Companies Like Tuas (ASX:TUA) Could Be Quite Risky

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Tuas (ASX:TUA) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Tuas

When Might Tuas Run Out Of Money?

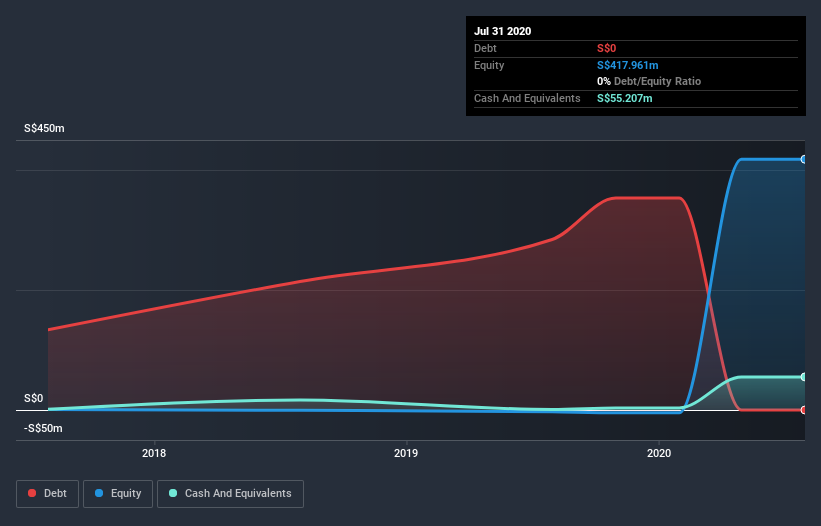

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In July 2020, Tuas had S$55m in cash, and was debt-free. Importantly, its cash burn was S$97m over the trailing twelve months. So it had a cash runway of approximately 7 months from July 2020. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Importantly, if we extrapolate recent cash burn trends, the cash runway would be a lot longer. The image below shows how its cash balance has been changing over the last few years.

How Is Tuas' Cash Burn Changing Over Time?

Whilst it's great to see that Tuas has already begun generating revenue from operations, last year it only produced S$5.1m, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. With the cash burn rate up 13% in the last year, it seems that the company is ratcheting up investment in the business over time. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. In reality, this article only makes a short study of the company's growth data. You can take a look at how Tuas is growing revenue over time by checking this visualization of past revenue growth.

How Easily Can Tuas Raise Cash?

Given its cash burn trajectory, Tuas shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Tuas' cash burn of S$97m is about 31% of its S$317m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

So, Should We Worry About Tuas' Cash Burn?

We must admit that we don't think Tuas is in a very strong position, when it comes to its cash burn. Although we can understand if some shareholders find its increasing cash burn acceptable, we can't ignore the fact that we consider its cash runway to be downright troublesome. After looking at that range of measures, we think shareholders should be extremely attentive to how the company is using its cash, as the cash burn makes us uncomfortable. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 3 warning signs for Tuas that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Tuas, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Tuas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tuas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:TUA

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives