Shareholders May Not Be So Generous With Telstra Corporation Limited's (ASX:TLS) CEO Compensation And Here's Why

Despite strong share price growth of 40% for Telstra Corporation Limited (ASX:TLS) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 11 October 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Telstra

Comparing Telstra Corporation Limited's CEO Compensation With the industry

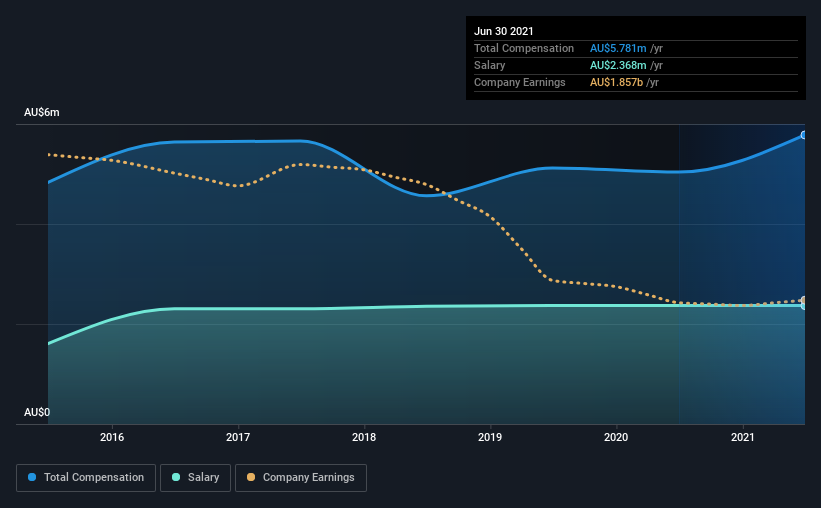

According to our data, Telstra Corporation Limited has a market capitalization of AU$46b, and paid its CEO total annual compensation worth AU$5.8m over the year to June 2021. Notably, that's an increase of 15% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$2.4m.

On comparing similar companies in the industry with market capitalizations above AU$11b, we found that the median total CEO compensation was AU$4.3m. This suggests that Andy Penn is paid more than the median for the industry. Furthermore, Andy Penn directly owns AU$50m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | AU$2.4m | AU$2.4m | 41% |

| Other | AU$3.4m | AU$2.7m | 59% |

| Total Compensation | AU$5.8m | AU$5.0m | 100% |

On an industry level, roughly 45% of total compensation represents salary and 55% is other remuneration. Telstra is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Telstra Corporation Limited's Growth

Telstra Corporation Limited has reduced its earnings per share by 20% a year over the last three years. It saw its revenue drop 9.1% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Telstra Corporation Limited Been A Good Investment?

Most shareholders would probably be pleased with Telstra Corporation Limited for providing a total return of 40% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for Telstra that investors should think about before committing capital to this stock.

Switching gears from Telstra, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Telstra Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:TLS

Telstra Group

Provides telecommunications and information services in Australia and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026