Exploring Life360 And 2 Prominent High Growth Tech Stocks In Australia

Reviewed by Simply Wall St

The Australian market has shown mixed performance recently, with the ASX 200 trading flat as sectors like Financials and Real Estate gained while IT stocks faced significant declines. In this fluctuating environment, identifying high growth tech stocks such as Life360 requires careful consideration of factors like innovation potential, market adaptability, and financial resilience amidst broader market volatility.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| WiseTech Global | 20.15% | 25.52% | ★★★★★★ |

| Wrkr | 56.40% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| Echo IQ | 61.50% | 65.86% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Immutep | 70.42% | 42.39% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 19.89% | 69.58% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our ASX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Life360 (ASX:360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Life360, Inc. operates a technology platform designed to locate people, pets, and things across various regions including North America, Europe, the Middle East, Africa, and beyond; it has a market capitalization of approximately A$7.50 billion.

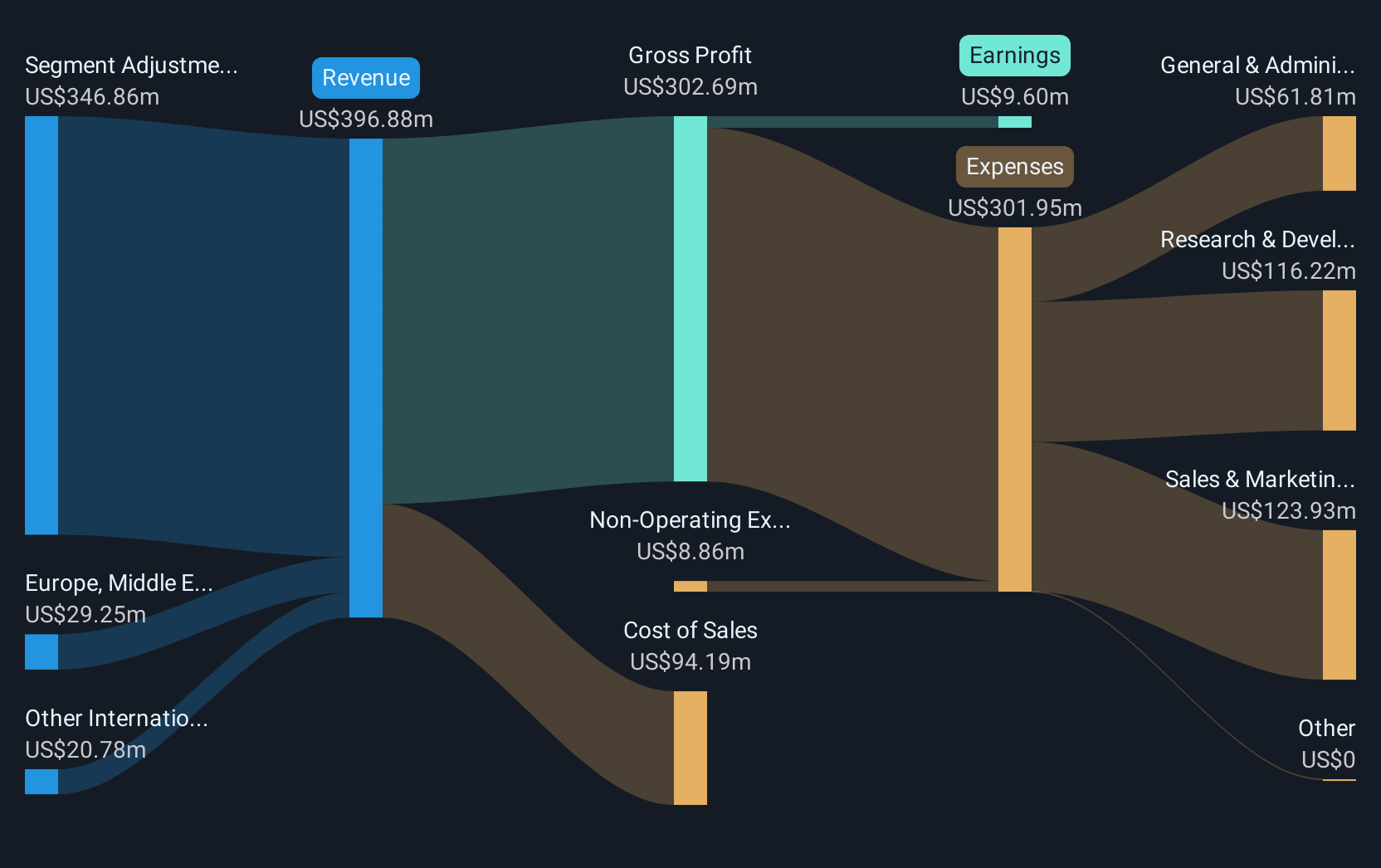

Operations: The company generates revenue primarily from its software and programming segment, amounting to $396.88 million. It operates across various international regions, focusing on technology solutions for location tracking of people, pets, and things.

Life360, a company at the forefront of family safety and connectivity, has recently shown significant financial and strategic growth. With an annual revenue increase of 16.1%, it outpaces the Australian market's average growth rate of 5.6%. This year marked a pivotal turn as it became profitable, showcasing an impressive forecasted earnings growth of 40.3% per annum. The firm's commitment to innovation is evident in its R&D spending, crucial for developing cutting-edge products like Place Ads and Uplift by Life360—tools that enhance advertising precision through real-time behavioral data from over 83 million users. These advancements not only boost user engagement but also attract substantial investments, highlighted by their recent $308.9 million from convertible notes aimed at funding strategic acquisitions and investments, positioning Life360 well within the high-growth tech sector in Australia.

- Unlock comprehensive insights into our analysis of Life360 stock in this health report.

Examine Life360's past performance report to understand how it has performed in the past.

Codan (ASX:CDA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Codan Limited specializes in developing technology solutions for a diverse clientele, including United Nations organizations, security and military groups, government departments, individuals, and small-scale miners, with a market cap of A$3.58 billion.

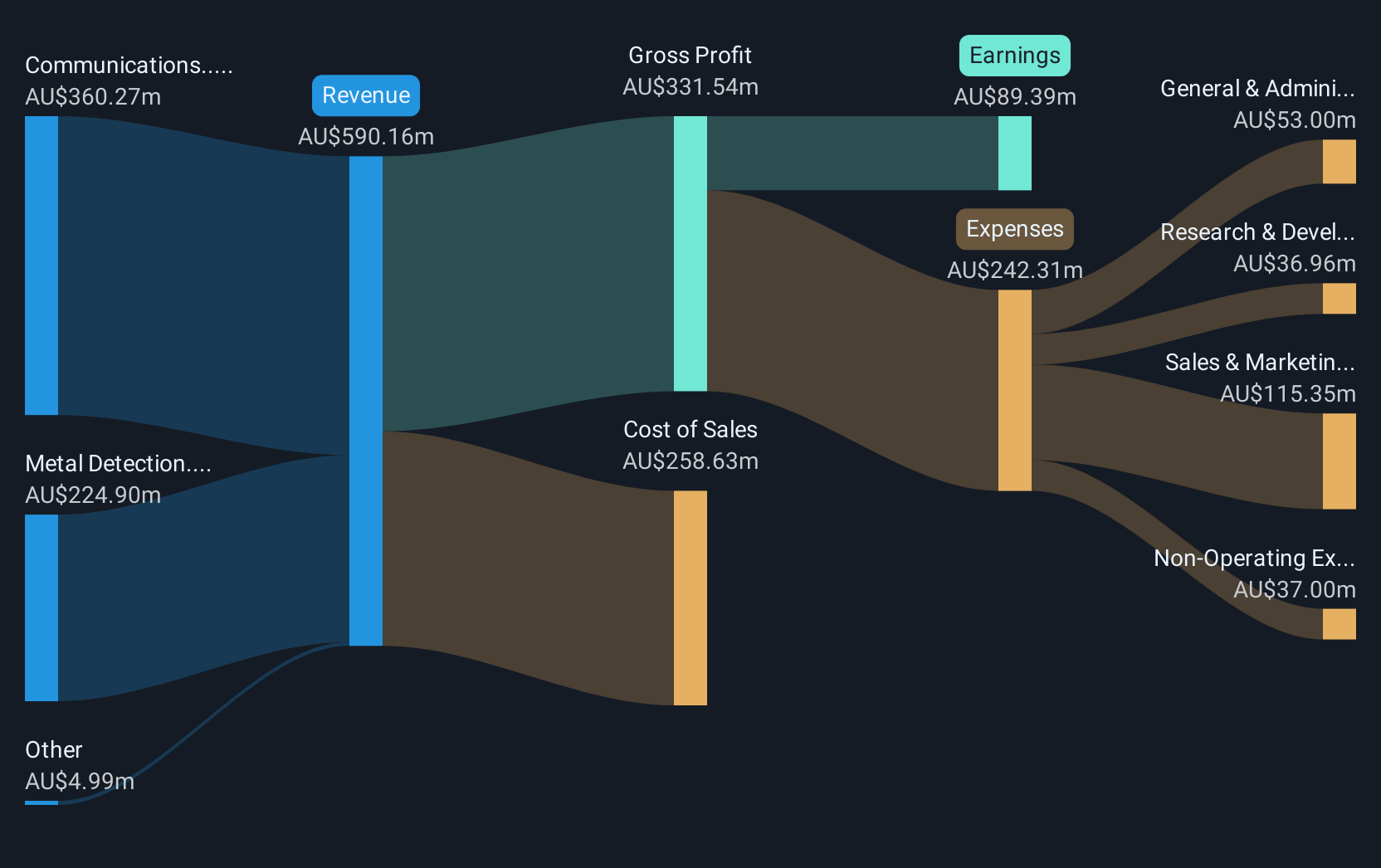

Operations: Codan Limited generates revenue primarily through its Communications and Metal Detection segments, with A$360.27 million from Communications and A$224.90 million from Metal Detection. The company serves a broad range of clients, including government and military organizations as well as individual users.

Codan, an innovator in high-tech solutions, has demonstrated robust financial health with a notable annual revenue growth of 10.8% and earnings expansion at 15.8% per year. Its strategic emphasis on R&D is reflected in substantial expenditures aimed at enhancing technological capabilities, vital for maintaining competitive advantage in the dynamic tech landscape of Australia. The company's performance surpasses the broader Australian market's average growth, positioning it favorably among peers. With a strong forecast for return on equity at 23%, Codan is well-poised to leverage its advanced product offerings and deep market penetration to sustain future growth trajectories.

- Navigate through the intricacies of Codan with our comprehensive health report here.

Review our historical performance report to gain insights into Codan's's past performance.

Nuix (ASX:NXL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuix Limited is a company that offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa, with a market capitalization of A$737.54 million.

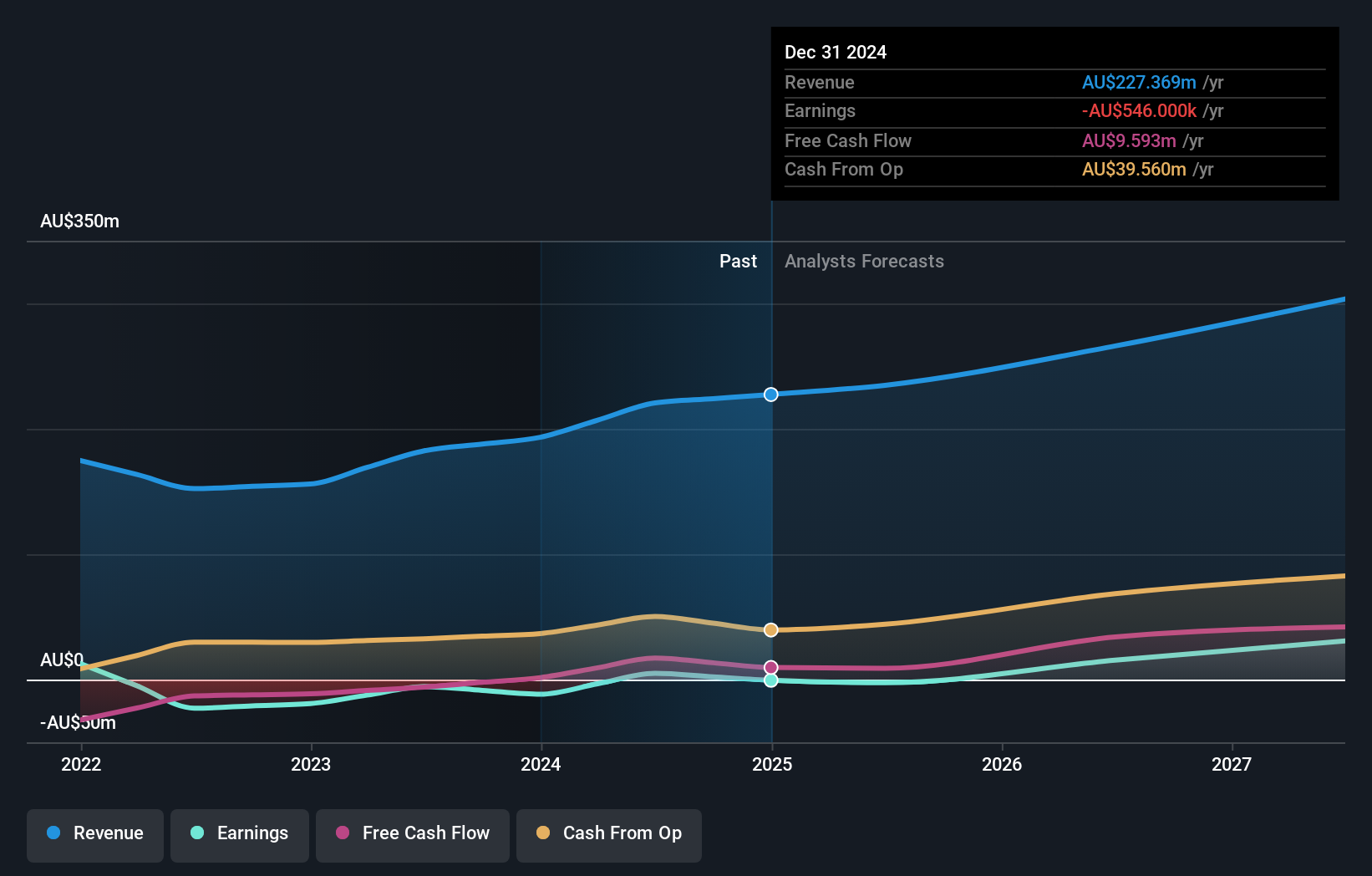

Operations: Nuix Limited generates revenue primarily from its Software & Programming segment, which contributes A$227.37 million. The company focuses on providing software solutions for investigative analytics and intelligence across multiple regions globally.

Nuix, recently added to the S&P/ASX 200 Index, is navigating its path in the tech sector with a promising outlook. Despite currently being unprofitable, Nuix's revenue growth at 13.8% annually outpaces the Australian market's average of 5.6%, indicating strong potential in a competitive landscape. The company is poised for significant transformations with earnings expected to surge by 51.8% annually over the next three years, coupled with a positive free cash flow that underscores its operational efficiency. This growth trajectory is supported by strategic moves into profitable segments and an emphasis on R&D to innovate further within its software solutions, setting a robust foundation for future profitability and industry impact.

- Click here to discover the nuances of Nuix with our detailed analytical health report.

Explore historical data to track Nuix's performance over time in our Past section.

Seize The Opportunity

- Discover the full array of 47 ASX High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military agencies, government departments, corporates, individuals consumers, and small-scale miners.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives