Xero (ASX:XRO) Valuation in Focus Following Strong Half-Year Earnings Results

Reviewed by Simply Wall St

Xero (ASX:XRO) just released its half-year earnings, revealing a clear uptick in both revenue and net income compared to last year. Investors are watching closely. These results give a snapshot of the company’s momentum.

See our latest analysis for Xero.

Despite delivering robust growth in both revenue and net income, Xero’s 1-day share price return fell 9.03% following the results, extending its recent slide to a 12.39% drop over the week. While long-term investors are still ahead with an 83.65% three-year total shareholder return, this year’s momentum has clearly faded as the stock is down nearly 24% year-to-date.

If today’s sharp move has you rethinking your next opportunity, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares falling despite improved earnings, the big question for investors is whether Xero is now undervalued after its recent drop, or if the market is correctly anticipating the company’s future performance and already pricing it in.

Most Popular Narrative: 33.5% Undervalued

Xero’s widely-followed narrative suggests the company’s fair value sits far above its last close, creating an intriguing contrast with market sentiment. This sets the stage for some bold assumptions about future earnings and profit margins.

The integration of advanced product features, such as the newly launched embedded bill payment solution and AI functionalities like Just Ask Xero, is expected to enhance Xero's service offerings and boost revenue via improved user satisfaction and retention.

Want to know what’s really driving this bullish price target? The fair value depends on aggressive growth in profits and a premium earnings multiple. But the key details behind these projections might surprise you. Find out which game-changing numbers make or break this calculation inside the full narrative.

Result: Fair Value of $191.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in subscriber growth or unexpected regulatory changes could quickly challenge the optimistic assumptions behind Xero’s current valuation narrative.

Find out about the key risks to this Xero narrative.

Another View: Looking at the Price Tag

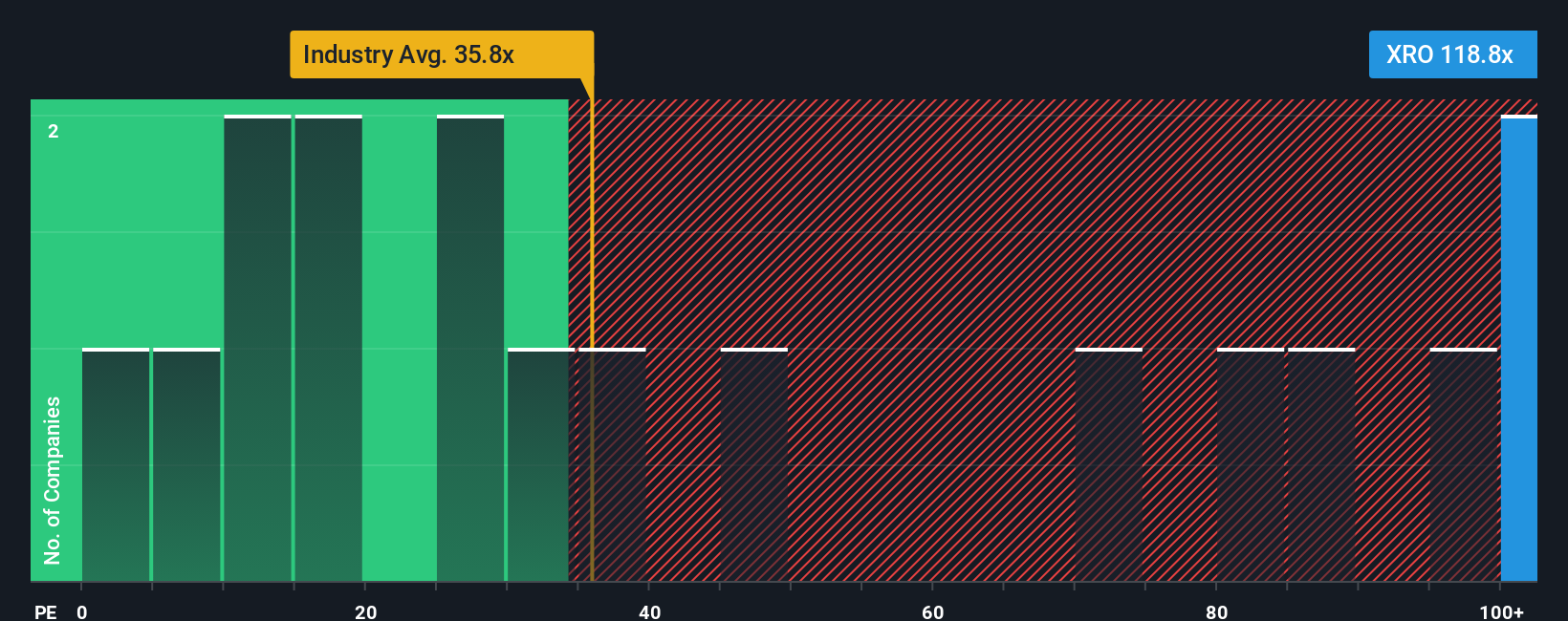

Taking a step back from fair value estimates, Xero’s price-to-earnings ratio stands at a steep 91.2x. This is significantly higher than both the software industry’s 35.9x average and the peer group’s 56.9x. When compared with the market’s fair ratio of 44.3x, Xero appears expensive, which highlights the risk if growth expectations change. Does this indicate potential for further downside, or is the market simply factoring in strong expectations for the company?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xero Narrative

If you see things differently, or want to dig into the numbers and form your own opinion, you can put together your own narrative in just minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Xero.

Looking for More Investment Ideas?

Smart investors never settle for yesterday’s winners. Make your next move count by tapping into exclusive stocks singled out for their potential, innovation, and resilience.

- Spot opportunities with high potential by reviewing these 882 undervalued stocks based on cash flows which are backed by robust cash flows and attractive valuations.

- Harness powerful trends in technology by looking over these 27 AI penny stocks that are pushing the boundaries of artificial intelligence and automation.

- Maximize your income strategy by checking out these 15 dividend stocks with yields > 3% with yields greater than 3% for stable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:XRO

Xero

Provides online business solutions for small businesses and their advisors in Australia, New Zealand, the United Kingdom, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives