Does Qantas Airways’ Strong FY25 Profit Growth Reinforce Its Investment Narrative for ASX:QAN?

Reviewed by Sasha Jovanovic

- Qantas Airways recently reported an 8.8% year-over-year revenue increase for FY25, along with significant gains in statutory profit after tax and gross margin.

- The company also provided guidance for FY26, forecasting revenue per available seat kilometre (RASK) growth and a stable cost base, indicating ongoing management confidence in future financial performance.

- We'll examine how Qantas's robust FY25 profit growth and outlook for RASK expansion may impact its investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Qantas Airways Investment Narrative Recap

Investors focused on Qantas must believe in the airline's ability to translate robust profit growth and RASK expansion into sustainable gains, while successfully managing cost pressures and capital-heavy fleet renewal. The recent revenue and profit uptick supports the outlook narrative, but the most material short-term catalyst remains the scale and timing of new aircraft deliveries. Risks from supplier delays and elevated entry-into-service costs have not diminished with these results, so the headline news only modestly alters the current risk-reward equation.

Among recent announcements, the company's sizeable special and ordinary dividend declarations for FY25 are most relevant, underscoring management's confidence in cash flow and ongoing shareholder returns. The payout aligns with expectations set by improved operating margins, but it is closely linked to the same profitability and cost efficiency drivers highlighted in the latest earnings, factors still sensitive to capacity and fleet transition risks in the near term.

On the flip side, investors should keep a close watch on how aircraft delivery delays could disrupt near-term growth and margin plans, as...

Read the full narrative on Qantas Airways (it's free!)

Qantas Airways is forecast to generate A$28.1 billion in revenue and A$2.1 billion in earnings by 2028. Achieving this will require 5.7% annual revenue growth and an increase in earnings of about A$0.5 billion from the current A$1.6 billion.

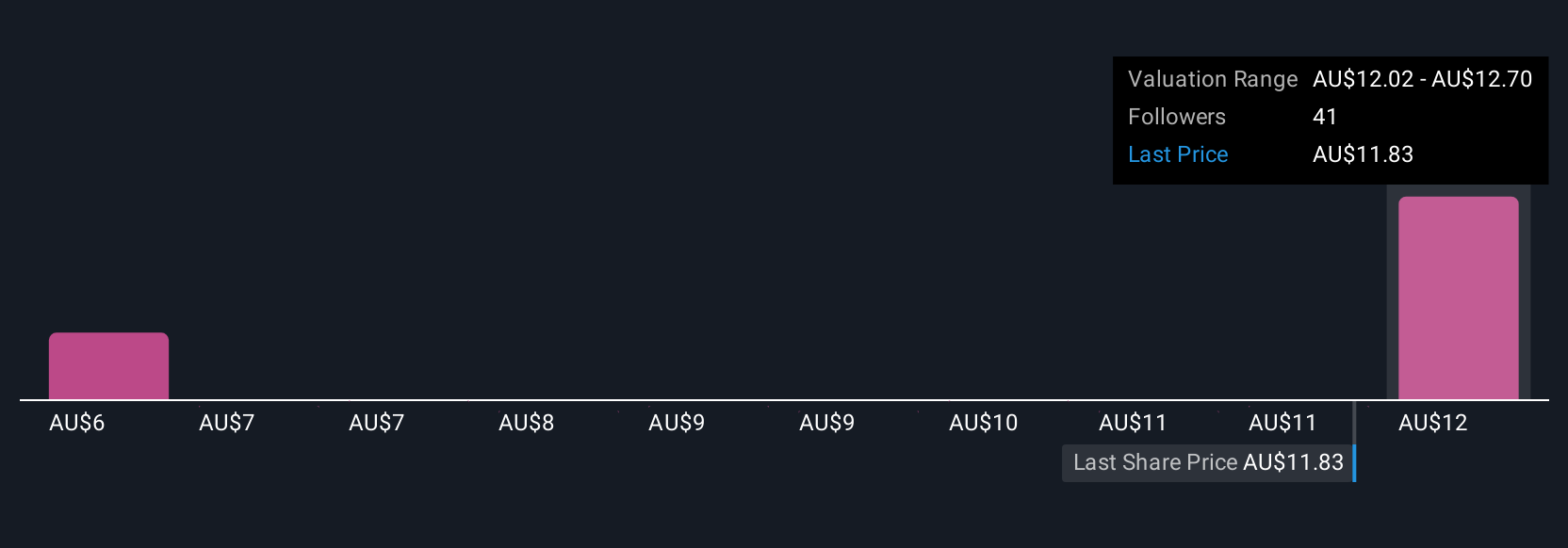

Uncover how Qantas Airways' forecasts yield a A$12.70 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members shared 10 fair value targets for Qantas between A$5.74 and A$12.70 per share. While fleet renewal is expected to boost future earnings, the broad estimates show just how much perspectives can differ, explore the range of opinions to better inform your view.

Explore 10 other fair value estimates on Qantas Airways - why the stock might be worth 45% less than the current price!

Build Your Own Qantas Airways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qantas Airways research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Qantas Airways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qantas Airways' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qantas Airways might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QAN

Qantas Airways

Provides air transportation services in Australia and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives