- Australia

- /

- Specialty Stores

- /

- ASX:SUL

Top ASX Dividend Stocks To Watch In November 2025

Reviewed by Simply Wall St

Amid a week of subdued performance on the Australian market, with futures indicating a modest decline of around 0.5%, investors are navigating cautious sentiment influenced by global economic factors, including significant job cuts in the US and ongoing concerns over AI valuations. In such an environment, dividend stocks can offer a measure of stability and income potential, making them particularly appealing to those looking for reliable returns despite broader market uncertainties.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 6.94% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.00% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.90% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.70% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.09% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.76% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.18% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.67% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.25% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 5.86% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

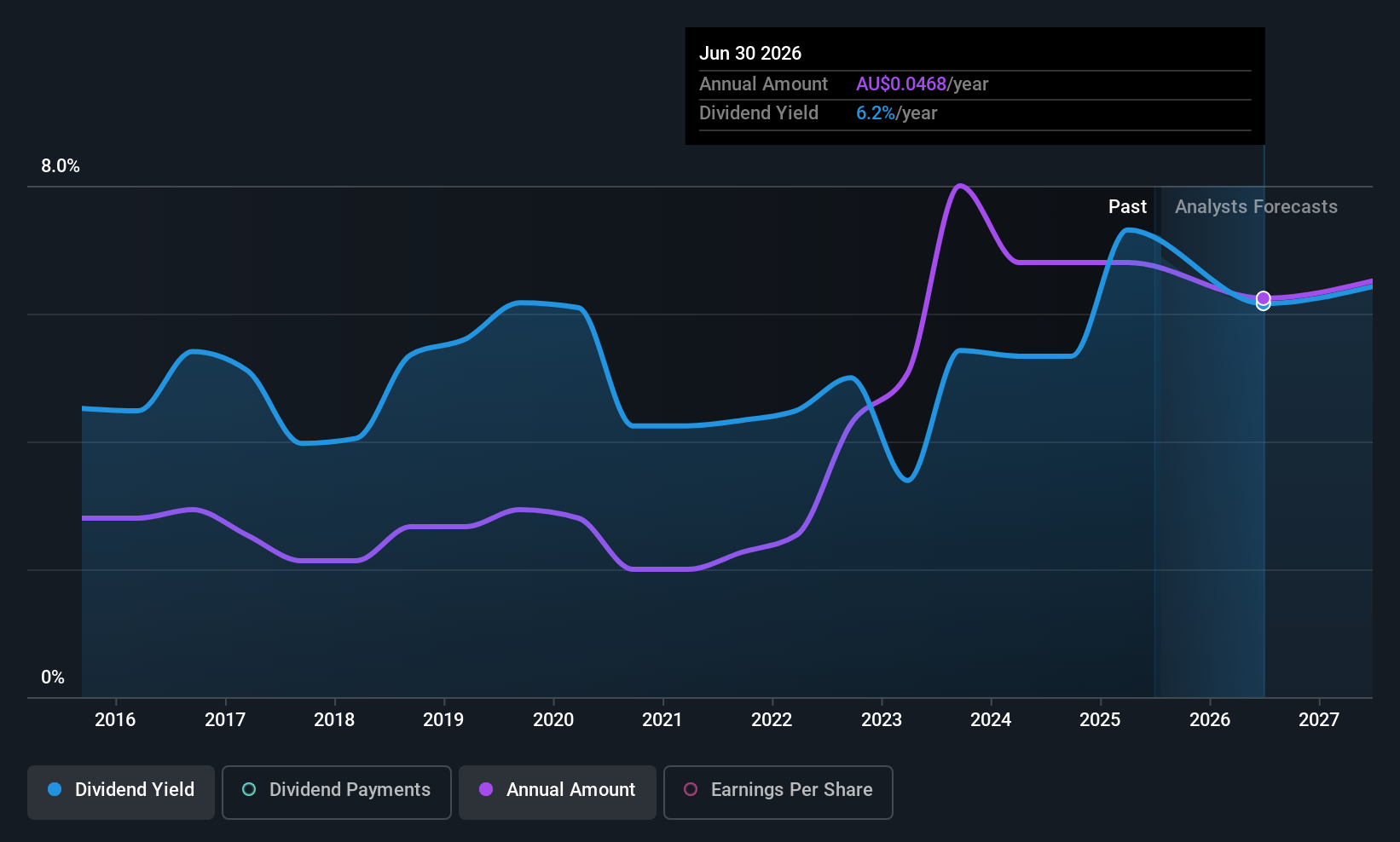

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lindsay Australia Limited, with a market cap of A$224.21 million, offers integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia.

Operations: Lindsay Australia Limited generates revenue from its key segments, including Transport (A$586.41 million), Rural (A$168.12 million), and Hunters (A$110.37 million).

Dividend Yield: 6.2%

Lindsay Australia's dividend yield of 6.18% places it in the top quartile among Australian dividend payers. Despite a reduction in net income to A$17.39 million, dividends remain covered by earnings with a payout ratio of 68.8% and are well-supported by cash flows at 26%. However, its dividend history is marked by volatility and unreliability over the past decade, raising concerns about sustainability despite recent increases in payouts.

- Click here to discover the nuances of Lindsay Australia with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Lindsay Australia's current price could be quite moderate.

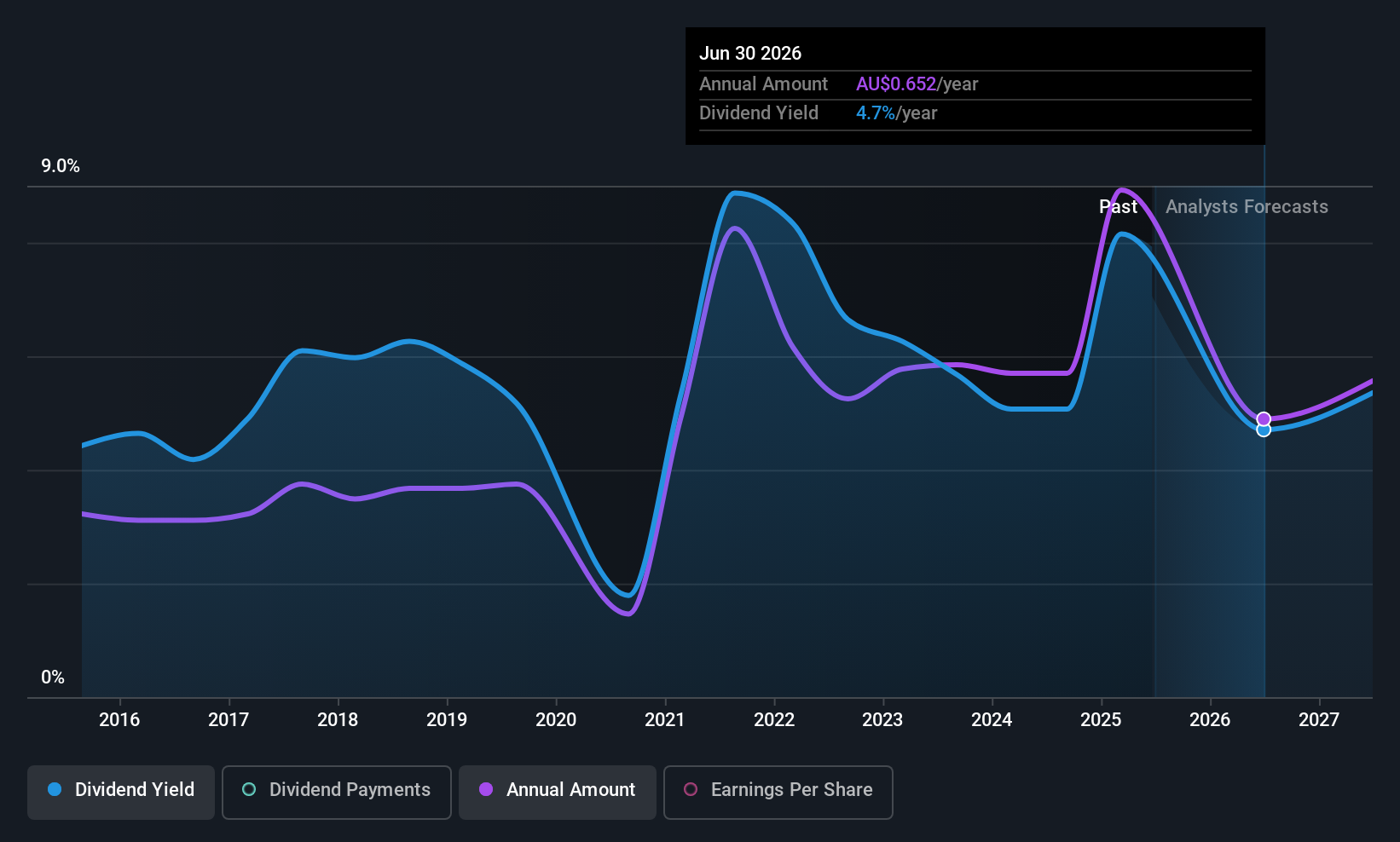

Super Retail Group (ASX:SUL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Super Retail Group Limited operates as a retailer of auto, sports, and outdoor leisure products in Australia and New Zealand with a market cap of A$3.61 billion.

Operations: Super Retail Group Limited's revenue is derived from its segments: Rebel at A$1.36 billion, Macpac at A$231.40 million, Super Cheap Auto (SCA) at A$1.53 billion, and Boating, Camping and Fishing (BCF) at A$950.70 million in Australia and New Zealand.

Dividend Yield: 6%

Super Retail Group's dividend yield of 6% is among the top 25% in Australia, supported by a sustainable payout ratio of 67.2% from earnings and 52.7% from cash flows. Despite recent growth, dividends have been volatile over the past decade, impacting reliability. Recent leadership changes with Paul Bradshaw as CEO may influence strategic direction and stability. The stock trades at a significant discount to estimated fair value, offering potential relative value compared to peers.

- Dive into the specifics of Super Retail Group here with our thorough dividend report.

- Our valuation report here indicates Super Retail Group may be undervalued.

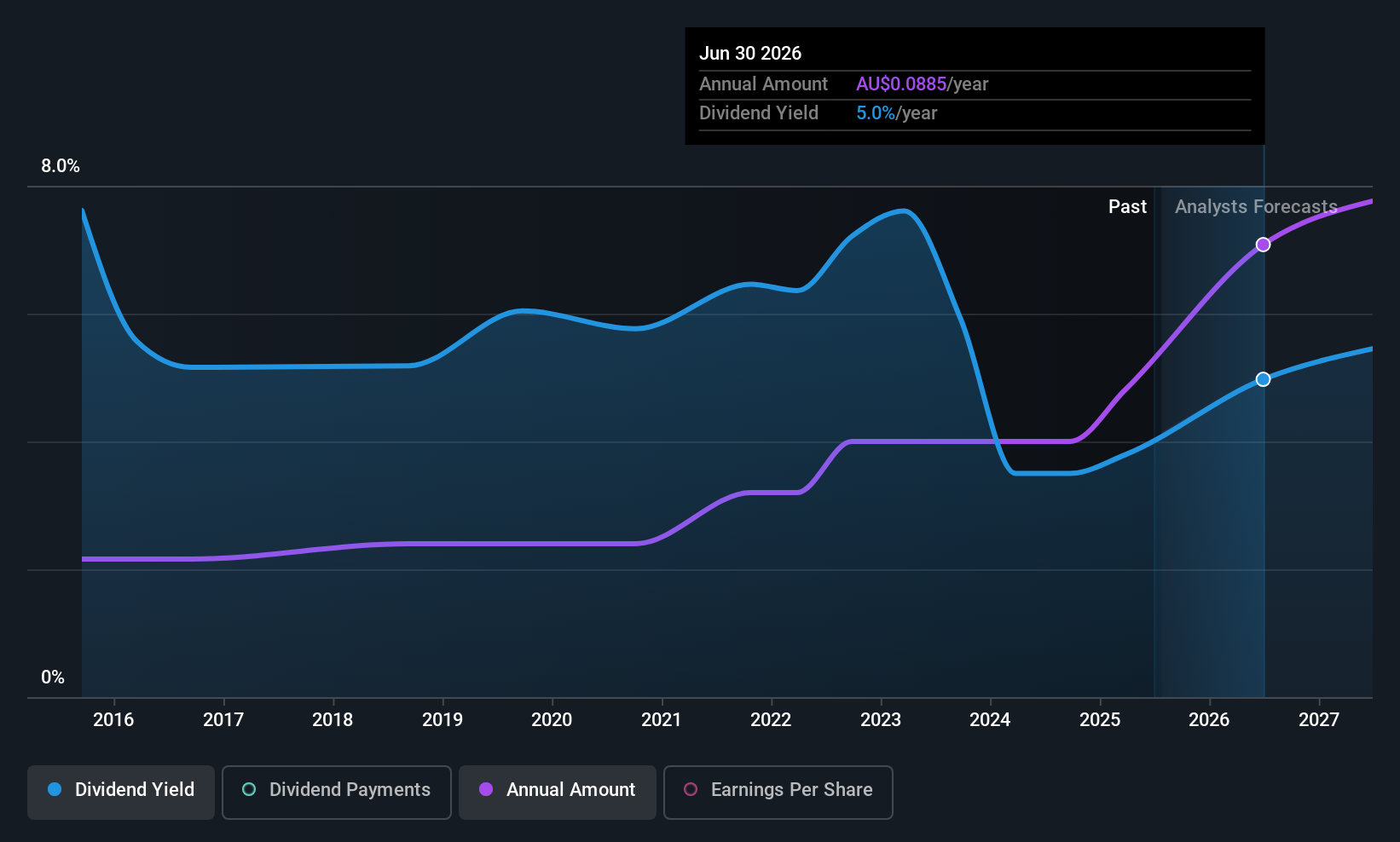

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited, with a market cap of A$601.10 million, offers electrical, instrumentation, communications, security, fire, and maintenance services and products across Australia.

Operations: Southern Cross Electrical Engineering Limited generates revenue primarily from the provision of electrical services, amounting to A$801.45 million.

Dividend Yield: 3.3%

Southern Cross Electrical Engineering's dividend yield of 3.32% is lower than Australia's top payers, but a payout ratio of 62.5% from earnings and 33.4% from cash flows indicates sustainability. Despite past volatility in dividends, recent earnings growth and strategic acquisitions could bolster future payouts. The appointment of Louise Daw as Non-Executive Director adds expertise in technology and governance, potentially enhancing long-term strategy and stability amidst ongoing acquisition initiatives for geographic expansion and capability enhancement.

- Click here and access our complete dividend analysis report to understand the dynamics of Southern Cross Electrical Engineering.

- According our valuation report, there's an indication that Southern Cross Electrical Engineering's share price might be on the expensive side.

Taking Advantage

- Click here to access our complete index of 29 Top ASX Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SUL

Super Retail Group

Engages in the retail of auto, sports, and outdoor leisure products in Australia and New Zealand.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives