The Australian market is showing resilience, with the ASX 200 expected to gain despite global economic uncertainties, such as newly proposed tariffs and geopolitical tensions. In this context, investors might find interest in penny stocks—typically smaller or newer companies that offer a blend of affordability and growth potential. While the term "penny stocks" may seem outdated, these investments can still present compelling opportunities when they exhibit strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$147.7M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$322.38M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$229.66M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.695 | A$830.68M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.54 | A$112.83M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.15 | A$65.35M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.71 | A$464.71M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix technology in the United States and internationally, with a market cap of A$231.08 million.

Operations: Aroa Biosurgery Limited has not reported specific revenue segments.

Market Cap: A$231.08M

Aroa Biosurgery, with a market cap of A$231.08 million, recently reported half-year sales of NZ$39.16 million, an increase from the previous year, while reducing its net loss to NZ$3.29 million. The company is debt-free and has strong short-term asset coverage over liabilities, indicating solid financial management despite being unprofitable. Its board and management are experienced, contributing to strategic stability. Although trading at a significant discount compared to estimated fair value and showing potential for substantial earnings growth annually, uncertainties remain about its cash runway sustainability if free cash flow trends change significantly.

- Take a closer look at Aroa Biosurgery's potential here in our financial health report.

- Understand Aroa Biosurgery's earnings outlook by examining our growth report.

Impact Minerals (ASX:IPT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Impact Minerals Limited is an exploration company in Australia with a market cap of A$39.77 million.

Operations: The company generates revenue from its mineral exploration segment, amounting to A$0.12 million.

Market Cap: A$39.77M

Impact Minerals, with a market cap of A$39.77 million, remains pre-revenue, reporting minimal sales of A$0.12 million and a net loss of A$6.75 million for the year ending June 2024. The company recently secured a significant A$2.87 million grant to advance its High Purity Alumina (HPA) project at Lake Hope, highlighting potential for future development despite current financial challenges and auditor concerns about going concern viability. Impact is debt-free with sufficient short-term assets to cover liabilities but has diluted shareholders over the past year and faces cash runway constraints without additional capital infusion or revenue generation advancements.

- Jump into the full analysis health report here for a deeper understanding of Impact Minerals.

- Understand Impact Minerals' track record by examining our performance history report.

NOVONIX (ASX:NVX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NOVONIX Limited specializes in providing battery materials and development technology to battery manufacturers, materials companies, automotive OEMs, and consumer electronics manufacturers across North America, Asia, Australia, and Europe with a market cap of A$476.48 million.

Operations: The company's revenue is primarily derived from its Battery Technology segment, totaling $6.88 million.

Market Cap: A$476.48M

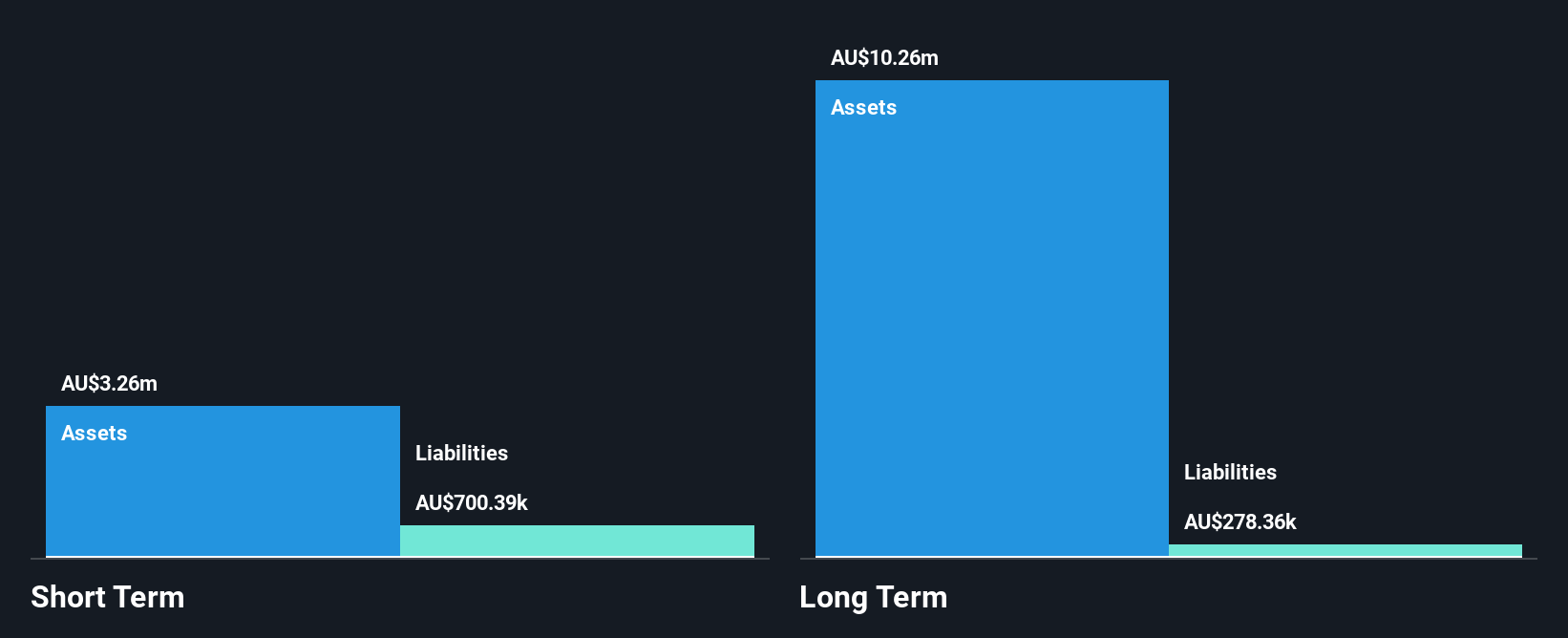

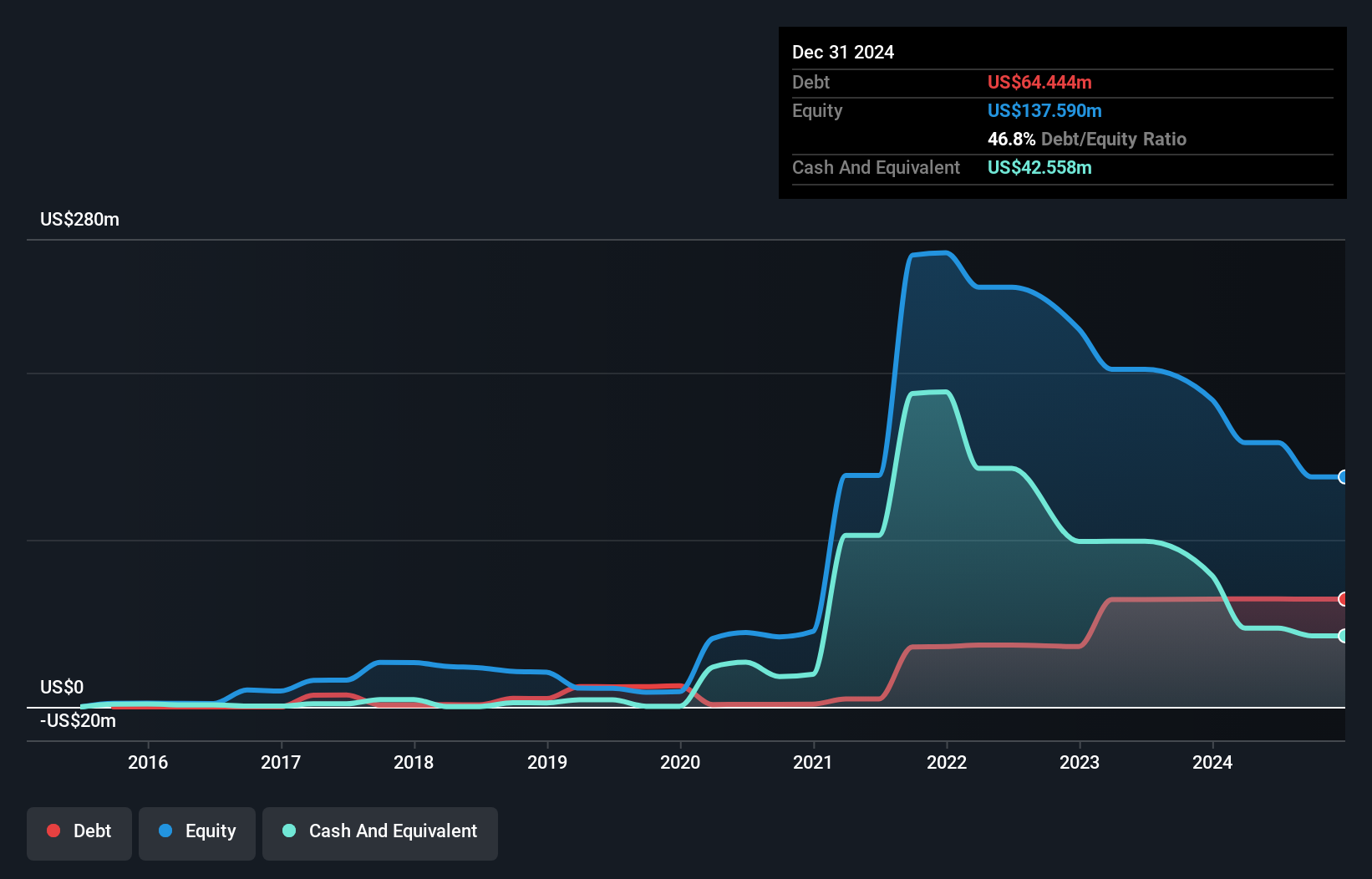

NOVONIX Limited, with a market cap of A$476.48 million, is navigating its growth phase with strategic initiatives despite being unprofitable and having negative equity returns. The company recently announced a follow-on equity offering to raise A$57.1 million, aimed at accelerating growth and expanding production capabilities in synthetic graphite materials for the battery sector. NOVONIX's collaboration agreements, including one with Stellantis NV for high-performance synthetic graphite supply starting in 2026, underscore its potential in the battery technology space. However, challenges remain with short-term assets not covering long-term liabilities and significant insider selling noted recently.

- Navigate through the intricacies of NOVONIX with our comprehensive balance sheet health report here.

- Learn about NOVONIX's future growth trajectory here.

Key Takeaways

- Explore the 1,047 names from our ASX Penny Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOVONIX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NVX

NOVONIX

A battery technology and materials company, provides products and mission critical services in North America, Asia, Australia, and Europe.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives