The Australian market recently experienced a slight uptick, finishing just above the flatline, despite some turbulence from major players like Aristocrat Leisure and Macquarie Group. In this context of mixed performance and investor appetite for tech offerings, exploring high growth tech stocks becomes crucial as they can offer potential opportunities for growth in an otherwise subdued market environment.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| WiseTech Global | 20.14% | 25.01% | ★★★★★★ |

| Wrkr | 57.01% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Immutep | 70.44% | 42.38% | ★★★★★☆ |

| Echo IQ | 61.50% | 65.86% | ★★★★★★ |

| SiteMinder | 19.87% | 69.57% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our ASX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Megaport (ASX:MP1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across multiple regions, with a market cap of A$2.09 billion.

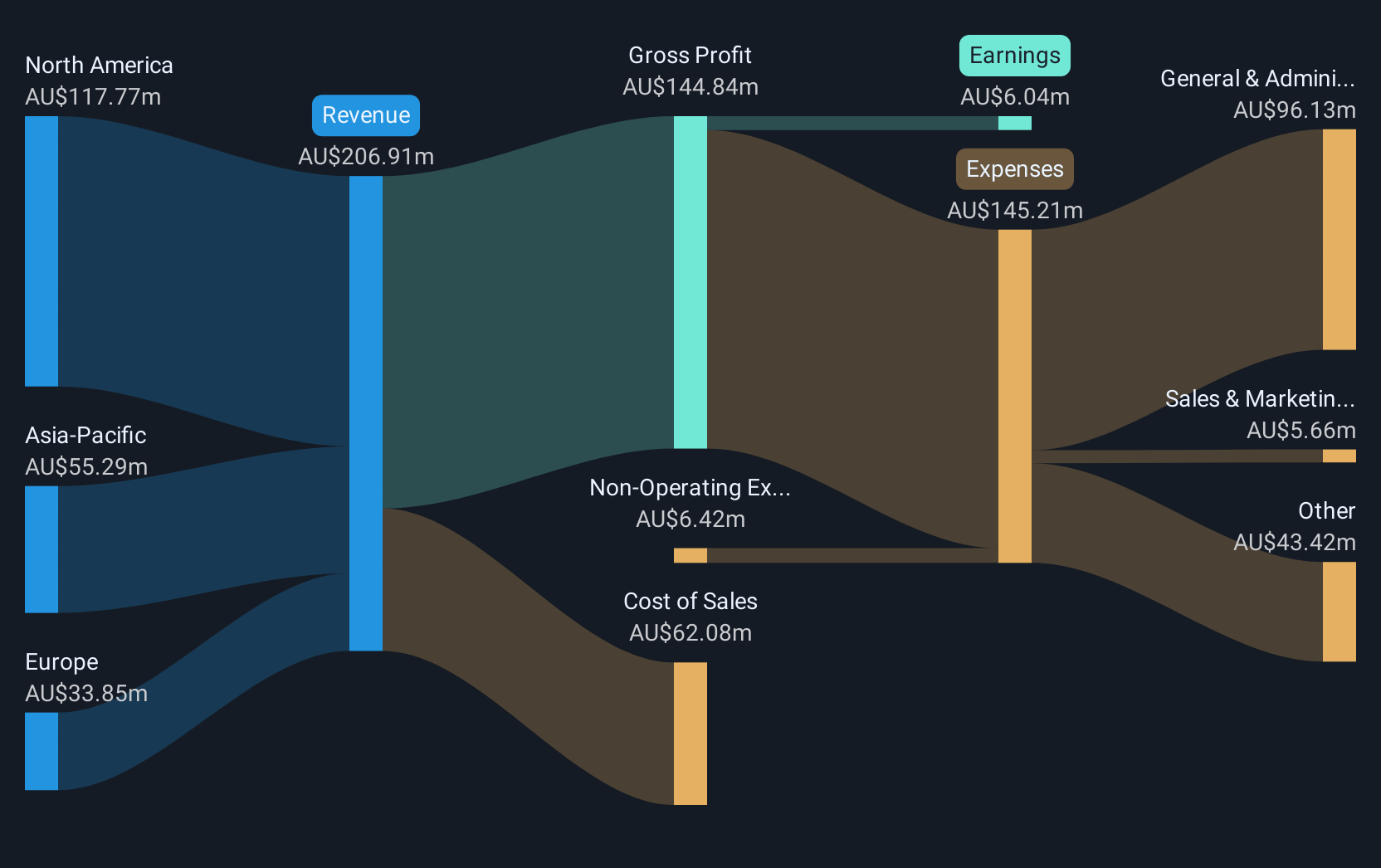

Operations: The company generates revenue through its on-demand interconnection and internet exchange services, with North America contributing A$117.77 million, Asia-Pacific A$55.29 million, and Europe A$33.85 million.

Despite a challenging year with a 25.9% dip in earnings, Megaport's strategic moves are setting it up for robust future growth, evidenced by its projected annual earnings increase of 40.3%. This growth is significantly above the Australian market's average of 11.7%, highlighting its recovery potential. Recent partnerships, like the one with Aviatrix to enhance encryption across its Network-as-a-Service platform, not only address critical cybersecurity needs but also expand its service capabilities globally—factors likely to drive Megaport’s revenue up by 12.5% annually, outpacing the broader market’s 5.5%.

- Delve into the full analysis health report here for a deeper understanding of Megaport.

Understand Megaport's track record by examining our Past report.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$10.60 billion.

Operations: Technology One generates revenue primarily from its software segment, which accounts for A$347.35 million, followed by corporate services at A$87.02 million and consulting services at A$72.17 million. The company's focus on enterprise business software solutions contributes to its market presence both in Australia and internationally.

Technology One, recently added to the FTSE All-World Index, is outpacing its peers with a 12.2% annual revenue growth and a robust 15.7% increase in earnings per year, significantly ahead of the Australian market's averages of 5.5% and 11.7%, respectively. This performance is bolstered by strategic leadership changes and shareholder-approved constitutional amendments aimed at streamlining operations. With R&D expenses consistently aligning with industry innovation demands, Technology One stands poised for sustained advancement in the software sector, leveraging high-quality earnings and a strong return on equity forecast at 33.9%.

Xero (ASX:XRO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xero Limited, a software as a service company, offers online business solutions for small businesses and their advisors across Australia, New Zealand, and internationally with a market cap of A$26.70 billion.

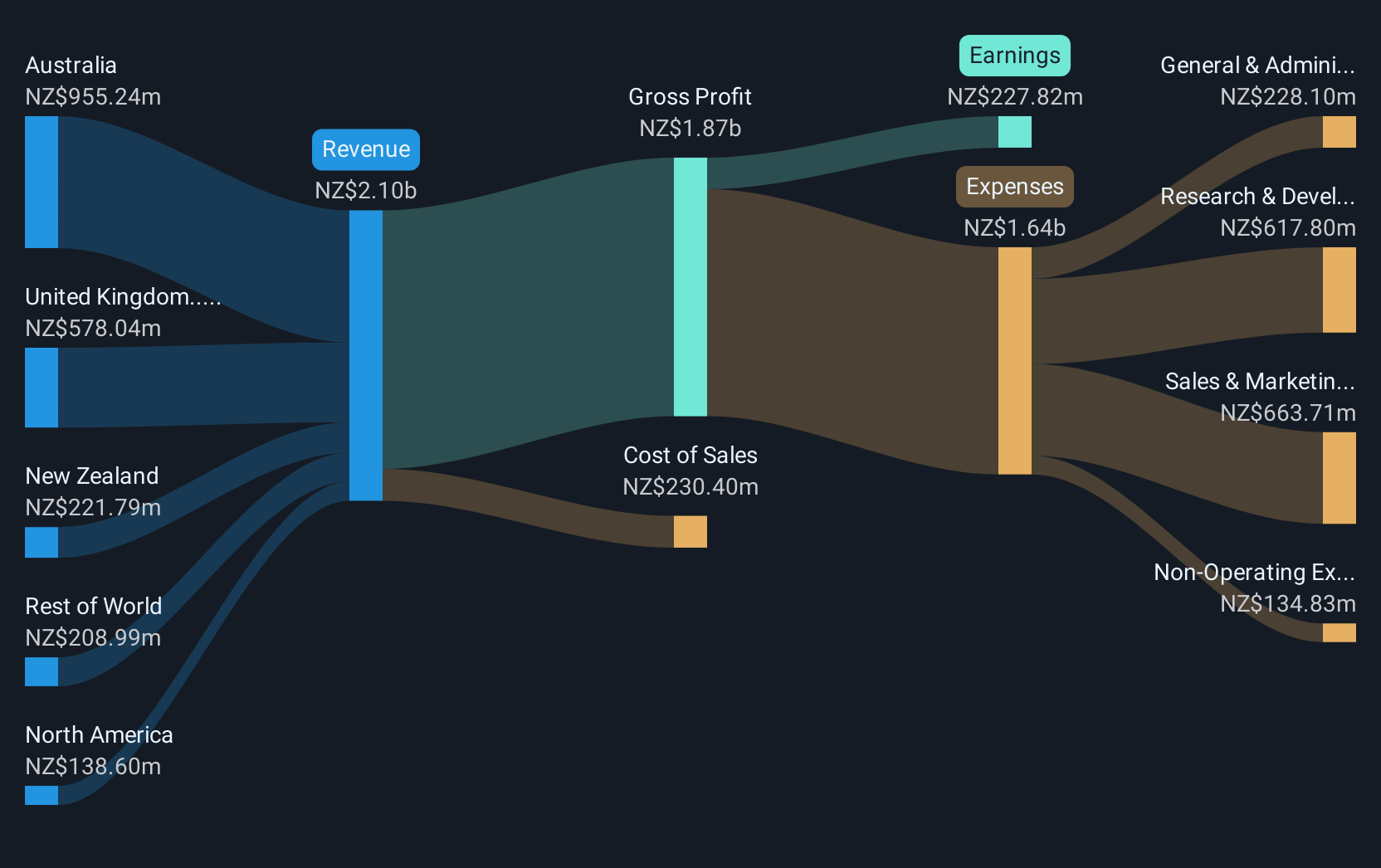

Operations: Xero generates revenue primarily through providing online solutions for small businesses and their advisors, with reported earnings of NZ$1.91 billion. The company focuses on delivering software as a service to enhance business operations in various regions including Australia and New Zealand.

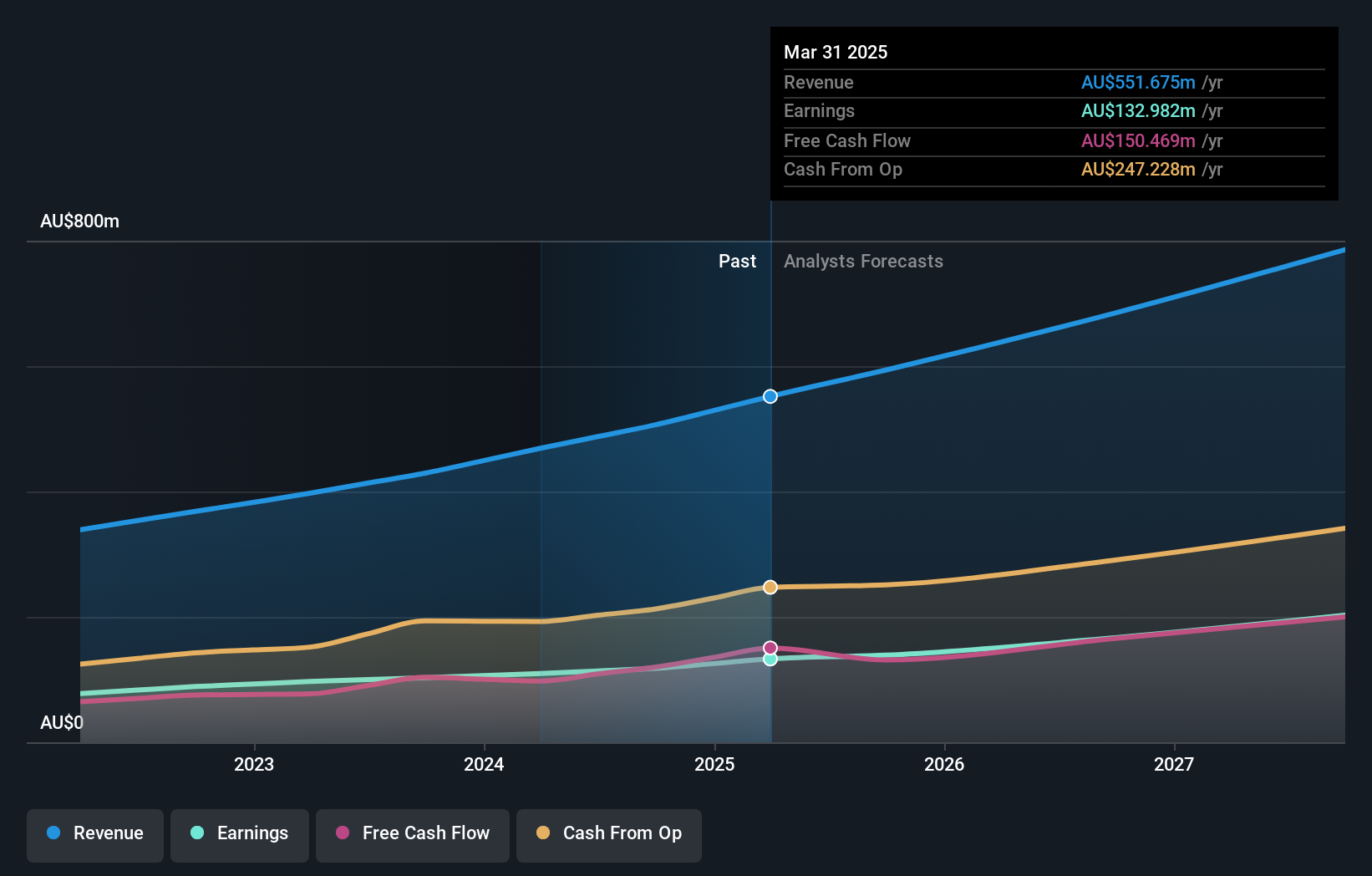

Xero's integration with BILL to enhance bill payment solutions for US small businesses marks a strategic move in simplifying financial workflows, reflecting its innovative approach to software development. This capability not only streamlines operations but also provides vital cash flow insights, crucial for small business sustainability. Financially, Xero is outpacing the Australian market with a projected annual revenue growth of 12.4% and earnings growth of 23.5%. These figures underscore Xero’s robust position in the tech landscape, further supported by its transition to profitability this year—a testament to its effective strategy and operational execution.

- Click here and access our complete health analysis report to understand the dynamics of Xero.

Explore historical data to track Xero's performance over time in our Past section.

Key Takeaways

- Unlock more gems! Our ASX High Growth Tech and AI Stocks screener has unearthed 45 more companies for you to explore.Click here to unveil our expertly curated list of 48 ASX High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives