- Australia

- /

- Hospitality

- /

- ASX:CKF

3 ASX Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

The Australian stock market recently faced a downturn, with the ASX200 closing down 0.87% amid concerns over the Chinese economy's strength, as all sectors ended in negative territory. In such volatile times, dividend stocks can offer a measure of stability and income for investors seeking to navigate uncertain markets.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 7.08% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.37% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.92% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.35% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.41% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.58% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.37% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.47% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.86% | ★★★★☆☆ |

| CTI Logistics (ASX:CLX) | 5.74% | ★★★★☆☆ |

Click here to see the full list of 38 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Commonwealth Bank of Australia (ASX:CBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Commonwealth Bank of Australia offers financial services across Australia, New Zealand, and internationally, with a market cap of A$238.87 billion.

Operations: Commonwealth Bank of Australia's revenue is primarily derived from Retail Banking Services including Bankwest (A$12.47 billion), Business Banking (A$8.14 billion), New Zealand operations (A$2.86 billion), and Institutional Banking and Markets (A$2.51 billion).

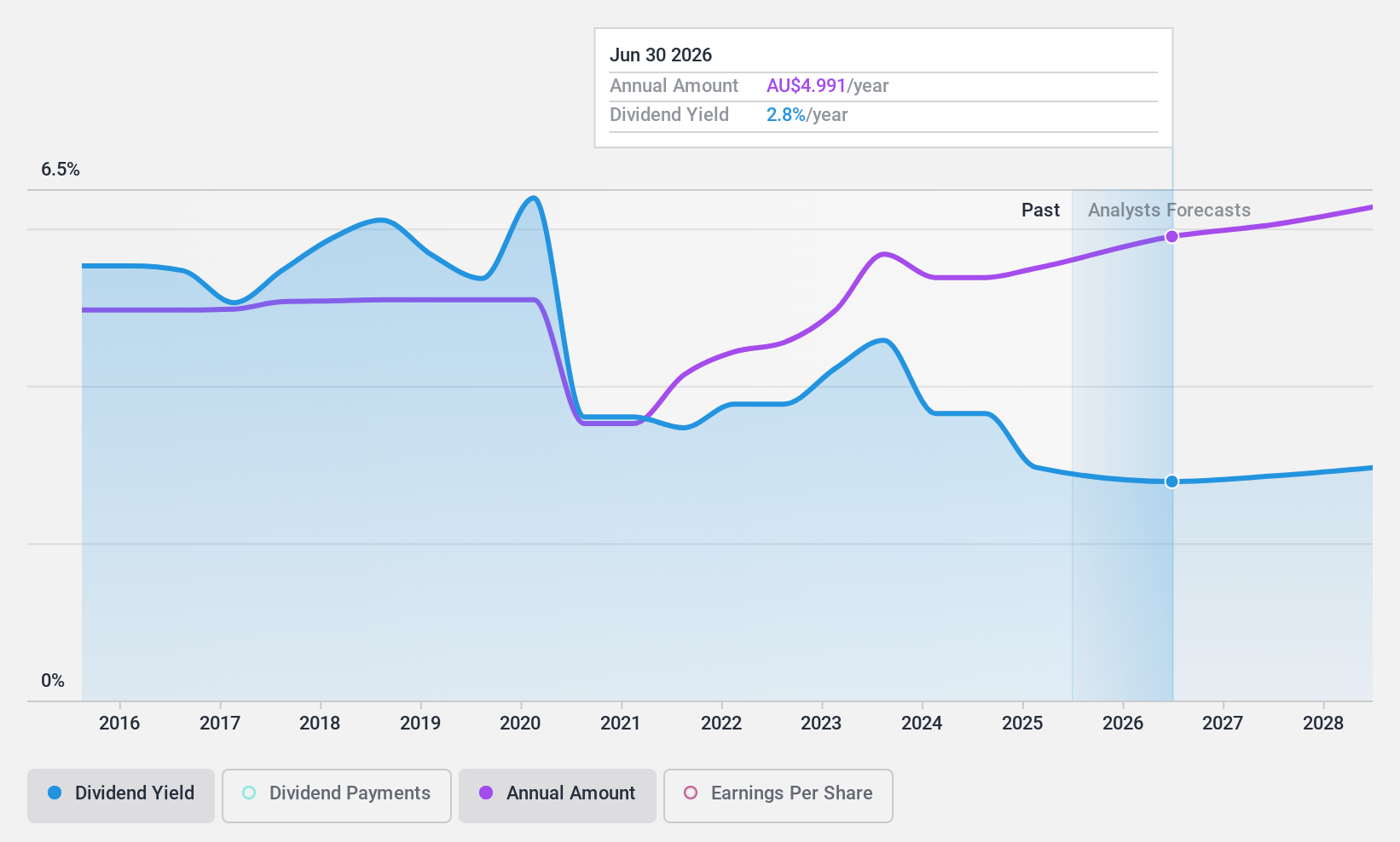

Dividend Yield: 3.3%

Commonwealth Bank of Australia has a dividend payout ratio currently at 82.1%, with forecasts suggesting coverage by earnings will remain sustainable over the next three years. However, its dividend yield of 3.26% is lower than the top quartile of Australian dividend payers, and its dividends have shown volatility over the past decade. Recent executive changes and fixed-income offerings may impact future financial stability but do not directly affect current dividend payments.

- Click here to discover the nuances of Commonwealth Bank of Australia with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Commonwealth Bank of Australia is priced higher than what may be justified by its financials.

Collins Foods (ASX:CKF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Collins Foods Limited operates, manages, and administers restaurants in Australia and Europe, with a market cap of A$986.11 million.

Operations: Collins Foods Limited generates revenue from its restaurant operations, with A$1.12 billion from KFC Restaurants in Australia, A$313.47 million from KFC Restaurants in Europe, and A$54.38 million from Taco Bell Restaurants.

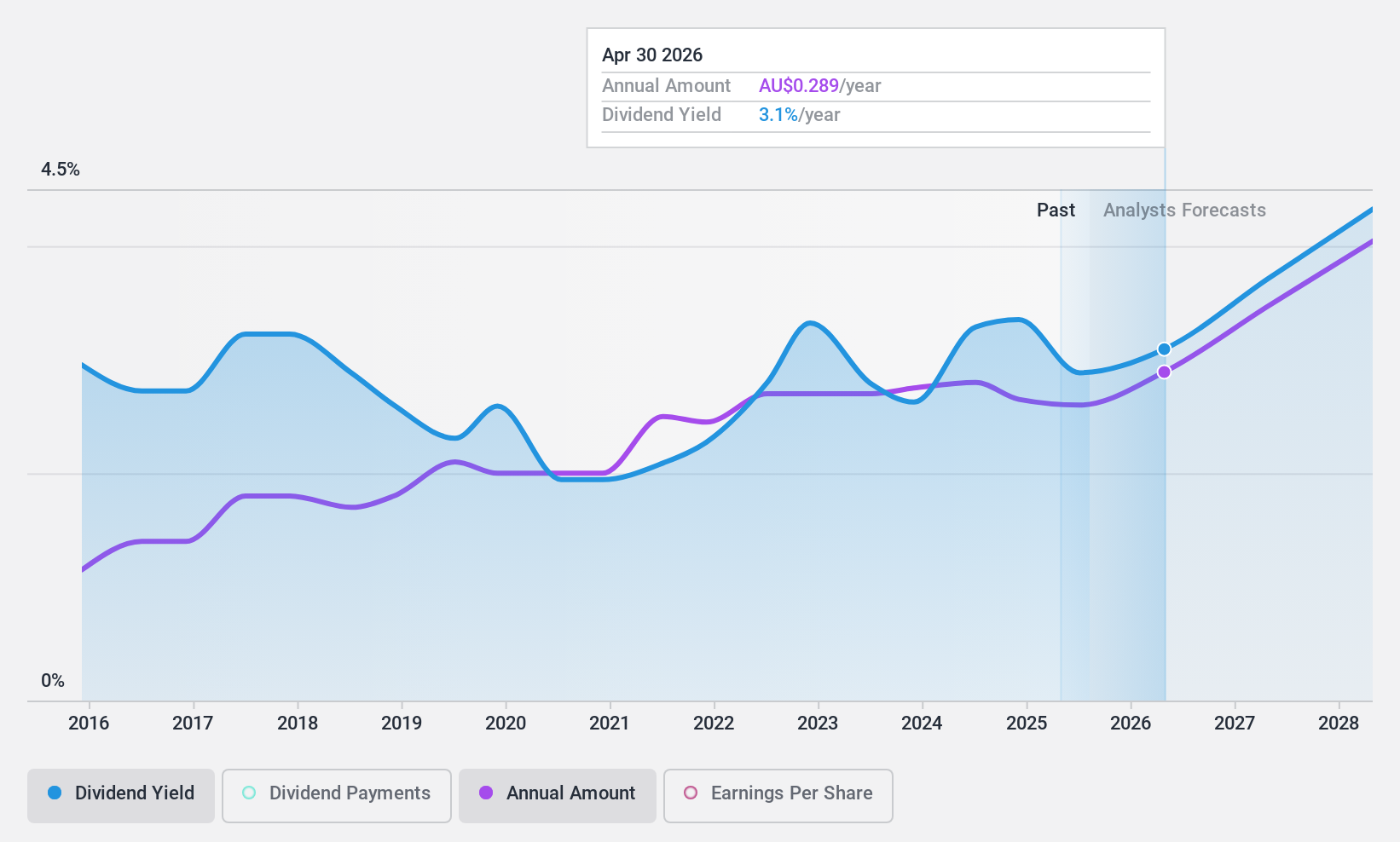

Dividend Yield: 3.3%

Collins Foods' dividend payments have grown steadily over the past decade, supported by a sustainable payout ratio of 59.1% and a cash payout ratio of 35.2%. Despite its yield being lower than Australia's top quartile at 3.35%, dividends remain reliable and stable. The company is trading below estimated fair value, suggesting potential undervaluation. Recent leadership changes, including the appointment of Xavier Simonet as CEO, may influence strategic direction but don't immediately impact dividend stability.

- Take a closer look at Collins Foods' potential here in our dividend report.

- Our valuation report here indicates Collins Foods may be undervalued.

CTI Logistics (ASX:CLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CTI Logistics Limited, with a market cap of A$153.71 million, operates in Australia offering transport and logistics services through its subsidiaries.

Operations: CTI Logistics Limited generates revenue primarily from its Transport segment at A$225.42 million and its Logistics segment at A$118.28 million, with additional income from Property amounting to A$6.37 million.

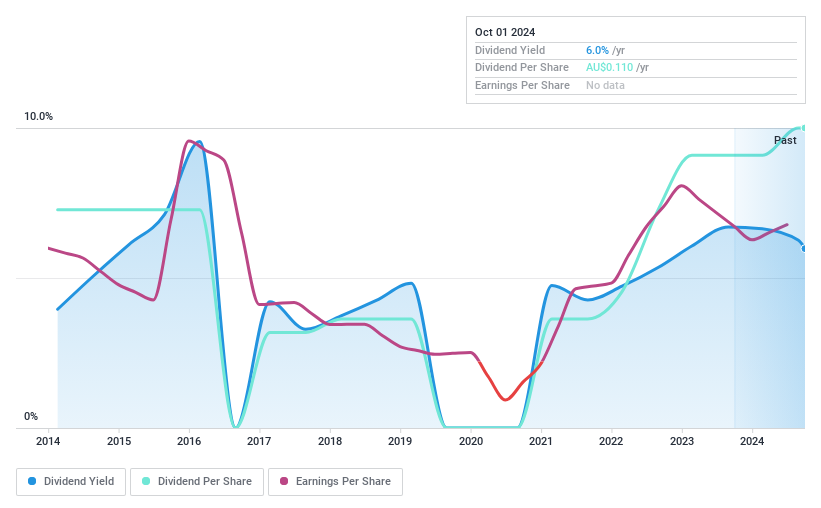

Dividend Yield: 5.7%

CTI Logistics' dividend history shows volatility and unreliability, though recent payments are covered by earnings with a payout ratio of 51.2% and cash flows at 57.2%. The company announced a A$0.055 per share dividend for the six months ending June 2024, despite a slight decline in net income to A$15.83 million from A$17.02 million last year. Trading significantly below estimated fair value, CTI's yield is lower than Australia's top quartile dividends.

- Navigate through the intricacies of CTI Logistics with our comprehensive dividend report here.

- Our expertly prepared valuation report CTI Logistics implies its share price may be lower than expected.

Turning Ideas Into Actions

- Investigate our full lineup of 38 Top ASX Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CKF

Collins Foods

Engages in the operation, management, and administration of restaurants in Australia and Europe.

Solid track record established dividend payer.