- Australia

- /

- Transportation

- /

- ASX:AZJ

Aurizon Holdings (ASX:AZJ) Has Announced That Its Dividend Will Be Reduced To AU$0.10

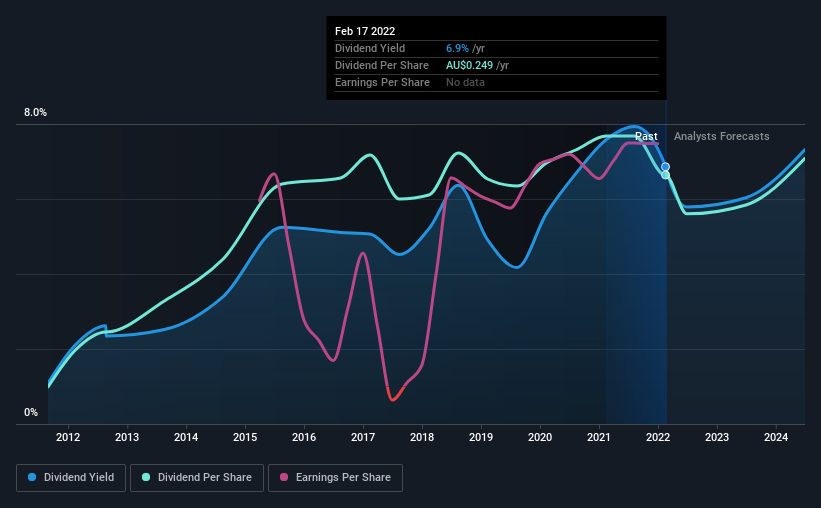

Aurizon Holdings Limited (ASX:AZJ) has announced it will be reducing its dividend payable on the 30th of March to AU$0.10. This means the annual payment is 6.9% of the current stock price, which is above the average for the industry.

View our latest analysis for Aurizon Holdings

Aurizon Holdings' Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before this announcement, Aurizon Holdings was paying out 77% of earnings, but a comparatively small 63% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

EPS is set to fall by 10.7% over the next 12 months. If recent patterns in the dividend continue, we could see the payout ratio reaching 88% in the next 12 months, which is on the higher end of the range we would say is sustainable.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2012, the dividend has gone from AU$0.037 to AU$0.25. This means that it has been growing its distributions at 21% per annum over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

Dividend Growth Could Be Constrained

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Aurizon Holdings has seen EPS rising for the last five years, at 13% per annum. Past earnings growth has been decent, but unless this is one of those rare businesses that can grow without additional capital investment or marketing spend, we'd generally expect the higher payout ratio to limit its future growth prospects.

Our Thoughts On Aurizon Holdings' Dividend

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Aurizon Holdings is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Aurizon Holdings that you should be aware of before investing. Is Aurizon Holdings not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AZJ

Aurizon Holdings

Through its subsidiaries, operates as a rail freight operator in Australia.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives