Wrkr (ASX:WRK) rallies 31% this week, taking three-year gains to 109%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Wrkr Ltd (ASX:WRK) share price has flown 109% in the last three years. How nice for those who held the stock! It's also good to see the share price up 53% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

The past week has proven to be lucrative for Wrkr investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for Wrkr

Wrkr wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Wrkr saw its revenue grow at 43% per year. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 28% compound over three years. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say Wrkr is still worth investigating - successful businesses can often keep growing for long periods.

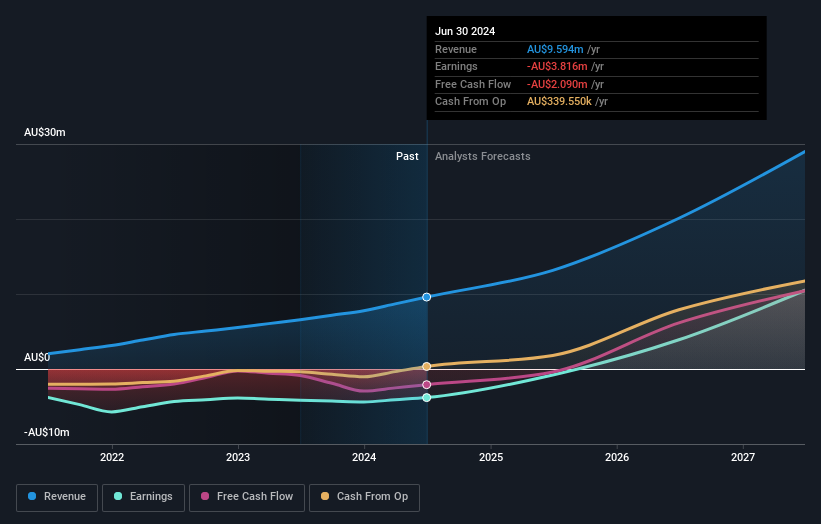

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Wrkr's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Wrkr shareholders have received a total shareholder return of 77% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 13% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Wrkr has 3 warning signs we think you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wrkr might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WRK

Wrkr

Provides software as a service to solve compliance needs for companies to process pay, superannuation and SMSF contributions, onboard new staff and contractors, and check credentials of new employees and contractors in Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives