The Flexiroam (ASX:FRX) Share Price Is Down 64% So Some Shareholders Are Wishing They Sold

Investing in stocks inevitably means buying into some companies that perform poorly. But long term Flexiroam Limited (ASX:FRX) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 64% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 38% lower in that time.

See our latest analysis for Flexiroam

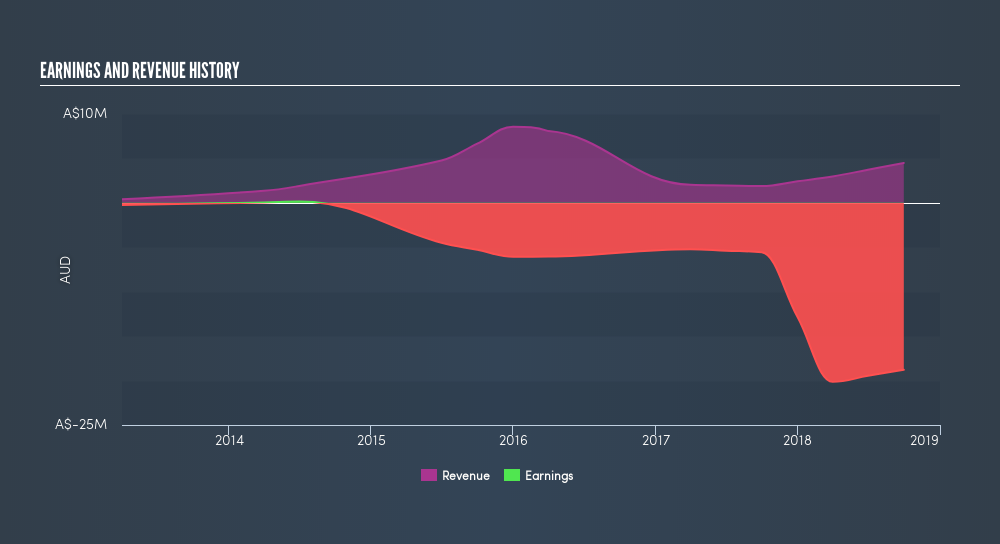

Flexiroam isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Flexiroam's revenue dropped 40% per year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 29% (annualized) in the same time period. Bagholders or 'baggies' are people who buy more of a stock as the price collapses. They are then left 'holding the bag' if the shares turn out to be worthless. It could be a while before the company repays long suffering shareholders with share price gains.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Flexiroam's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Flexiroam shareholders are down 38% for the year, but the broader market is up 11%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 29% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Flexiroam is not the only stock that insiders are buying. For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:FRX

Flexiroam

Engages in the telecommunications and Internet of Things (IoT) connectivity business worldwide.

Low with imperfect balance sheet.

Market Insights

Community Narratives