- Australia

- /

- Healthcare Services

- /

- ASX:SHL

Three ASX Dividend Stocks Offering Yields From 4.1% To 7.0%

Reviewed by Simply Wall St

Amidst a challenging day on the ASX200, where all sectors closed in the red and notable declines were observed across materials and real estate sectors, investors may seek stability and potential income through dividend-yielding stocks. In times of market volatility, such stocks can offer a semblance of predictability and steady returns, making them an appealing option for those looking to mitigate risk.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 7.06% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.97% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.72% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.94% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.54% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.21% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.68% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 8.56% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.12% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.98% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

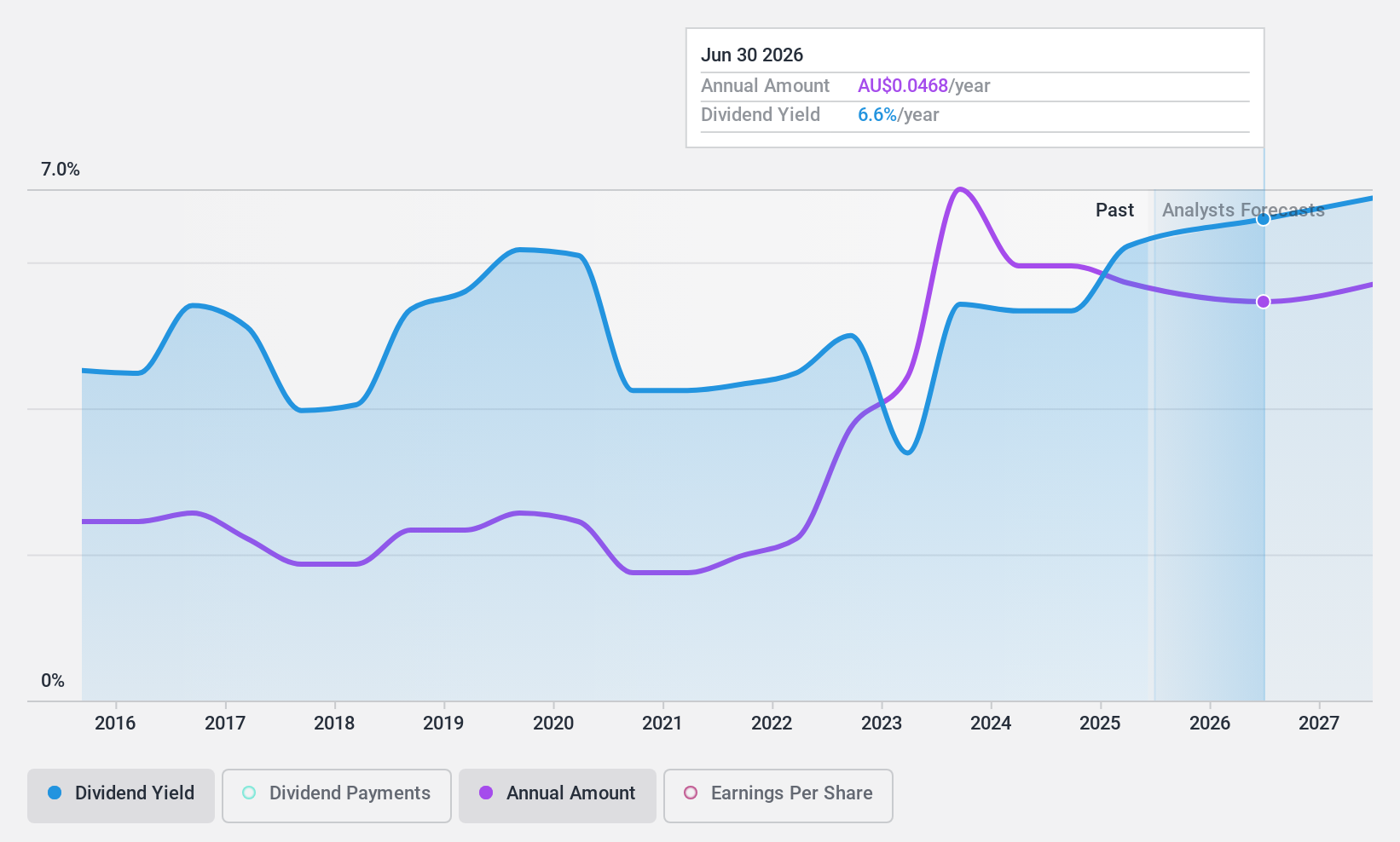

Lindsay Australia (ASX:LAU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lindsay Australia Limited operates in Australia, offering integrated transport, logistics, and rural supply services primarily to sectors like food processing and horticulture, with a market capitalization of approximately A$271.81 million.

Operations: Lindsay Australia Limited generates revenue through its rural and transport services, with the rural segment bringing in A$158.73 million and the transport segment accounting for A$571.38 million.

Dividend Yield: 7.1%

Lindsay Australia offers a dividend yield of 7.06%, ranking in the top 25% of Australian dividend payers. Despite past volatility in dividend payments, current dividends are well-supported by both earnings and cash flows, with a payout ratio of 43.7% and a cash payout ratio of 38.9%. Additionally, the company's earnings have shown significant growth, increasing by 50.3% over the past year with future growth projected at 9% annually. However, shareholder dilution occurred over the past year, indicating potential concerns about equity value retention.

- Delve into the full analysis dividend report here for a deeper understanding of Lindsay Australia.

- According our valuation report, there's an indication that Lindsay Australia's share price might be on the cheaper side.

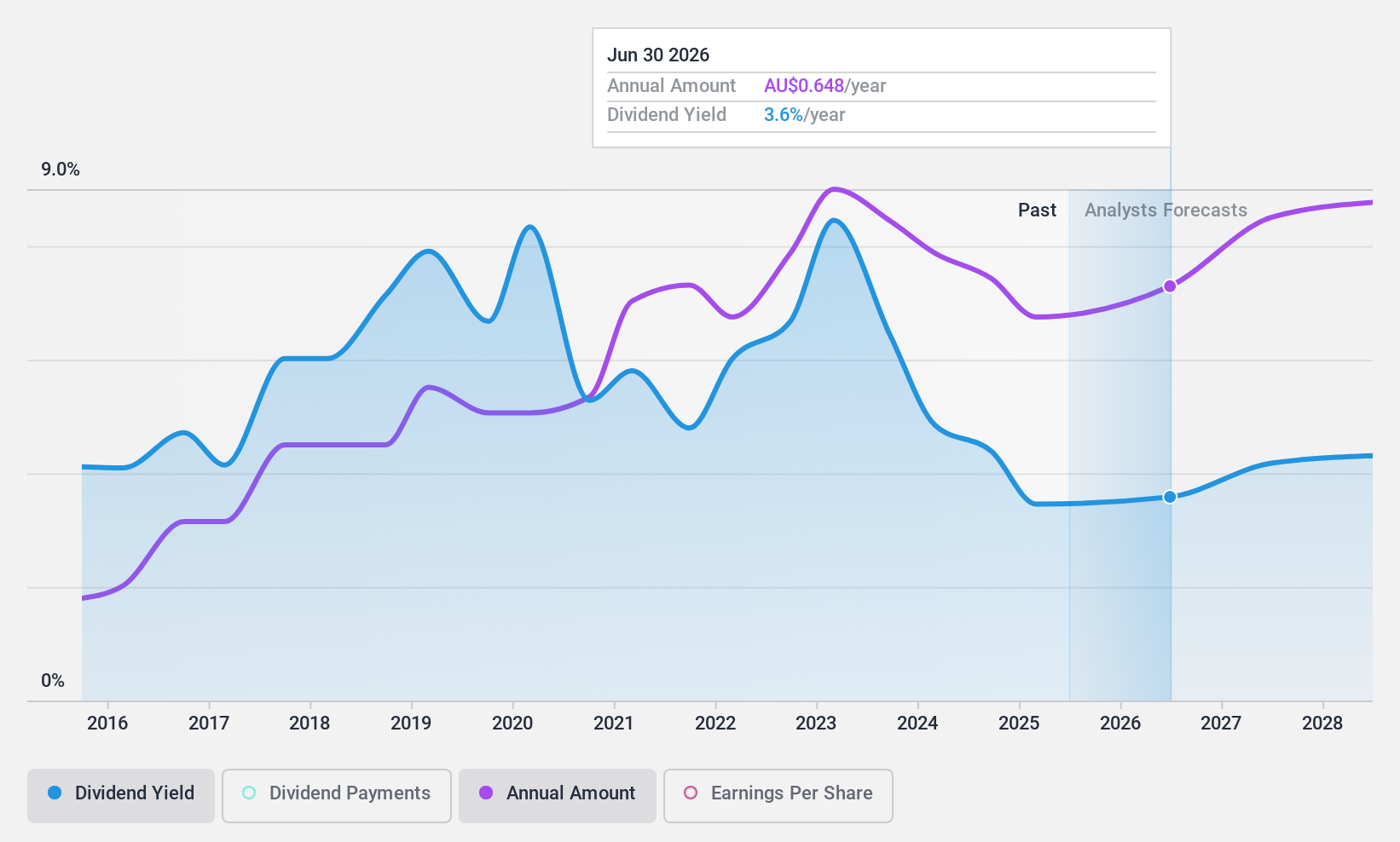

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited operates in the sourcing and retailing of household furniture and related accessories across Australia and New Zealand, with a market capitalization of approximately A$1.20 billion.

Operations: Nick Scali Limited generates its revenue primarily from the retailing of furniture, amounting to A$450.45 million.

Dividend Yield: 4.9%

Nick Scali Limited's dividend yield stands at 4.94%, which is lower than the top Australian dividend payers. Despite this, its dividends have shown consistency and growth over the past decade, supported by a stable payout ratio of 67.9% and a cash payout ratio of 45.6%. Recent follow-on equity offerings totaling A$70 million may raise concerns about shareholder dilution, although no significant insider selling has occurred in the last quarter. The company's earnings are expected to grow by 8.3% annually, suggesting potential for future dividend increases.

- Dive into the specifics of Nick Scali here with our thorough dividend report.

- Our expertly prepared valuation report Nick Scali implies its share price may be lower than expected.

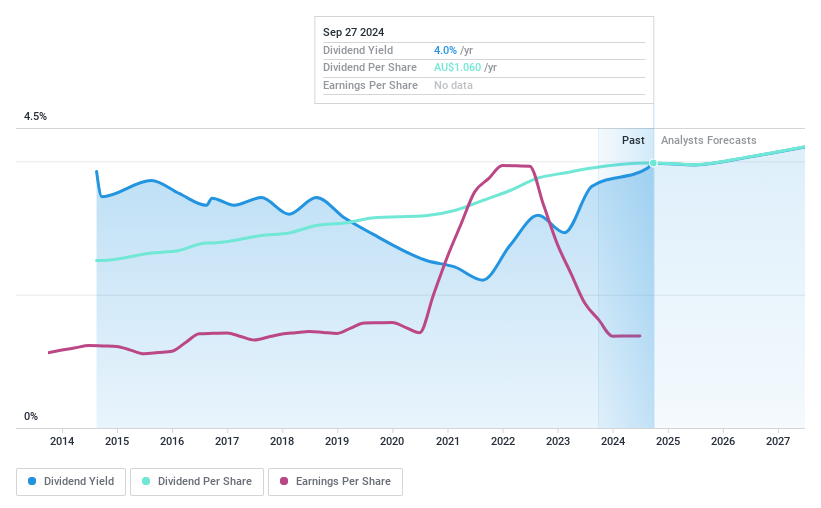

Sonic Healthcare (ASX:SHL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sonic Healthcare Limited provides medical diagnostic services to a range of healthcare providers and their patients, with a market capitalization of approximately A$12.00 billion.

Operations: Sonic Healthcare Limited generates A$7.12 billion from its Laboratory segment and A$0.84 billion from Radiology.

Dividend Yield: 4.2%

Sonic Healthcare's dividend yield of 4.19% trails behind the leading Australian dividend stocks. While its dividends have grown and remained stable over the last decade, they are poorly covered by earnings with a high payout ratio of 98%. Additionally, profit margins have decreased from 11.7% to 6% this year, further stressing dividend sustainability despite being supported by cash flows with an 87.5% cash payout ratio. Recent M&A activity could influence future performance, as Sonic eyes a potential A$800 million acquisition in the diagnostic imaging sector.

- Get an in-depth perspective on Sonic Healthcare's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Sonic Healthcare shares in the market.

Taking Advantage

- Reveal the 27 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sonic Healthcare, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SHL

Sonic Healthcare

Offers medical diagnostic and administrative services to medical practitioners, hospitals, community health services, and patients in Australia, the United States, Germany, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives