Elsight (ASX:ELS) Valuation in Focus Following S&P/ASX Index Inclusions

Reviewed by Kshitija Bhandaru

Elsight (ASX:ELS) just landed in both the S&P/ASX Emerging Companies Index and the S&P/ASX All Ordinaries Index. This has sparked fresh attention, as these inclusions can widen the investor base and boost trading activity.

See our latest analysis for Elsight.

Elsight’s latest index inclusions have put a spotlight on the stock, and the market seems to be taking a long-term view. While recent share price movement has been modest, momentum has picked up year to date with a 4.68% share price return, and the 1-year total shareholder return sits just under 4%. For investors, this signals market expectations of future growth even as valuation and profitability risks remain a talking point.

If you’re curious which other companies could be the next breakout, now’s a great time to broaden your view and discover fast growing stocks with high insider ownership

With the spotlight intensifying following recent index inclusions, the key question is whether Elsight’s current share price offers genuine value or if the optimistic outlook is already reflected, which could leave limited upside for new investors.

Price-to-Book of 167.6x: Is it justified?

Elsight currently trades at a price-to-book ratio of 167.6x, which stands out when compared to both its direct peers and the broader global electronic industry averages. At A$2.16 per share, this elevated multiple suggests the market is pricing in significant future growth or unique value drivers, despite recent volatility and losses.

The price-to-book ratio compares a company’s market value to its book value. For asset-light or high-growth tech companies, this measure is often skewed by intangible assets. However, such an extreme number signals investors have high expectations for future returns or are willing to look past current unprofitability. For Elsight, the ratio far exceeds typical industry markers, meaning investors believe in a turnaround or strategic advantage that has not yet filtered through to financial results.

To put it in perspective, Elsight’s price-to-book ratio is sharply higher than its peer average of 4x and the global industry average of 2.2x. This premium suggests the market may be overestimating short-term prospects or underestimating sector risks. Unless a major catalyst justifies such optimism, today’s valuation could be difficult to sustain.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 167.6x (OVERVALUED)

However, sustained losses and unclear revenue growth trends remain key risks. These factors could challenge current optimism and shift market sentiment quickly.

Find out about the key risks to this Elsight narrative.

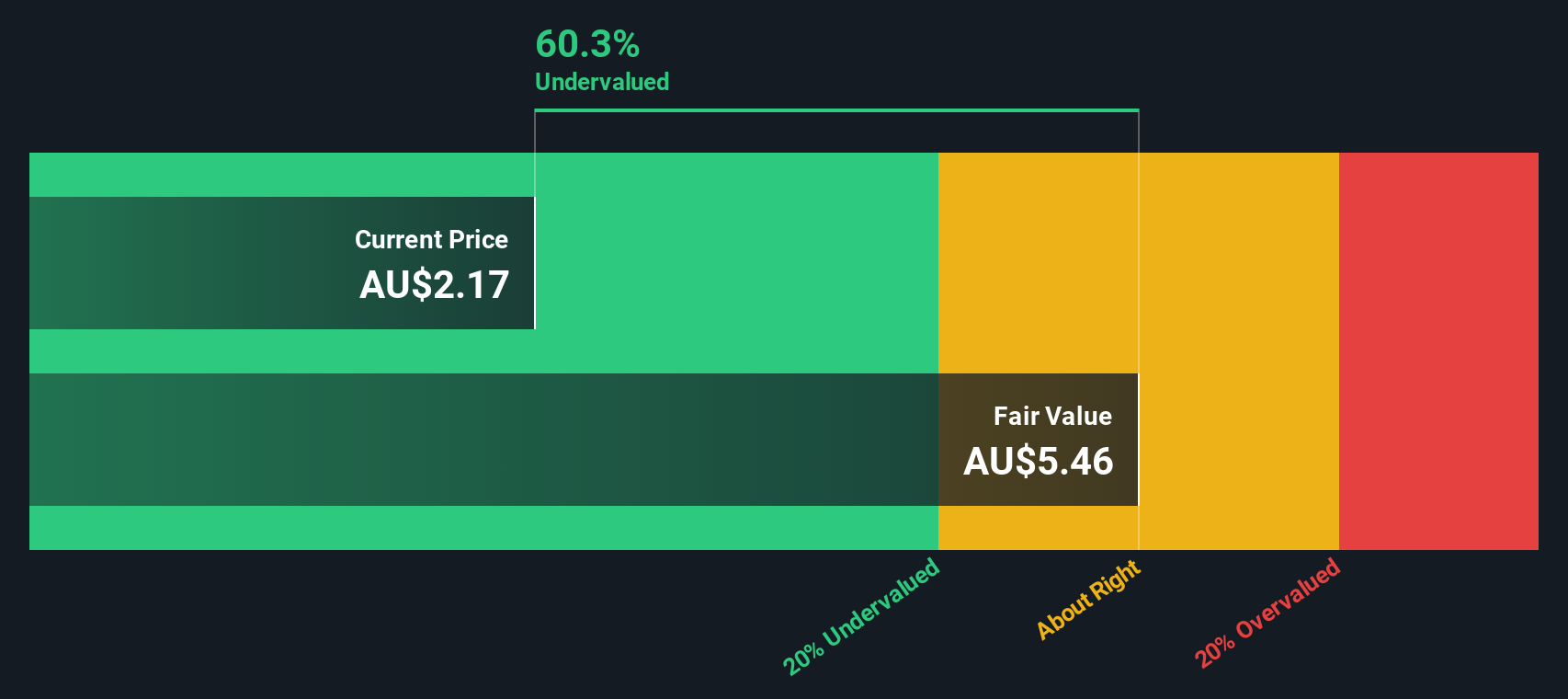

Another View: Undervalued by DCF?

While the price-to-book multiple suggests Elsight appears expensive, our DCF model presents a different perspective. According to this approach, Elsight is trading about 60% below its fair value. Could the market be overlooking something, or is this discount a value trap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elsight for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elsight Narrative

If you have a different perspective or enjoy digging into the numbers yourself, you can assemble your own view of Elsight in just a few minutes, and Do it your way

A great starting point for your Elsight research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more smart investing opportunities with these powerful screeners. Each one highlights stocks with unique advantages and growth stories you won't want to overlook.

- Pinpoint emerging companies with strong financials by reviewing these 3563 penny stocks with strong financials making waves in untapped markets.

- Spot the latest breakthroughs riding the AI boom by checking out these 24 AI penny stocks driving innovation across industries.

- Maximize potential returns by targeting value plays through these 904 undervalued stocks based on cash flows that are priced attractively based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elsight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELS

Elsight

Provides connectivity solutions in Israel, the United States, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives