- Australia

- /

- Transportation

- /

- ASX:KLS

3 ASX Stocks That Could Be Undervalued According To Analysts

Reviewed by Simply Wall St

The Australian market has climbed 2.0% in the last 7 days and 6.4% over the past year, with earnings expected to grow by 13% per annum over the next few years. In this environment, identifying undervalued stocks that have strong fundamentals and growth potential can be key to achieving solid investment returns.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.695 | A$1.37 | 49.2% |

| Elders (ASX:ELD) | A$9.08 | A$18.11 | 49.9% |

| Regal Partners (ASX:RPL) | A$3.36 | A$6.38 | 47.3% |

| Telix Pharmaceuticals (ASX:TLX) | A$18.43 | A$33.16 | 44.4% |

| Megaport (ASX:MP1) | A$10.94 | A$21.65 | 49.5% |

| Domino's Pizza Enterprises (ASX:DMP) | A$33.12 | A$63.95 | 48.2% |

| Infomedia (ASX:IFM) | A$1.69 | A$3.06 | 44.7% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Airtasker (ASX:ART) | A$0.28 | A$0.52 | 46.5% |

| Sandfire Resources (ASX:SFR) | A$8.22 | A$16.36 | 49.7% |

Let's dive into some prime choices out of the screener.

Goodman Group (ASX:GMG)

Overview: Goodman Group (ASX:GMG) is an integrated property group operating across Australia, New Zealand, Asia, Europe, the United Kingdom and the Americas with a market cap of A$66.78 billion.

Operations: Goodman Group generates revenue from its diverse property operations across Australia, New Zealand, Asia, Europe, the United Kingdom and the Americas.

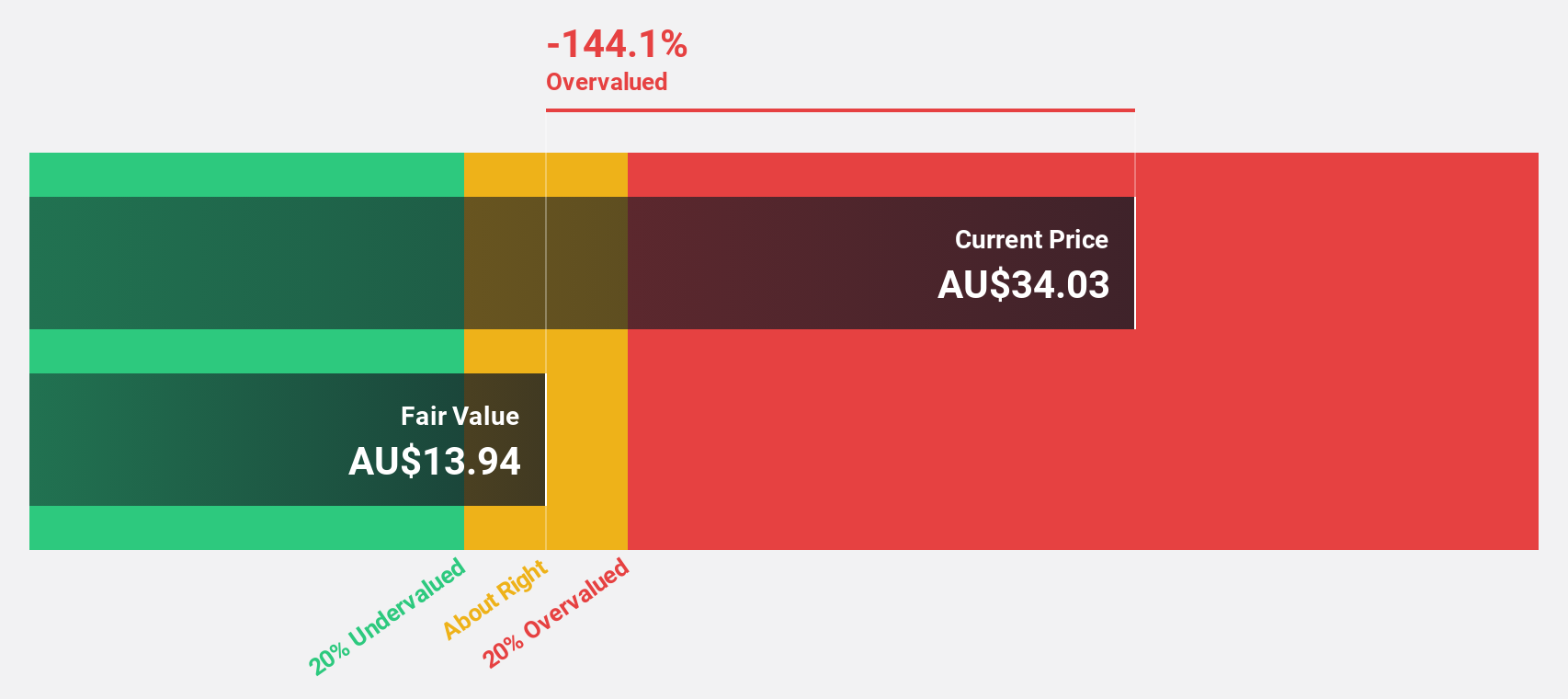

Estimated Discount To Fair Value: 13.3%

Goodman Group is trading at A$35.16, 13.3% below its estimated fair value of A$40.57, indicating it may be undervalued based on cash flows. Despite a drop in profit margins from 65.7% to 17.5%, earnings and revenue are forecasted to grow significantly at 28.57% and 20.5% per year respectively, outpacing the Australian market's growth rates. However, recent insider selling could be a concern for potential investors ahead of their upcoming earnings call on August 15, 2024.

- Our earnings growth report unveils the potential for significant increases in Goodman Group's future results.

- Unlock comprehensive insights into our analysis of Goodman Group stock in this financial health report.

Kelsian Group (ASX:KLS)

Overview: Kelsian Group Limited operates land and marine transport and tourism services across Australia, the United States, Singapore, and the United Kingdom, with a market cap of A$1.36 billion.

Operations: Revenue segments for Kelsian Group Limited are as follows: Australian Bus: A$934.76 million, International Bus: A$448.87 million, and Marine and Tourism: A$337.90 million.

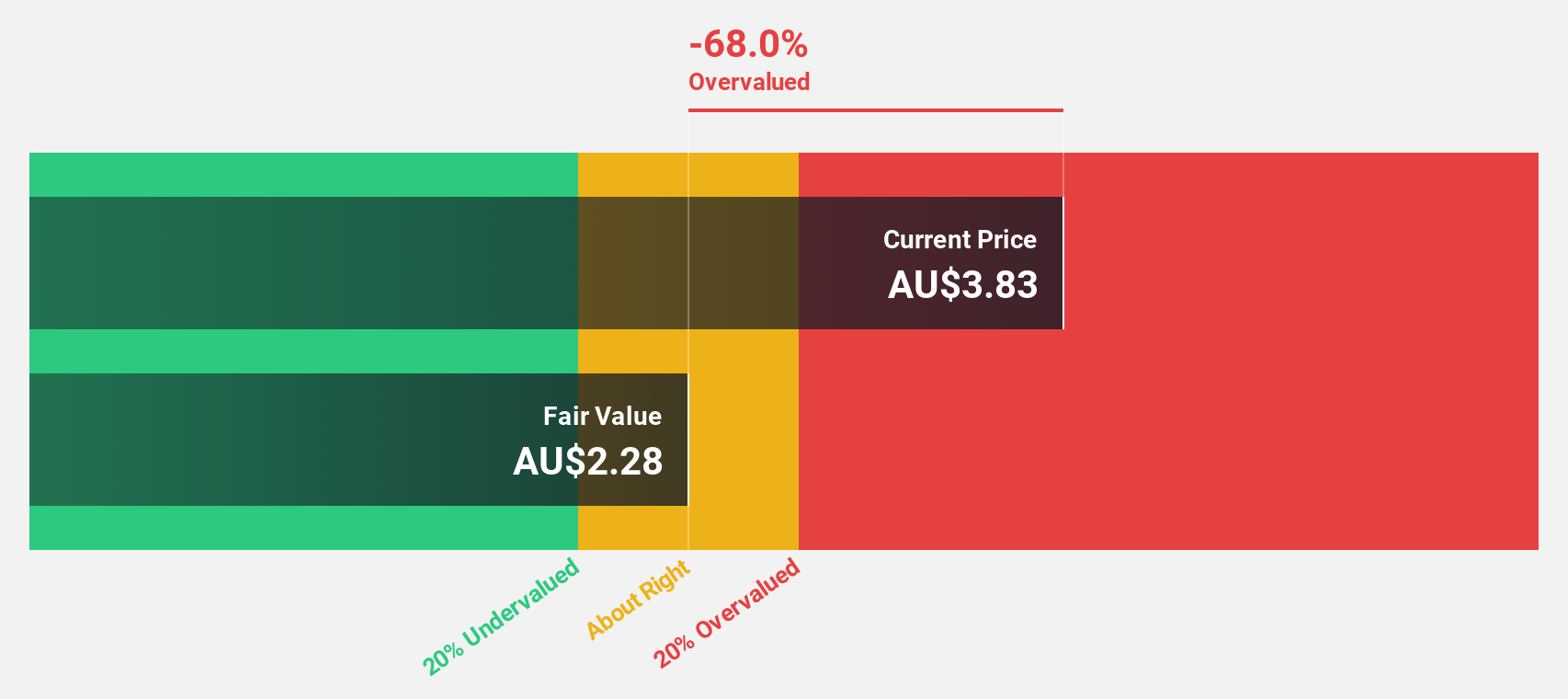

Estimated Discount To Fair Value: 29.4%

Kelsian Group is trading at A$5.05, 29.4% below its estimated fair value of A$7.15, highlighting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 25.53% annually over the next three years, outpacing the Australian market's growth rate of 12.7%. However, profit margins have declined from 3.8% to 1.7%, and interest payments are not well covered by earnings, posing some financial risks for investors.

- Our expertly prepared growth report on Kelsian Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Kelsian Group.

Megaport (ASX:MP1)

Overview: Megaport Limited (ASX:MP1) offers elastic interconnection services to enterprises and service providers across various regions including Australia, New Zealand, Hong Kong, Singapore, Japan, North America, and Europe with a market cap of A$1.75 billion.

Operations: The company's revenue segments are comprised of A$99.78 million from North America, A$48.84 million from Asia-Pacific, and A$28.88 million from Europe.

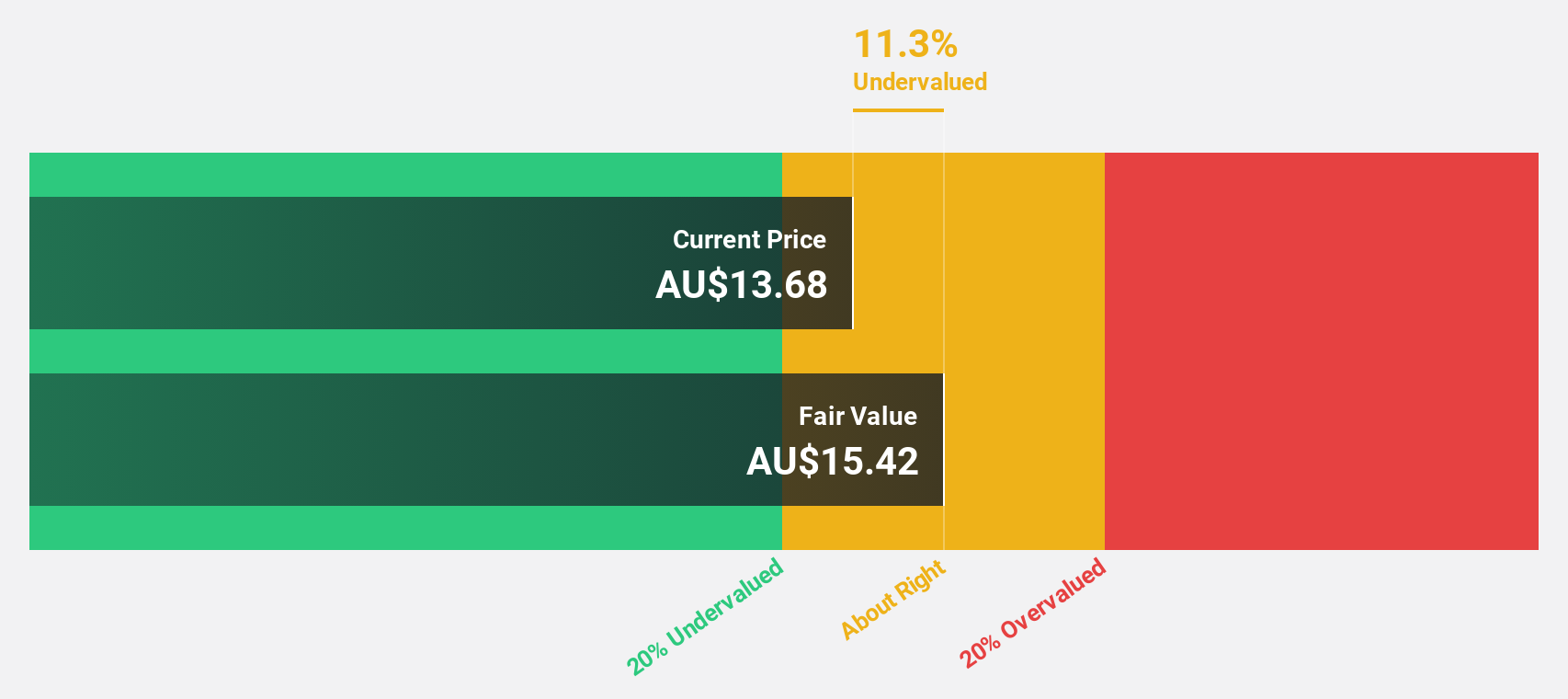

Estimated Discount To Fair Value: 49.5%

Megaport, trading at A$10.94, is significantly undervalued based on cash flows with an estimated fair value of A$21.65. Recent strategic partnerships with 365 Data Centers and Aviatrix enhance its cloud connectivity offerings, potentially driving future revenue growth of 16.2% annually. Despite insider selling in the past quarter, earnings are forecast to grow at a robust 35.5% per year over the next three years, outpacing the Australian market's growth rate of 12.7%.

- The growth report we've compiled suggests that Megaport's future prospects could be on the up.

- Navigate through the intricacies of Megaport with our comprehensive financial health report here.

Summing It All Up

- Embark on your investment journey to our 35 Undervalued ASX Stocks Based On Cash Flows selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kelsian Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KLS

Kelsian Group

Provides land and marine transport and tourism services in Australia, the United States, Singapore, and the United Kingdom.

Solid track record with limited growth.

Similar Companies

Market Insights

Community Narratives