NOVONIX (ASX:NVX) Is Up 11.8% After Delivering First Commercial Graphite Sample for Mass Production

Reviewed by Sasha Jovanovic

- Recently, NOVONIX announced the delivery of its first commercial-scale, synthetic graphite sample for mass production to a major North American carbon processor, marking a significant operational milestone at the company’s Riverside facility.

- This achievement showcases NOVONIX's proprietary continuous graphitisation furnace technology and its readiness to supply high-performance synthetic graphite for battery, defence, and industrial sectors in North America.

- We'll explore how NOVONIX's move into large-scale manufacturing with its Riverside facility shapes its evolving investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is NOVONIX's Investment Narrative?

If you’re considering NOVONIX as a potential investment, the story right now rests on whether its move into commercial-scale synthetic graphite production can unlock the rapid revenue growth forecast for the business. The latest news, delivering its first mass-produced synthetic graphite sample to a major North American processor, could prove a key short-term catalyst, lending real-world validation to NOVONIX’s technology and its readiness to tap the North American battery and industrial sectors. This milestone might help address prior concerns about converting ambitious plans and offtake agreements into operational delivery. At the same time, it doesn’t erase some of the risks highlighted before: ongoing operating losses, persistent shareholder dilution and significant insider selling seen in recent months. If this commercial delivery is followed by firm supply agreements, it could meaningfully shift expectations around cash flow timing and scale, though risks from revenue delays or execution setbacks remain.

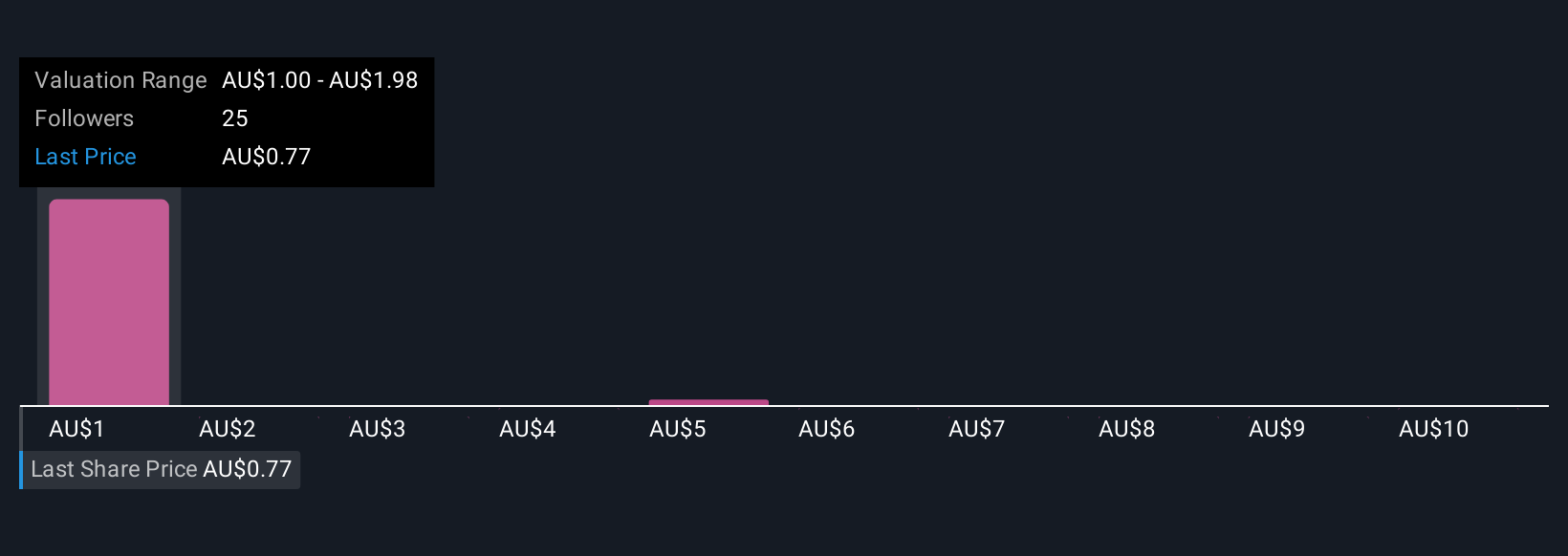

But investors should weigh how insider selling might influence sentiment in coming months. Our expertly prepared valuation report on NOVONIX implies its share price may be too high.Exploring Other Perspectives

Explore 7 other fair value estimates on NOVONIX - why the stock might be worth just A$1.00!

Build Your Own NOVONIX Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NOVONIX research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free NOVONIX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NOVONIX's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOVONIX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NVX

NOVONIX

A battery technology and materials company, provides products and mission critical services in North America, Asia, Australia, and Europe.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives