- Australia

- /

- Diversified Financial

- /

- ASX:FND

We're Not Counting On Vortiv (ASX:VOR) To Sustain Its Statutory Profitability

As a general rule, we think profitable companies are less risky than companies that lose money. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether Vortiv's (ASX:VOR) statutory profits are a good guide to its underlying earnings.

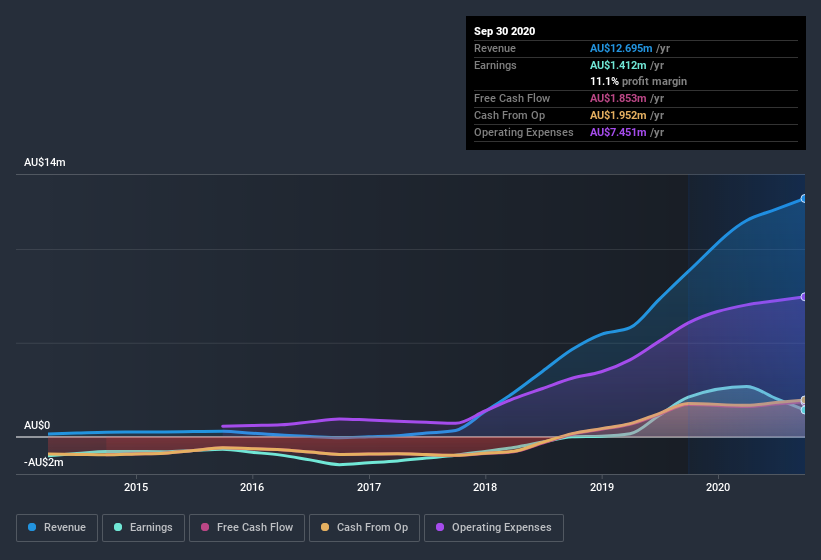

It's good to see that over the last twelve months Vortiv made a profit of AU$1.41m on revenue of AU$12.7m. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

View our latest analysis for Vortiv

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Therefore, we think it is well worth considering the impact that unusual items and a spike in non-operating revenue have had on Vortiv's statutory profit result. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Vortiv.

The Power Of Non-Operating Revenue

Companies will classify their revenue streams as either operating revenue or other revenue. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. Notably, Vortiv had a significant increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from -AU$545.8k last year to AU$232.0k this year. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

The Impact Of Unusual Items On Profit

Alongside that spike in non-operating revenue, it's also important to note that Vortiv'sprofit was boosted by unusual items worth AU$591k in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. We can see that Vortiv's positive unusual items were quite significant relative to its profit in the year to September 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Vortiv's Profit Performance

In its last report Vortiv benefitted from a spike in non-operating revenue which may have boosted its profit in a way that may be no more sustainable than low quality coal mining. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated and everything else is equal. For all the reasons mentioned above, we think that, at a glance, Vortiv's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. If you want to do dive deeper into Vortiv, you'd also look into what risks it is currently facing. In terms of investment risks, we've identified 3 warning signs with Vortiv, and understanding them should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Vortiv, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:FND

Findi

Through its subsidiaries, engages in the development of digital payment systems in India.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion