Does Macquarie Telecom Group (ASX:MAQ) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Macquarie Telecom Group Limited (ASX:MAQ) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Macquarie Telecom Group

What Is Macquarie Telecom Group's Debt?

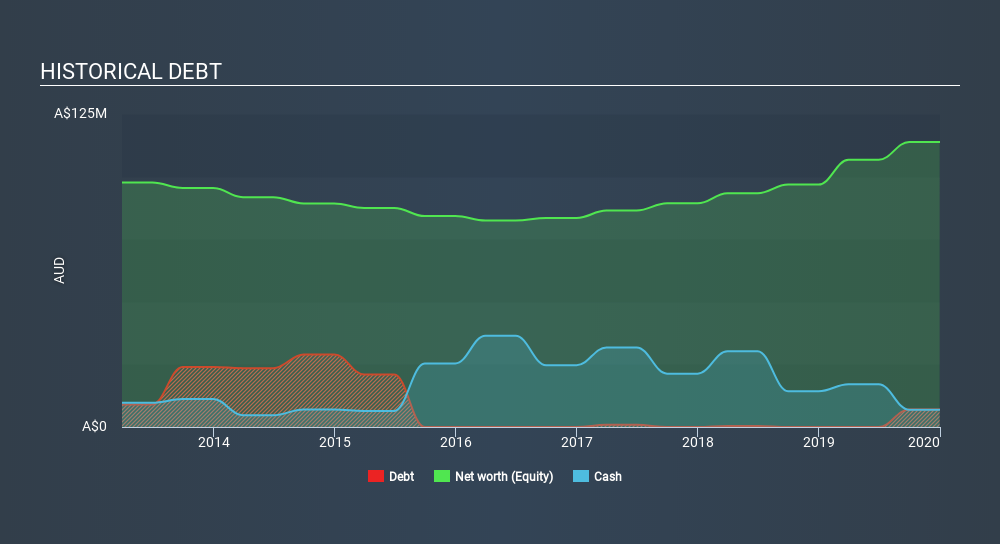

The image below, which you can click on for greater detail, shows that at December 2019 Macquarie Telecom Group had debt of AU$7.00m, up from none in one year. However, because it has a cash reserve of AU$6.86m, its net debt is less, at about AU$140.0k.

How Strong Is Macquarie Telecom Group's Balance Sheet?

The latest balance sheet data shows that Macquarie Telecom Group had liabilities of AU$40.3m due within a year, and liabilities of AU$91.7m falling due after that. Offsetting these obligations, it had cash of AU$6.86m as well as receivables valued at AU$23.7m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$101.5m.

Since publicly traded Macquarie Telecom Group shares are worth a total of AU$556.3m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Carrying virtually no net debt, Macquarie Telecom Group has a very light debt load indeed.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Macquarie Telecom Group's debt of just 0.0028 times EBITDA is really very modest. And this impression is enhanced by its strong EBIT which covers interest costs 9.2 times. On the other hand, Macquarie Telecom Group saw its EBIT drop by 6.2% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Macquarie Telecom Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Macquarie Telecom Group basically broke even on a free cash flow basis. Some might say that's a concern, when it comes considering how easily it would be for it to down debt.

Our View

On our analysis Macquarie Telecom Group's net debt to EBITDA should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. In particular, conversion of EBIT to free cash flow gives us cold feet. Looking at all this data makes us feel a little cautious about Macquarie Telecom Group's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Macquarie Telecom Group .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:MAQ

Macquarie Technology Group

Provides telecommunication, cloud computing, cybersecurity, and data center services to corporate and government customers in Australia.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)