Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Saferoads Holdings Limited (ASX:SRH) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Saferoads Holdings

What Is Saferoads Holdings's Net Debt?

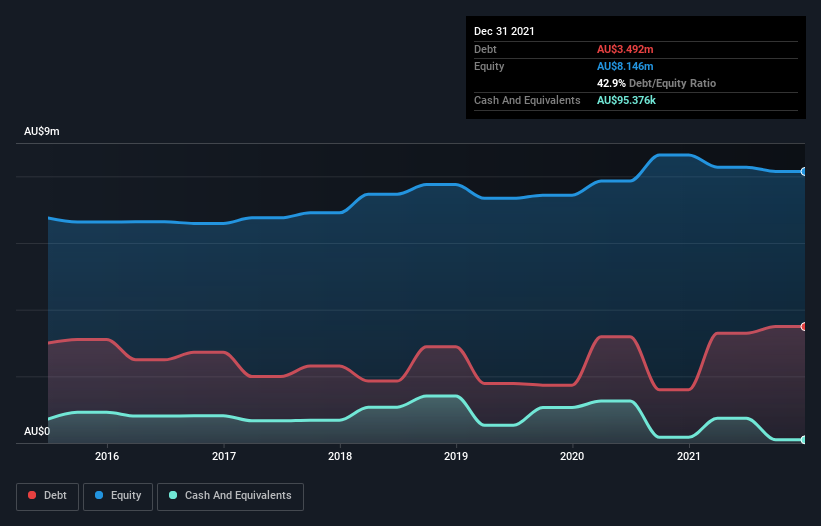

You can click the graphic below for the historical numbers, but it shows that as of December 2021 Saferoads Holdings had AU$3.49m of debt, an increase on AU$1.60m, over one year. However, because it has a cash reserve of AU$95.4k, its net debt is less, at about AU$3.40m.

How Strong Is Saferoads Holdings' Balance Sheet?

The latest balance sheet data shows that Saferoads Holdings had liabilities of AU$3.39m due within a year, and liabilities of AU$3.91m falling due after that. Offsetting this, it had AU$95.4k in cash and AU$1.45m in receivables that were due within 12 months. So it has liabilities totalling AU$5.75m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of AU$7.12m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Saferoads Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Saferoads Holdings made a loss at the EBIT level, and saw its revenue drop to AU$11m, which is a fall of 30%. That makes us nervous, to say the least.

Caveat Emptor

Not only did Saferoads Holdings's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost AU$195k at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled AU$319k in negative free cash flow over the last twelve months. So to be blunt we think it is risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Saferoads Holdings has 3 warning signs (and 2 which are potentially serious) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SRH

Saferoads Holdings

Provides road safety products and solutions in Australia, New Zealand, and the United States.

Flawless balance sheet low.

Market Insights

Community Narratives