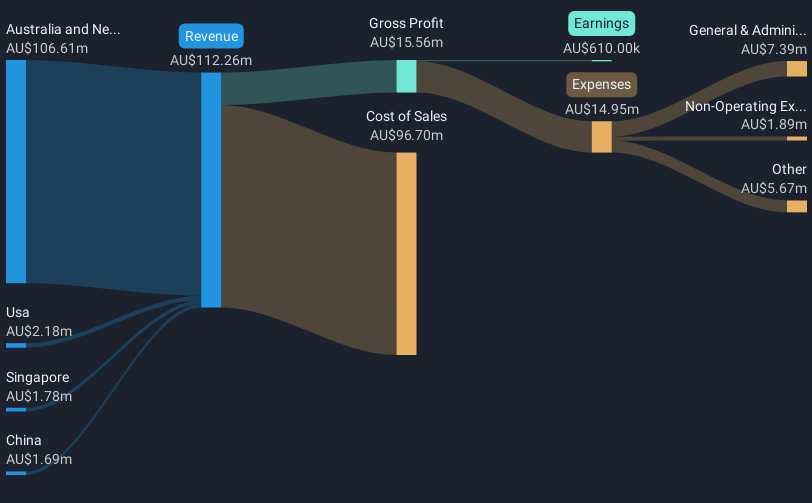

Operations: The company generates revenue of A$112.26 million from its freight forwarding services.

Market Cap: A$21.75M

Wiseway Group Limited, with a market cap of A$21.75 million, has recently achieved profitability, reporting a net income of A$0.61 million for the year ending June 30, 2024. Despite this positive shift from a previous net loss, the company faces challenges such as short-term liabilities exceeding short-term assets and an inexperienced management team with an average tenure of 1.7 years. The company's share price has been highly volatile over recent months, and while its debt is well-covered by operating cash flow, the debt to equity ratio has increased significantly over five years to 74.7%.

- Take a closer look at Wiseway Group's potential here in our financial health report.

- Gain insights into Wiseway Group's historical outcomes by reviewing our past performance report.

Where To Now?

- Explore the 1,033 names from our ASX Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bailador Technology Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BTI

Bailador Technology Investments

A venture capital firm specializing in investments in series A, mid venture, growth capital, late venture and PIPESs and expansion capital in companies which have advanced through the start-up phase.

Flawless balance sheet and fair value.

Market Insights

Community Narratives