The Hills Share Price Is Down 90% So Some Shareholders Are Rather Upset

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

While it may not be enough for some shareholders, we think it is good to see the Hills Limited (ASX:HIL) share price up 11% in a single quarter. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Like a ship taking on water, the share price has sunk 90% in that time. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Hills

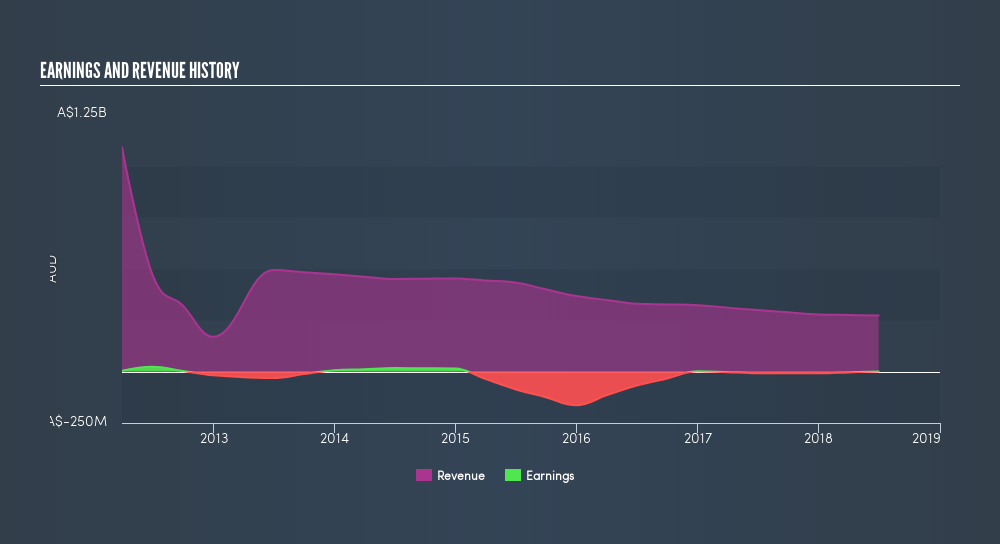

We don't think that Hills's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, companies that are not judged on their (small) profits should be growing revenue quickly. As you can imagine, it's easy to imagine a fast growing company becoming (potentially very) profitable, but when revenue growth slows, then the potential upside often seems less impressive.

Over half a decade Hills reduced its trailing twelve month revenue by 13% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 37% per year in the same time period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Take a more thorough look at Hills's financial health with this freereport on its balance sheet.

A Different Perspective

Investors in Hills had a tough year, with a total loss of 13%, against a market gain of about 8.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 36% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:HIL

Hills

Hills Limited supplies technology solutions to the healthcare, security, surveillance, and IT markets in Australia and New Zealand.

Slightly overvalued with worrying balance sheet.

Market Insights

Community Narratives