Introducing Vault Intelligence (ASX:VLT), The Stock That Slid 54% In The Last Three Years

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term Vault Intelligence Limited (ASX:VLT) shareholders. Sadly for them, the share price is down 54% in that time. It's down 55% in about a quarter. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for Vault Intelligence

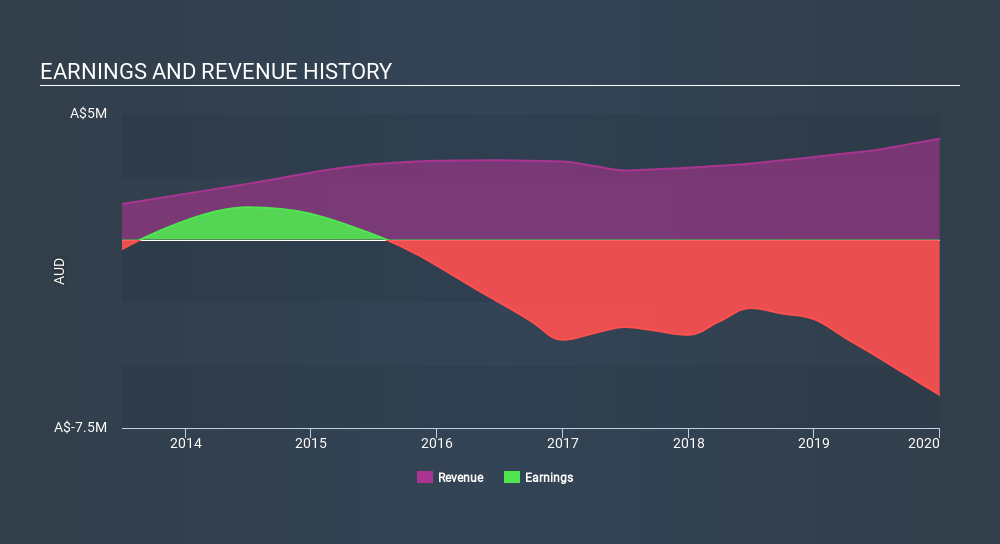

Vault Intelligence wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Vault Intelligence grew revenue at 11% per year. That's a pretty good rate of top-line growth. That contrasts with the weak share price, which has fallen 23% compounded, over three years. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. So this is one stock that might be worth investigating further, or even adding to your watchlist.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Vault Intelligence's financial health with this free report on its balance sheet.

A Different Perspective

The last twelve months weren't great for Vault Intelligence shares, which performed worse than the market, costing holders 8.3%. Meanwhile, the broader market slid about 4.9%, likely weighing on the stock. However, the loss over the last year isn't as bad as the 23% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 6 warning signs with Vault Intelligence , and understanding them should be part of your investment process.

But note: Vault Intelligence may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives