As the Australian market anticipates a modest 0.17% gain with the ASX 200 futures pointing upwards, investors are keeping a close eye on tech stocks amid recent global uncertainties and shifting economic dynamics. In this environment, identifying high growth tech companies that demonstrate resilience and adaptability to market fluctuations can be key for those looking to navigate potential opportunities in Australia’s evolving landscape.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| WiseTech Global | 20.14% | 25.01% | ★★★★★★ |

| Wrkr | 57.01% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| Immutep | 70.42% | 42.39% | ★★★★★☆ |

| Echo IQ | 61.50% | 65.86% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| SiteMinder | 19.93% | 69.52% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Audinate Group (ASX:AD8)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Audinate Group Limited specializes in developing and selling digital audio visual networking solutions both in Australia and internationally, with a market cap of A$621.01 million.

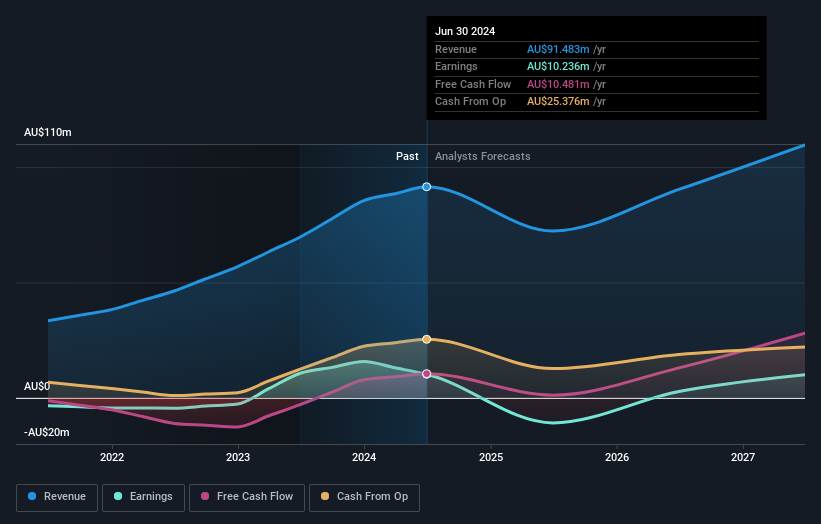

Operations: The company generates revenue primarily through its Contract Electronics Manufacturing Services, amounting to A$73.60 million.

Audinate Group, despite recent challenges including its drop from the S&P/ASX 200 Index, exhibits promising growth metrics. With an annual revenue increase of 16.2%, surpassing the Australian market's average of 5.6%, and a projected earnings surge of 50.3% per year, AD8 is outpacing general market expectations significantly. However, it's crucial to note that its profit margins have declined from last year's 18.5% to just 4.5%. This financial juxtaposition highlights a volatile yet potentially rewarding trajectory for investors focused on tech innovation and market resilience in Australia’s high-tech sector.

- Click to explore a detailed breakdown of our findings in Audinate Group's health report.

Gain insights into Audinate Group's historical performance by reviewing our past performance report.

Data#3 (ASX:DTL)

Simply Wall St Growth Rating: ★★★★☆☆

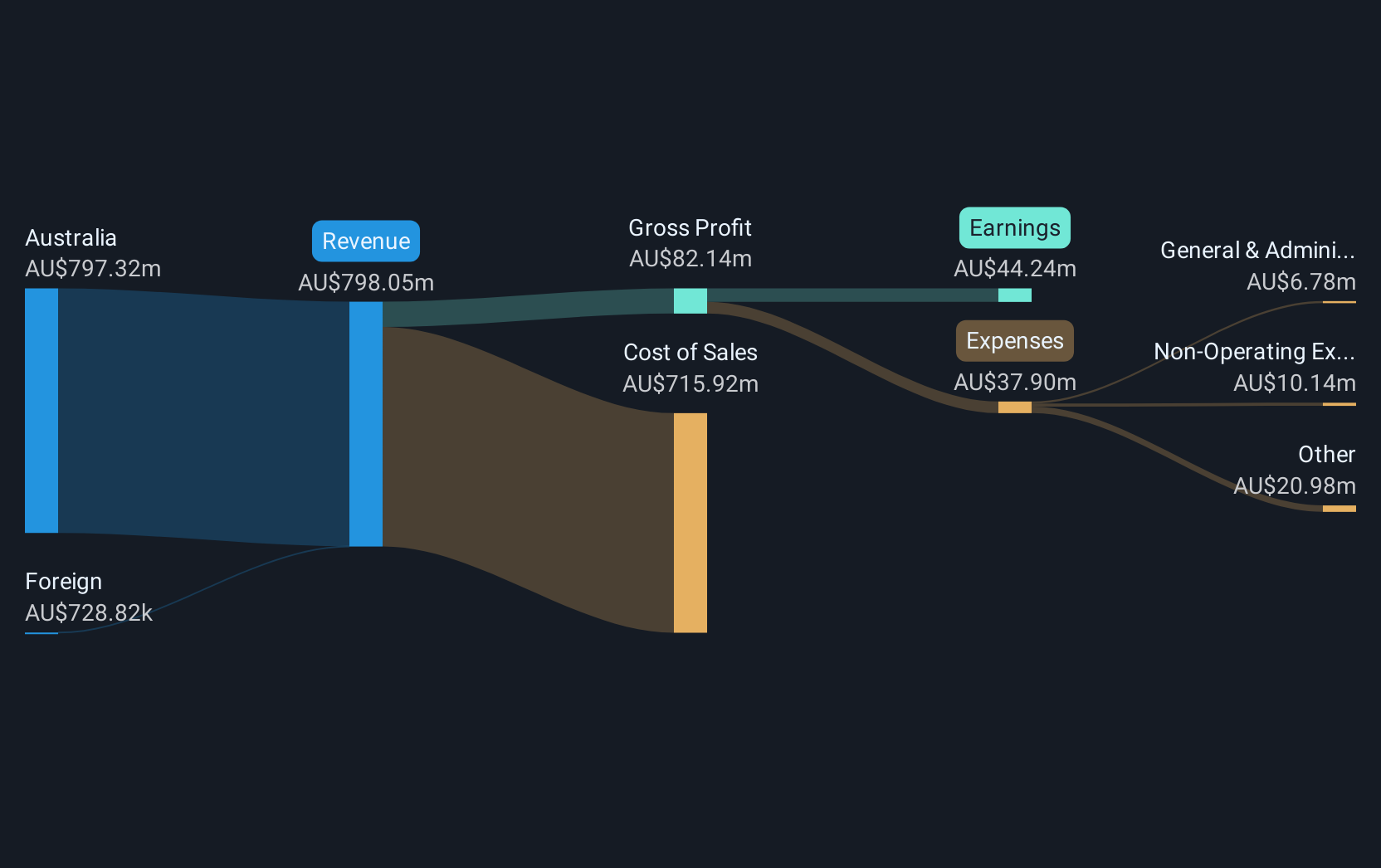

Overview: Data#3 Limited is an IT solutions and services provider operating in Australia, Fiji, and the Pacific Islands with a market capitalization of A$1.17 billion.

Operations: The company generates revenue primarily through its role as a value-added IT reseller and solutions provider, with this segment contributing A$798.05 million. The business focuses on delivering comprehensive IT services across Australia, Fiji, and the Pacific Islands.

Data#3 Limited, amidst a dynamic IT landscape, is demonstrating robust growth with a notable annual revenue increase of 24.4%, significantly outpacing the Australian market average of 5.6%. Despite this surge, its earnings growth at 10.5% per year trails the broader market forecast of 11.8%. The company's strategic focus on innovation is evident from its substantial R&D investment, aligning with industry shifts towards more integrated tech solutions. Recent board changes could signal a fresh perspective to propel future strategies, though insider selling raises cautions about potential undercurrents within its corporate governance structure.

- Take a closer look at Data#3's potential here in our health report.

Review our historical performance report to gain insights into Data#3's's past performance.

FINEOS Corporation Holdings (ASX:FCL)

Simply Wall St Growth Rating: ★★★★☆☆

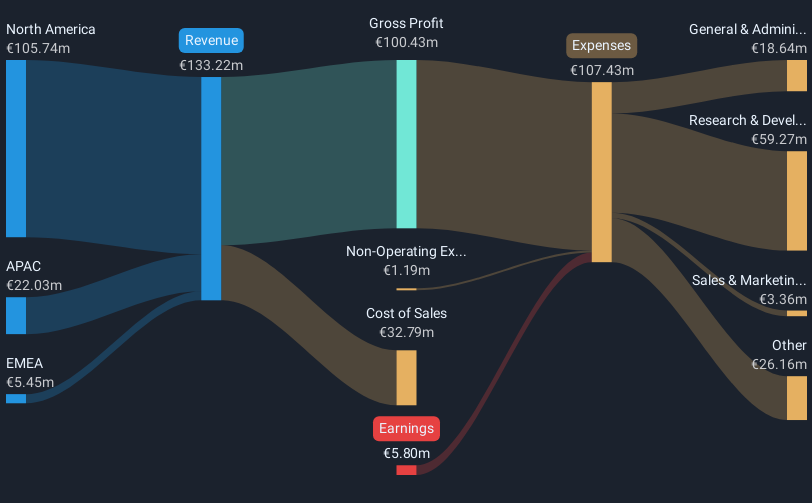

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa with a market cap of A$842.91 million.

Operations: FINEOS Corporation Holdings generates revenue primarily from its software and programming segment, amounting to €133.22 million. The company focuses on providing enterprise solutions for claims and policy management tailored to the needs of insurers and benefits providers across various regions including North America, Asia Pacific, the Middle East, and Africa.

FINEOS Corporation Holdings is navigating a transformative phase, underscored by strategic alliances and robust guidance for fiscal 2025. The company's recent partnership with Wellthy aims to revolutionize care management through advanced integration and automation, enhancing operational efficiency and broadening service offerings beyond traditional insurance benefits. This collaboration aligns with the increasing demand for holistic, personalized healthcare solutions, potentially accelerating FINEOS' market presence and customer satisfaction. Moreover, the firm has reaffirmed its revenue forecast between €138 million to €143 million for FY25, reflecting confidence in its growth trajectory despite reporting a net loss of €5.8 million in FY24. These initiatives could position FINEOS as a pivotal player in reshaping health benefits administration through technology-driven solutions.

- Click here and access our complete health analysis report to understand the dynamics of FINEOS Corporation Holdings.

Gain insights into FINEOS Corporation Holdings' past trends and performance with our Past report.

Key Takeaways

- Unlock more gems! Our ASX High Growth Tech and AI Stocks screener has unearthed 46 more companies for you to explore.Click here to unveil our expertly curated list of 49 ASX High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AD8

Audinate Group

Engages in develops and sells digital audio visual (AV) networking solutions Australia and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives