- Australia

- /

- Wireless Telecom

- /

- ASX:HTA

Hutchison Telecommunications (Australia) (ASX:HTA) Is Carrying A Fair Bit Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Hutchison Telecommunications (Australia) Limited (ASX:HTA) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Hutchison Telecommunications (Australia)

What Is Hutchison Telecommunications (Australia)'s Debt?

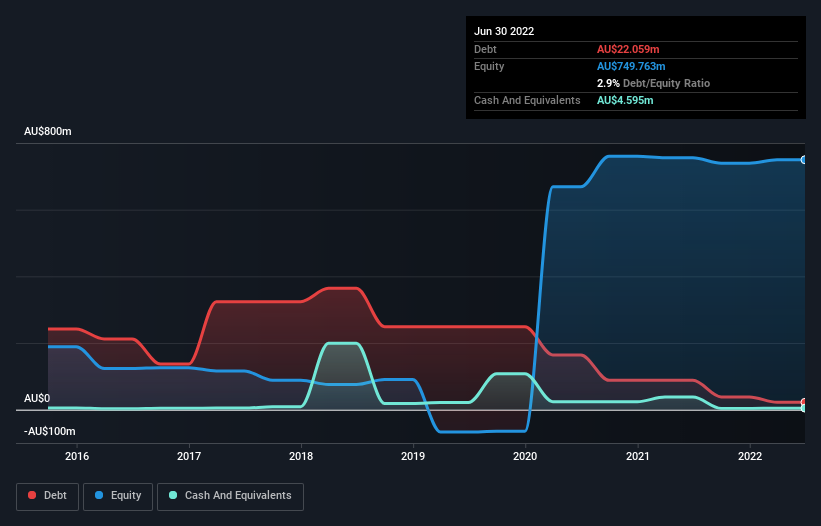

As you can see below, Hutchison Telecommunications (Australia) had AU$22.1m of debt at June 2022, down from AU$88.0m a year prior. However, it also had AU$4.60m in cash, and so its net debt is AU$17.5m.

How Healthy Is Hutchison Telecommunications (Australia)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hutchison Telecommunications (Australia) had liabilities of AU$22.8m due within 12 months and no liabilities due beyond that. Offsetting this, it had AU$4.60m in cash and AU$2.0k in receivables that were due within 12 months. So its liabilities total AU$18.2m more than the combination of its cash and short-term receivables.

Having regard to Hutchison Telecommunications (Australia)'s size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the AU$990.8m company is short on cash, but still worth keeping an eye on the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Hutchison Telecommunications (Australia) will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given it has no significant operating revenue at the moment, shareholders will be hoping Hutchison Telecommunications (Australia) can make progress and gain better traction for the business, before it runs low on cash.

Caveat Emptor

Over the last twelve months Hutchison Telecommunications (Australia) produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at AU$1.6m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. For example, we would not want to see a repeat of last year's loss of AU$3.2m. So to be blunt we do think it is risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 1 warning sign with Hutchison Telecommunications (Australia) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you're looking to trade Hutchison Telecommunications (Australia), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hutchison Telecommunications (Australia) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:HTA

Hutchison Telecommunications (Australia)

Provides telecommunications services in Australia.

Flawless balance sheet low.

Market Insights

Community Narratives