As Australian shares track U.S. trends with the ASX 200 futures pointing to a modest gain, buoyed by Wall Street's record highs and strong performances in tech-heavy indices like the Nasdaq, there's a growing interest in high-growth tech stocks within Australia. In this dynamic market environment, identifying promising stocks often involves looking for companies that are not only innovative but also well-positioned to benefit from technological advancements and investor enthusiasm as demonstrated by recent developments such as successful funding rounds and new product launches.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pro Medicus | 20.19% | 22.27% | ★★★★★★ |

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| BlinkLab | 51.57% | 52.67% | ★★★★★★ |

| WiseTech Global | 20.26% | 25.03% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| Echo IQ | 49.20% | 51.35% | ★★★★★★ |

| Wrkr | 55.92% | 116.30% | ★★★★★★ |

| Immutep | 70.26% | 43.18% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 18.78% | 55.55% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our ASX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Megaport (ASX:MP1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across multiple regions, with a market cap of A$2.08 billion.

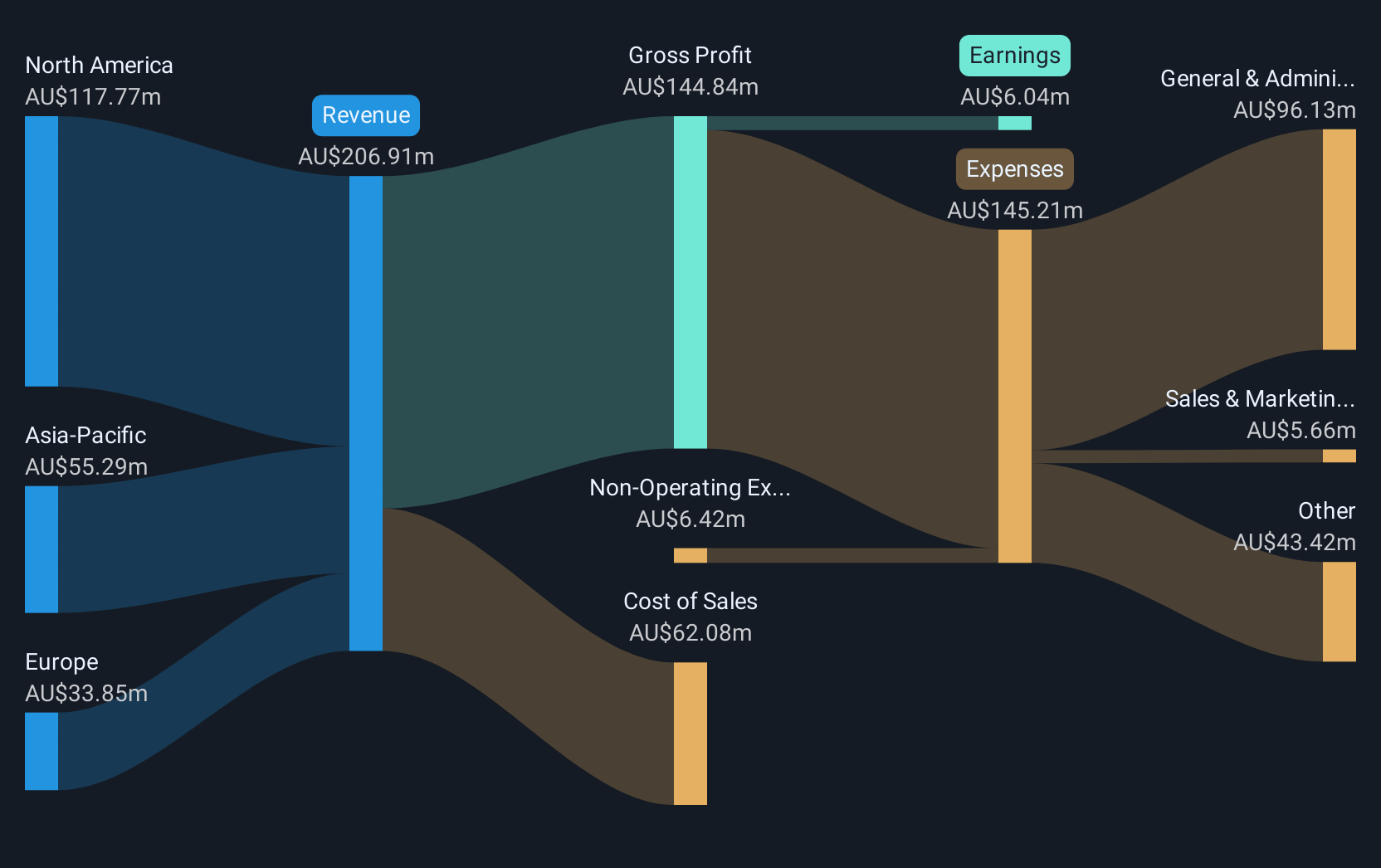

Operations: The company generates revenue from on-demand interconnection and internet exchange services, with significant contributions from North America (A$117.77 million), Asia-Pacific (A$55.29 million), and Europe (A$33.85 million).

At the recent Macquarie Emerging Leaders Conference, Megaport showcased its robust expansion strategy, emphasizing innovations in cloud connectivity and data center interconnects. This aligns with their participation in Connectbase's The Connected World platform, enhancing serviceability across a global network. Financially, Megaport is poised for growth with a revenue increase projected at 12.2% annually, outpacing the Australian market's 5.5%. However, challenges persist as their profit margins dipped to 2.9% from last year’s 4.6%, and earnings saw a decline of 25.9%. Despite these hurdles, the forecast for earnings growth remains strong at an impressive rate of 33.9% per year, suggesting potential resilience and adaptability in navigating market dynamics.

- Click here to discover the nuances of Megaport with our detailed analytical health report.

Explore historical data to track Megaport's performance over time in our Past section.

Qoria (ASX:QOR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qoria Limited is engaged in marketing, distributing, and selling cyber safety products and services across Australia, New Zealand, the United Kingdom, the United States, Europe, and other international markets with a market capitalization of A$543.01 million.

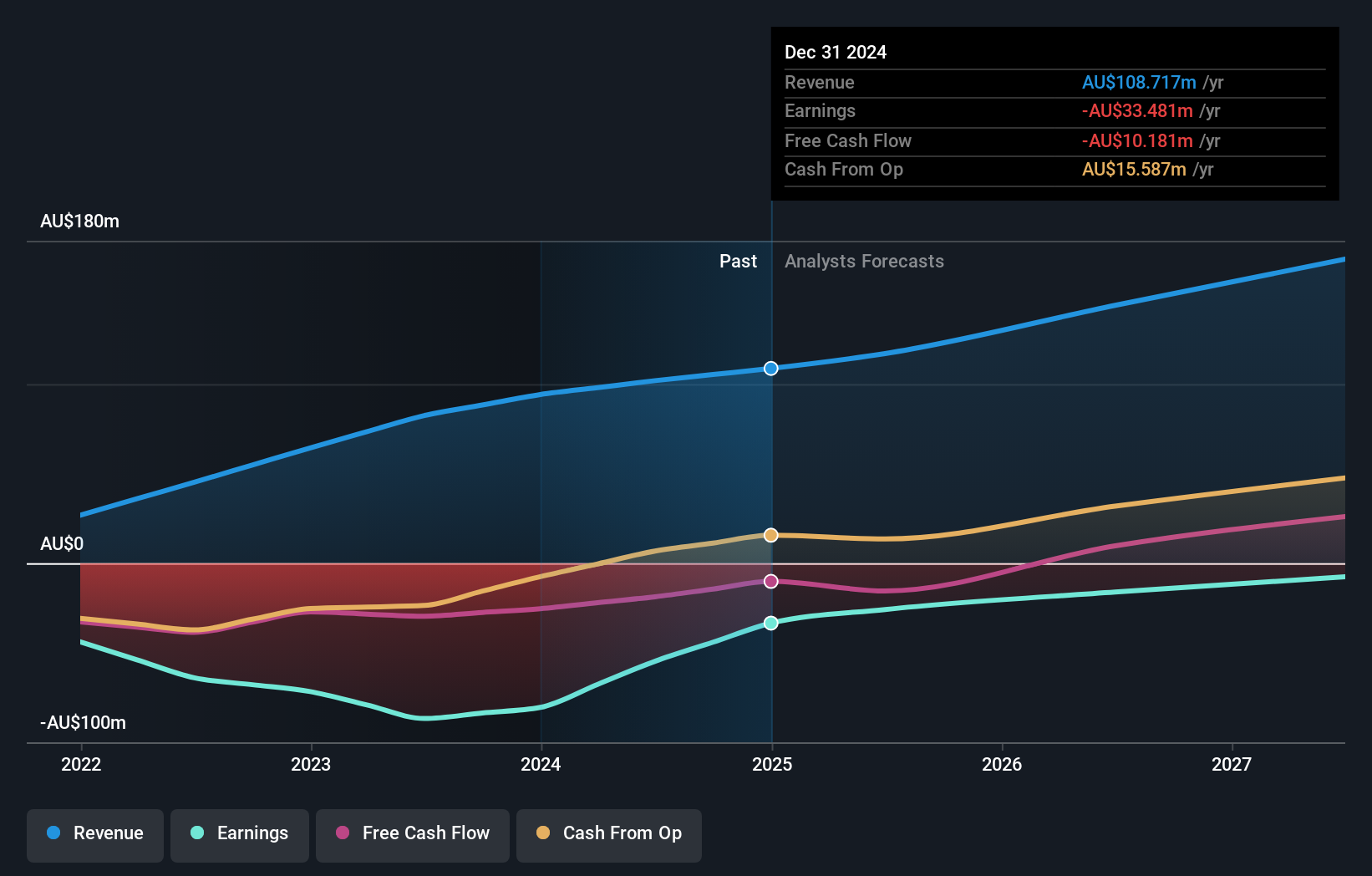

Operations: Qoria Limited generates revenue primarily through its provision of cyber safety services, amounting to A$108.72 million. The company's operations span multiple regions, including Australia, New Zealand, the UK, the US, and Europe.

At the Macquarie Emerging Leaders Conference, Qoria outlined its strategy emphasizing AI and software innovations, a move aligning with industry shifts towards more integrated tech solutions. Despite currently being unprofitable, Qoria is on a trajectory to profitability with expected earnings growth of 58.3% annually. This growth is supported by robust R&D investments which are crucial for maintaining its competitive edge in the fast-evolving tech landscape. Moreover, with an annual revenue increase of 16.1%, Qoria outpaces the general Australian market's growth rate of 5.5%, positioning it well for future advancements in high-tech sectors.

- Dive into the specifics of Qoria here with our thorough health report.

Review our historical performance report to gain insights into Qoria's's past performance.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an Australian company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both domestically and internationally, with a market cap of A$12.92 billion.

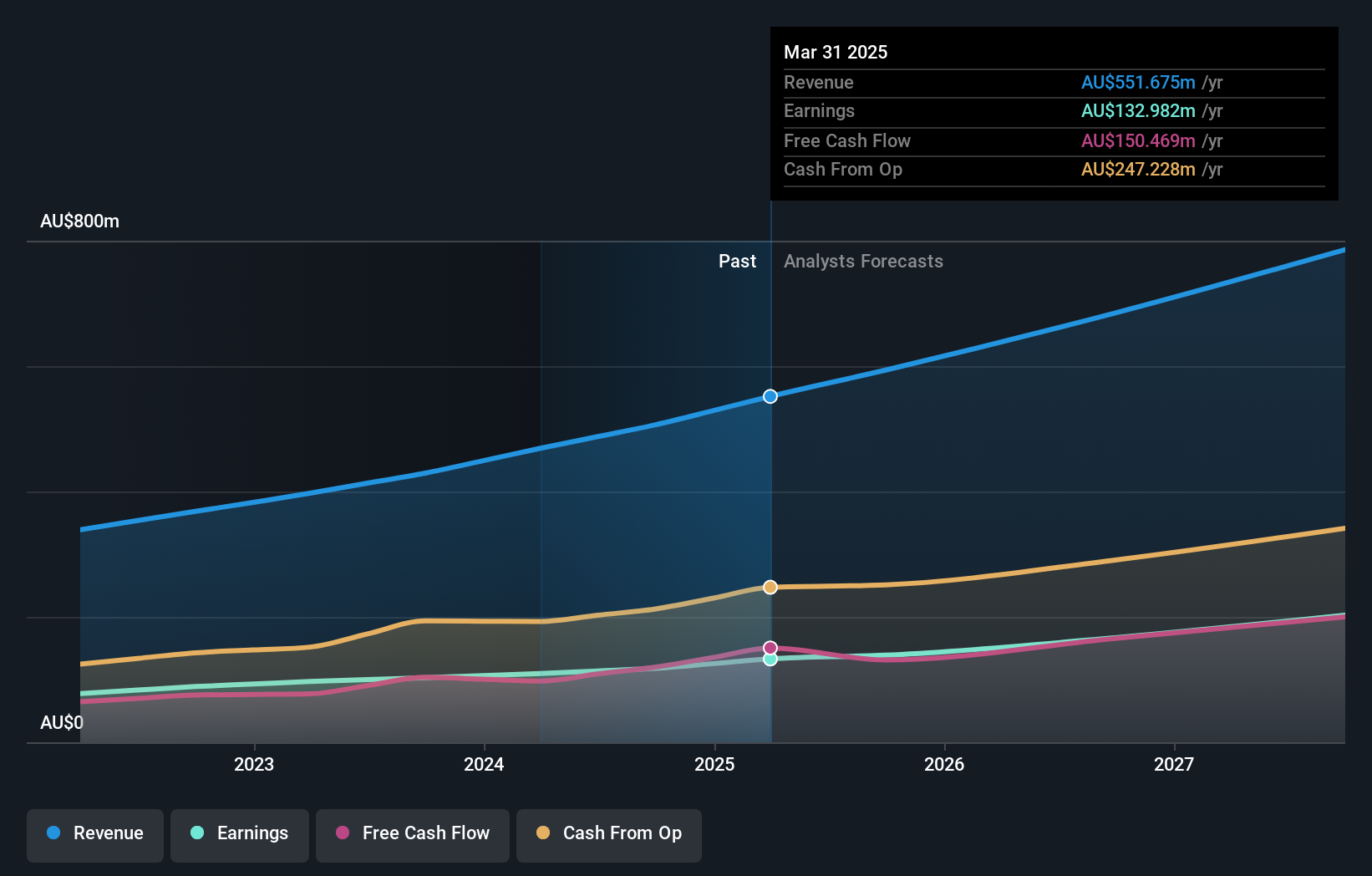

Operations: Technology One Limited generates revenue primarily from its Software segment, contributing A$378.25 million, followed by Corporate at A$90.55 million and Consulting at A$82.87 million.

Technology One, a significant player in the Australian tech sector, has demonstrated robust growth with a 13.1% annual increase in revenue and 16.4% in earnings, outpacing the broader market's averages of 5.5% and 10.9%, respectively. This growth trajectory is underpinned by strategic R&D investments that have not only enhanced its product offerings but also solidified its competitive position within the software industry, where it recently reported a substantial half-year revenue jump to AUD 285.69 million from AUD 240.55 million year-over-year. With recent dividends indicating strong financial health and an earnings call highlighting further progress, Technology One stands poised for continued relevance in high-tech sectors moving forward.

- Take a closer look at Technology One's potential here in our health report.

Evaluate Technology One's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 46 ASX High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives