- Australia

- /

- Transportation

- /

- ASX:KLS

ASX Growth Companies With High Insider Ownership Spotlight May 2024

Reviewed by Simply Wall St

Amid a challenging day on the Australian stock market, where indices and sectors across the board faced declines, investors might find solace in exploring growth companies with high insider ownership. Such stocks often suggest that company leaders have significant skin in the game, potentially aligning their interests closely with shareholders especially in turbulent times.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Gratifii (ASX:GTI) | 15.6% | 112.4% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Alpha HPA (ASX:A4N) | 26.3% | 95.9% |

| Plenti Group (ASX:PLT) | 12.6% | 106.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Botanix Pharmaceuticals (ASX:BOT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Botanix Pharmaceuticals Limited, based in Australia, focuses on the research and development of dermatology and antimicrobial products with a market capitalization of approximately A$472.54 million.

Operations: The company generates its revenue primarily from the development of products for dermatological and antimicrobial applications, totaling A$0.44 million.

Insider Ownership: 11.4%

Earnings Growth Forecast: 120.9% p.a.

Botanix Pharmaceuticals, with its inclusion in the S&P/ASX All Ordinaries Index and a significant increase in half-year sales to A$0.38 million from A$0.04 million year-over-year, demonstrates potential amidst challenges like increased net losses of A$5.47 million. Despite high insider ownership, it faces hurdles such as a short cash runway and recent shareholder dilution. However, prospects look promising with an expected sharp revenue growth at 120.4% annually and forecasts indicating profitability within three years bolstered by a very high projected Return on Equity of 43.9%.

- Click here to discover the nuances of Botanix Pharmaceuticals with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Botanix Pharmaceuticals' share price might be too optimistic.

Kelsian Group (ASX:KLS)

Simply Wall St Growth Rating: ★★★★☆☆

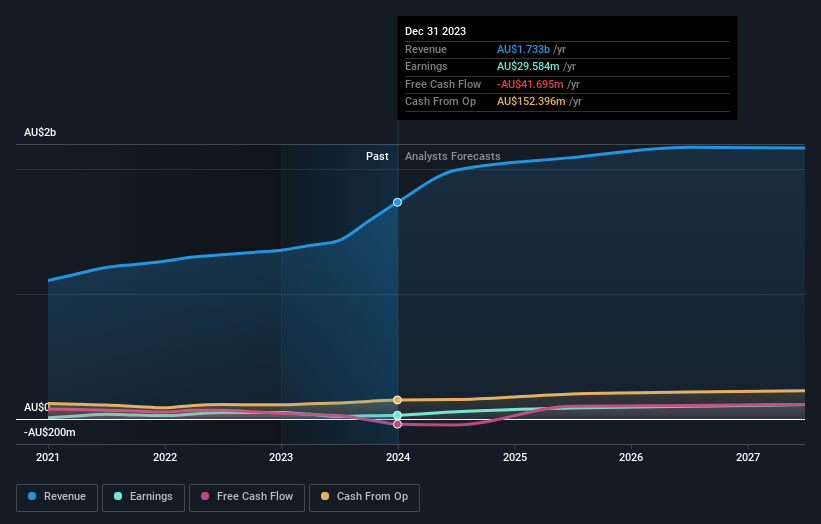

Overview: Kelsian Group Limited operates in the provision of land and marine transport and tourism services across Australia, the United States, Singapore, and the United Kingdom, with a market capitalization of approximately A$1.41 billion.

Operations: The company's revenue is divided into three primary segments: Australian Bus operations generating A$934.76 million, International Bus services contributing A$448.87 million, and Marine and Tourism activities accounting for A$337.90 million.

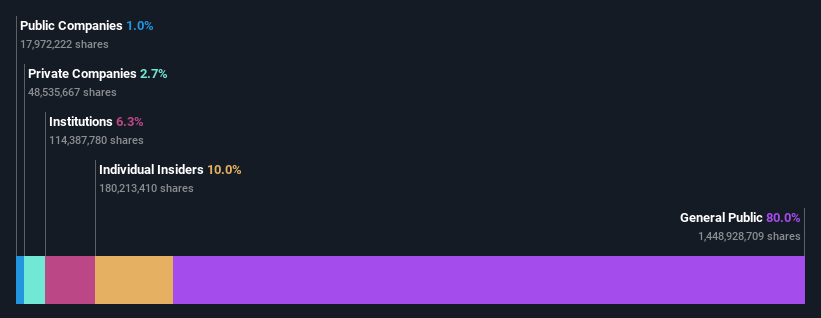

Insider Ownership: 20.9%

Earnings Growth Forecast: 25.7% p.a.

Kelsian Group, despite its modest revenue growth forecast of 5.7% annually, is outpacing the Australian market's 5% growth rate. Analysts predict a significant price increase of 33.7%, and earnings are expected to surge by 25.7% per year, well above the market's 13.6%. However, concerns include low return on equity projections (11.9%) and financial strains such as poor coverage of interest payments by earnings. Recent insider buying trends suggest confidence from within, aligning with substantial half-yearly earnings improvements reported in February 2024.

- Take a closer look at Kelsian Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Kelsian Group is priced higher than what may be justified by its financials.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally, with a market capitalization of A$5.79 billion.

Operations: The company generates revenue through three primary segments: software sales contributing A$317.24 million, corporate services A$83.83 million, and consulting services A$68.13 million.

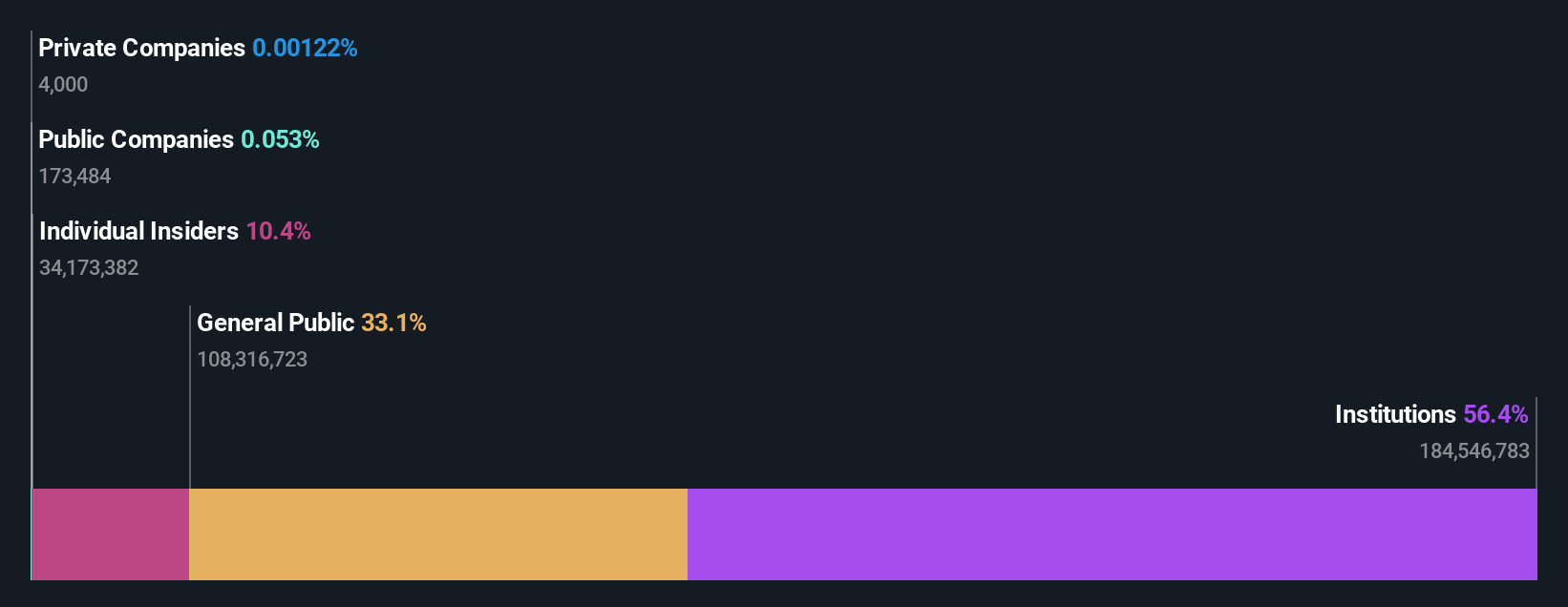

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.2% p.a.

Technology One Limited, an Australian software company, reported a solid performance with half-year revenue reaching A$240.83 million and net income at A$48 million, reflecting year-over-year growth. While its revenue is expected to grow by 11.1% annually, slightly outpacing the Australian market forecast of 5%, earnings are projected to increase by 14.2% per year, also above the domestic average of 13.6%. However, its price-to-earnings ratio stands at 52.9x, below the industry average of 61.3x, suggesting a potentially undervalued status despite high insider ownership not indicating recent substantial buying or selling activities.

- Get an in-depth perspective on Technology One's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Technology One's shares may be trading at a premium.

Seize The Opportunity

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 88 more companies for you to explore.Click here to unveil our expertly curated list of 91 Fast Growing ASX Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kelsian Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KLS

Kelsian Group

Provides land and marine transport and tourism services in Australia, the United States, Singapore, and the United Kingdom.

Solid track record second-rate dividend payer.