Exploring Three Undervalued Small Caps In Australia With Insider Action

In recent trading sessions, the Australian market has shown a relatively flat trajectory with the ASX200 barely moving, reflecting a cautious sentiment among investors. This subdued atmosphere in broader indices contrasts with specific sectors where companies like Narryer Metals and Kingsland Minerals are actively pursuing significant exploration initiatives. In such a market environment, identifying undervalued small-cap stocks can be particularly compelling, especially those where insider actions suggest confidence in future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 17.3x | 2.7x | 45.60% | ★★★★★★ |

| Tabcorp Holdings | NA | 0.6x | 25.66% | ★★★★★★ |

| Neuren Pharmaceuticals | 16.2x | 11.0x | 47.23% | ★★★★★☆ |

| Codan | 27.4x | 4.0x | 25.22% | ★★★★☆☆ |

| Smartgroup | 17.8x | 4.4x | 47.22% | ★★★★☆☆ |

| Eagers Automotive | 9.5x | 0.3x | 29.33% | ★★★★☆☆ |

| Tasmea | 13.8x | 0.9x | 15.79% | ★★★☆☆☆ |

| Dicker Data | 21.6x | 0.8x | -1.83% | ★★★☆☆☆ |

| Coventry Group | 289.4x | 0.4x | -30.11% | ★★★☆☆☆ |

| Lynch Group Holdings | NA | 0.4x | -13.03% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★☆☆☆

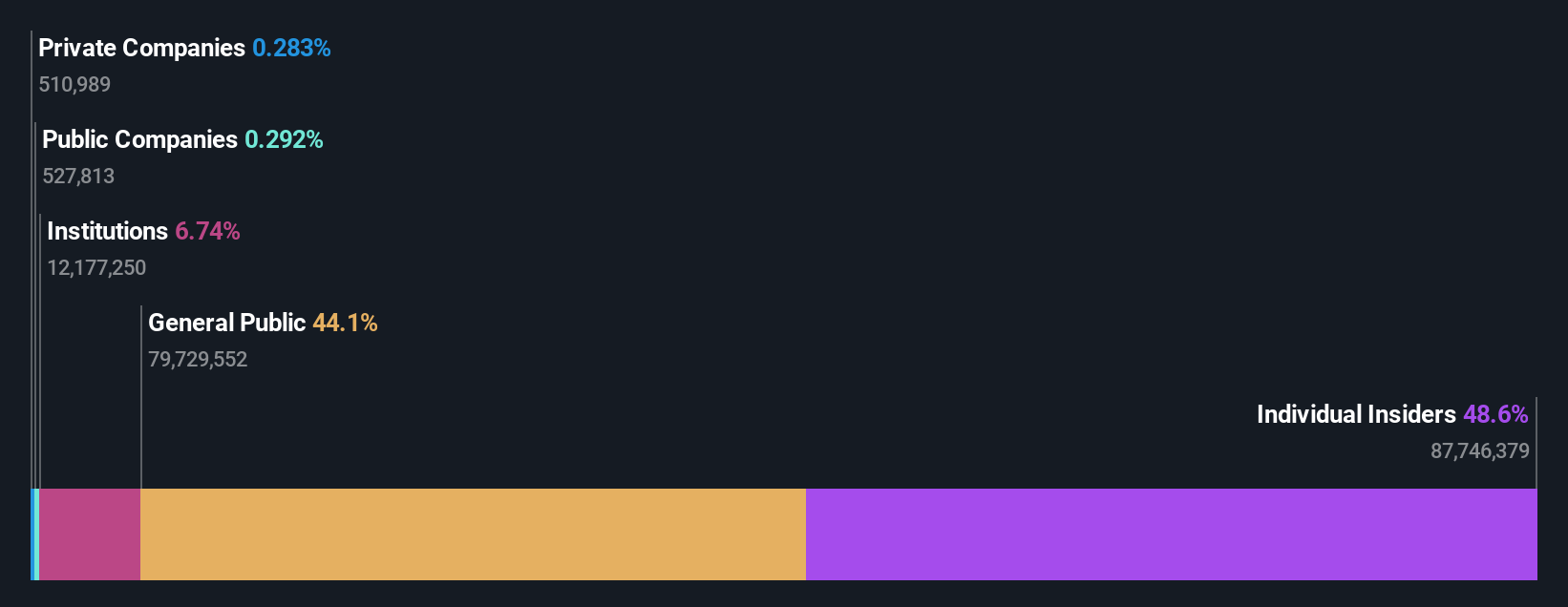

Overview: Dicker Data is a wholesale distributor of computer peripherals, with a market capitalization of approximately A$2.27 billion.

Operations: Wholesale of computer peripherals generated A$2.27 billion in revenue, with a gross profit margin of 14.23% as of the latest reporting period. The company's net income for the same period was A$82.15 million, reflecting a net income margin of 3.62%.

PE: 21.6x

Dicker Data, a lesser-known yet promising player in the Australian market, recently saw significant insider confidence as David Dicker acquired 58,165 shares for A$703,674. This move in May underscores a strong belief in the company's prospects amidst its financial landscape characterized by high debt levels and reliance on external borrowing—a riskier funding strategy. Despite these challenges, earnings are expected to grow annually by 7.94%. Moreover, the firm maintained its shareholder commitment by announcing a regular dividend of A$0.11 per share due mid-May.

Neuren Pharmaceuticals (ASX:NEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neuren Pharmaceuticals is a company focused on the development of pharmaceutical products, with a market capitalization of approximately A$231.94 million.

Operations: Pharmaceutical Products generated A$231.94 million in revenue, with a gross profit margin of 88.47% due to costs of goods sold totaling A$26.75 million. Operating expenses amounted to A$5.95 million for the period.

PE: 16.2x

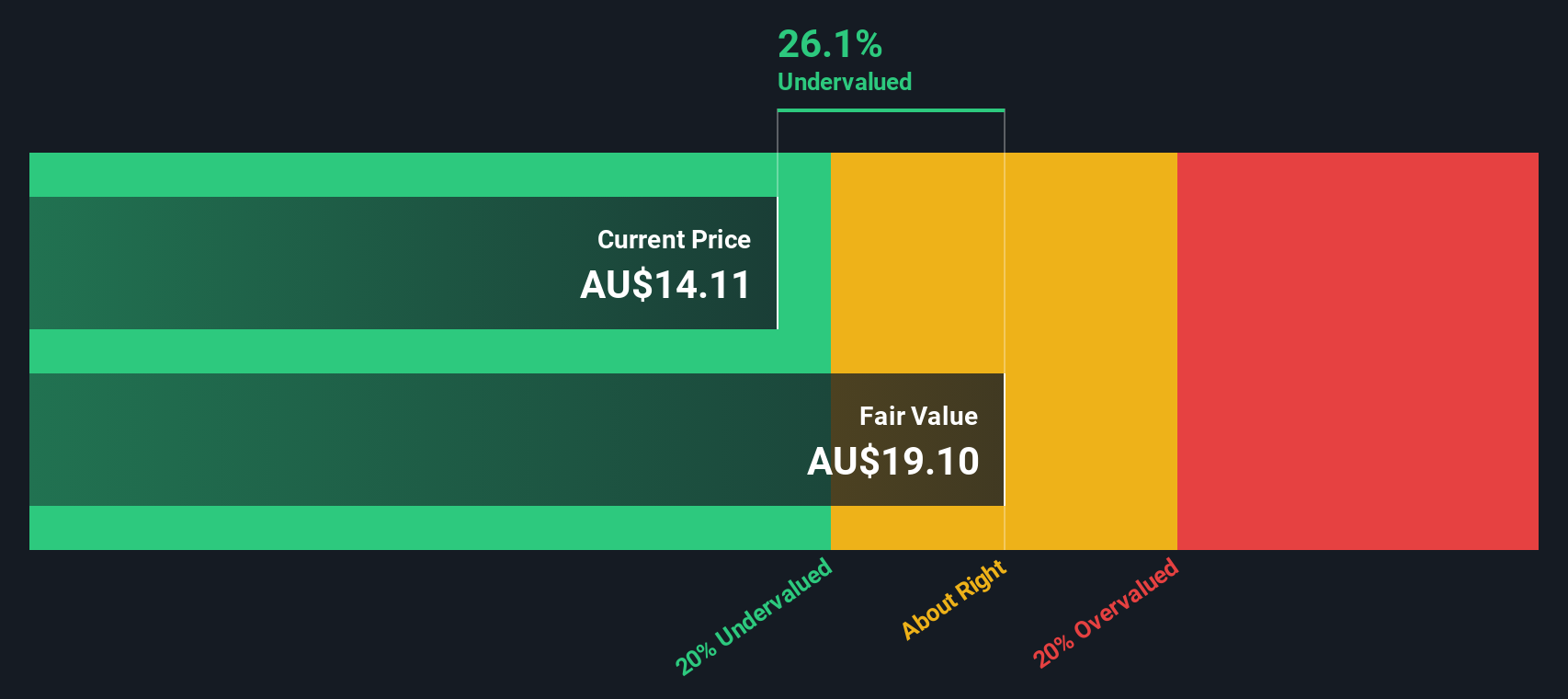

Recently, Neuren Pharmaceuticals showcased promising results from a Phase 2 clinical trial for NNZ-2591, targeting Pitt Hopkins syndrome—a condition with no approved treatments. Demonstrating statistically significant improvements and a strong safety profile, these findings underscore the company's potential in addressing rare neurological disorders. Notably, insider confidence is reflected through recent share purchases by executives, signaling belief in the company’s trajectory. Amidst this progress, Neuren also actively engaged the investment community with presentations at major conferences.

Tabcorp Holdings (ASX:TAH)

Simply Wall St Value Rating: ★★★★★★

Overview: Tabcorp Holdings operates primarily in gaming services and wagering, with a focus on the Australian market.

Operations: Gaming Services and Wagering and Media are the primary revenue contributors, generating A$187.8 million and A$2181.7 million respectively. The company has demonstrated a consistently high gross profit margin, averaging approximately 98% over multiple reporting periods, highlighting efficient cost management relative to its revenue generation.

PE: -2.5x

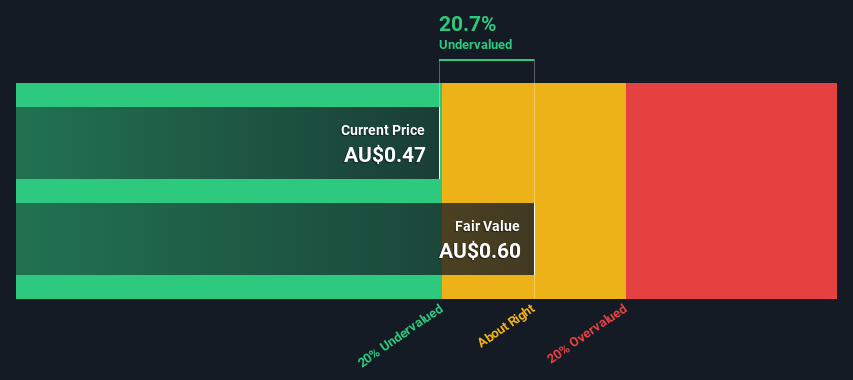

In a display of insider confidence, executives at Tabcorp Holdings recently purchased shares, signaling strong belief in the company's prospects. This Australian firm, known for its lean operations without reliance on customer deposits, faces financial scrutiny with 100% of its liabilities sourced from higher-risk external borrowings. Despite this, earnings are poised to surge by 82% annually. Such growth potential amidst cautious funding strategies paints Tabcorp as a noteworthy player in the undervalued sector.

- Navigate through the intricacies of Tabcorp Holdings with our comprehensive valuation report here.

-

Examine Tabcorp Holdings' past performance report to understand how it has performed in the past.

Taking Advantage

- Discover the full array of 25 Undervalued ASX Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dicker Data, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DDR

Dicker Data

Engages in the wholesale distribution of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand.

Good value with adequate balance sheet.

Market Insights

Community Narratives