The Australian market has been experiencing mixed performance, with the ASX200 slightly down by 0.1% at 8,317 points, as energy and financial sectors show resilience while discretionary stocks face pressure. In this environment of fluctuating indices and sector-specific dynamics, identifying high-growth tech stocks such as Life360 can be crucial for investors seeking opportunities amidst broader market challenges.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 6.77% | 20.97% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 21.38% | 26.16% | ★★★★★☆ |

| Pureprofile | 14.31% | 71.53% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| Telix Pharmaceuticals | 21.55% | 38.32% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| AVA Risk Group | 25.54% | 77.32% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 37.21% | 98.46% | ★★★★★★ |

| SiteMinder | 18.84% | 60.66% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our ASX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Life360 (ASX:360)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Life360, Inc. operates a technology platform designed to locate people, pets, and things across various regions globally, with a market cap of A$4.82 billion.

Operations: The company generates revenue primarily through its Software & Programming segment, totaling $342.92 million. It operates a technology platform that facilitates location services across multiple regions, including North America and Europe.

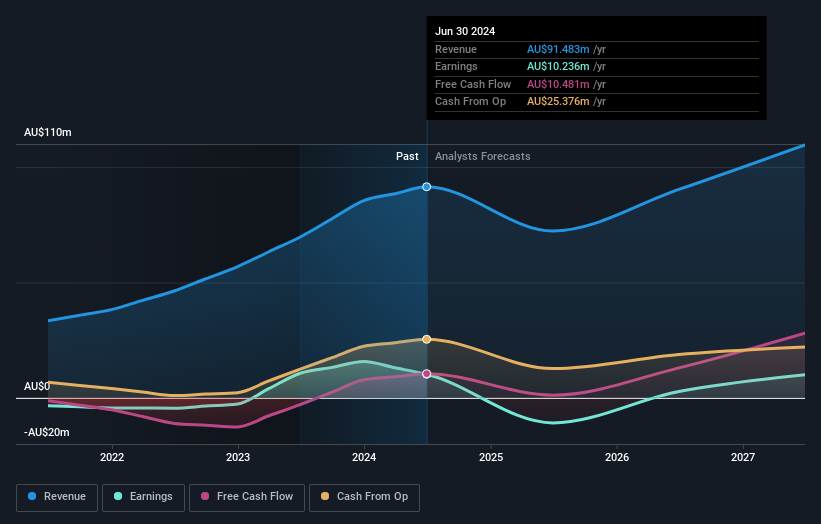

Life360 has demonstrated resilience and strategic foresight in the tech sector, particularly with its recent enhancement of Tile Bluetooth trackers, which now integrate more deeply with the Life360 app. This innovation not only extends the product's utility but also reinforces customer loyalty by improving safety features and device interconnectivity. Despite a slight downward revision in their 2024 revenue forecast to $368 million from an earlier range of $370 million to $378 million, Life360 reported a significant turnaround with third-quarter revenues jumping to $92.87 million from $78.62 million year-over-year and swinging to a net profit of $7.69 million from a loss previously. These figures underscore a robust core subscription growth maintained at over 25% annually, reflecting strong market demand and effective business adaptations amidst competitive pressures.

- Navigate through the intricacies of Life360 with our comprehensive health report here.

Gain insights into Life360's past trends and performance with our Past report.

Audinate Group (ASX:AD8)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Audinate Group Limited develops and sells digital audio visual (AV) networking solutions in Australia and internationally, with a market capitalization of A$751.74 million.

Operations: Audinate Group generates revenue primarily through its Contract Electronics Manufacturing Services, amounting to A$91.48 million.

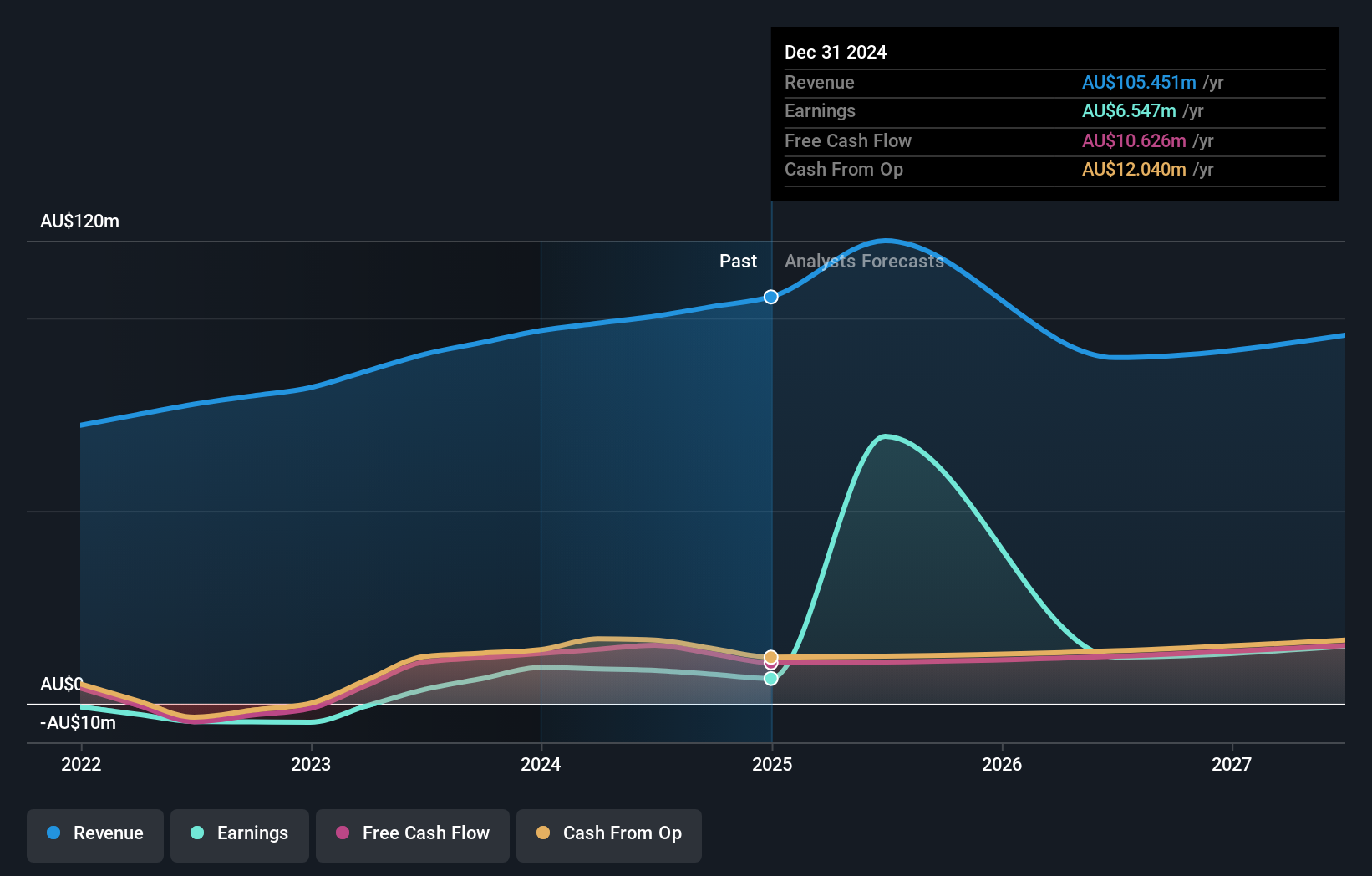

Audinate Group's strategic positioning in the tech sector is underscored by its robust commitment to innovation, as evidenced by its significant R&D expenditure. In the latest fiscal period, R&D expenses accounted for a substantial portion of revenue, highlighting an aggressive pursuit of technological advancement. This investment is bearing fruit with anticipated earnings growth of 25% annually, outpacing the broader Australian market's average. Additionally, Audinate's recent executive shake-up with Chris Rollinson stepping in as CFO could inject fresh strategic insights into financial management and corporate governance. Despite a challenging environment marked by a 3.8% dip in earnings last year, Audinate’s focus on core technologies and new leadership are pivotal for its trajectory in high-growth sectors.

- Unlock comprehensive insights into our analysis of Audinate Group stock in this health report.

Explore historical data to track Audinate Group's performance over time in our Past section.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited is an Australian company that develops and provides mining software solutions across various regions including Asia, the Americas, Africa, and Europe, with a market capitalization of A$693.28 million.

Operations: RPMGlobal Holdings generates revenue primarily through its Software segment, contributing A$72.67 million, and its Advisory segment with A$31.41 million. The company focuses on developing and providing mining software solutions across multiple regions globally.

RPMGlobal Holdings has demonstrated robust performance with a notable 134.6% earnings growth over the past year, significantly outpacing the software industry's average of 6.8%. This surge is backed by a strategic focus on R&D, where expenditures are not just substantial but pivotal in driving innovation—evident from its revenue forecast growing at 10.4% annually, surpassing the Australian market's projection of 5.7%. Additionally, the inclusion of RPMGlobal in both S&P/ASX Small Ordinaries and S&P/ASX 300 Indexes underscores its rising prominence within the tech landscape. Looking ahead, with earnings expected to climb by 22.6% per year, RPMGlobal is positioning itself as a dynamic contender in technology advancement and market expansion.

- Delve into the full analysis health report here for a deeper understanding of RPMGlobal Holdings.

Understand RPMGlobal Holdings' track record by examining our Past report.

Make It Happen

- Navigate through the entire inventory of 57 ASX High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RUL

RPMGlobal Holdings

Develops and provides mining software solutions in Australia, Asia, the Americas, Africa, and Europe.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives