How a New Company Secretary at Technology One (ASX:TNE) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Technology One Limited has appointed Mr. Matthew Thompson as Company Secretary, effective 15 July 2025, while Mr. Stephen Kennedy remains in the role as well.

- This leadership addition brings extensive corporate governance, M&A, and legal expertise to Technology One’s executive team, reflecting ongoing efforts to strengthen organisational oversight.

- We will explore how the appointment of a seasoned governance executive may influence Technology One's investment outlook and risk factors.

Technology One Investment Narrative Recap

Technology One stands out for its strong recurring revenue growth, high customer retention, and innovation focus in the cloud ERP sector. The recent appointment of Mr. Matthew Thompson as Company Secretary adds governance depth, but does not materially affect the company’s immediate catalysts or its central risks around open data policies and competitive shifts that could impact revenue stickiness and growth trajectory.

Among recent developments, the appointment of Paul Robson as Non-Executive Director earlier this year is particularly relevant. This move, pairing SaaS leadership expertise with continued board refreshment, underlines Technology One’s commitment to operational oversight and experienced management, a key factor as the company pursues further adoption of its platform and seeks margin expansion from SaaS+ and consulting transitions.

By contrast, investors should also be aware of how growing momentum toward data interoperability in government IT procurement could...

Read the full narrative on Technology One (it's free!)

Technology One's outlook projects A$841.0 million in revenue and A$224.2 million in earnings by 2028. This reflects a 15.1% annual revenue growth rate and an A$91.2 million increase in earnings from the current A$133.0 million.

Exploring Other Perspectives

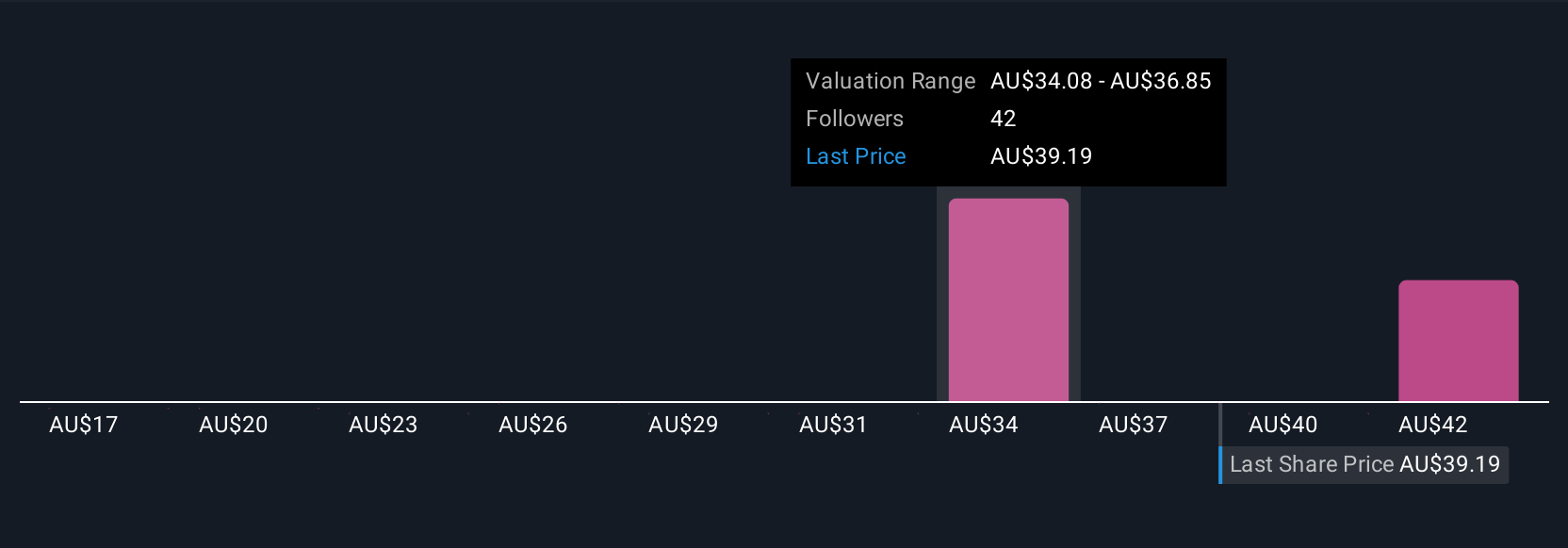

Simply Wall St Community members estimate fair values between A$17.49 and A$45.03, based on 9 varied viewpoints. Some highlight the risk that accelerating sector trends toward open data and contract contestability may test Technology One's robust customer retention and recurring revenue model.

Build Your Own Technology One Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Technology One research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Technology One research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Technology One's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives