Easy Come, Easy Go: How Trimantium GrowthOps (ASX:TGO) Shareholders Got Unlucky And Saw 79% Of Their Cash Evaporate

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But serious investors should think long and hard about avoiding extreme losses. So we hope that those who held Trimantium GrowthOps Limited (ASX:TGO) during the last year don't lose the lesson, in addition to the 79% hit to the value of their shares. A loss like this is a stark reminder that portfolio diversification is important. We wouldn't rush to judgement on Trimantium GrowthOps because we don't have a long term history to look at. Shareholders have had an even rougher run lately, with the share price down 58% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Check out our latest analysis for Trimantium GrowthOps

Given that Trimantium GrowthOps didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Trimantium GrowthOps saw its revenue grow by 257%. That's a strong result which is better than most other loss making companies. So the hefty 79% share price crash makes us think the company has somehow offended market participants. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

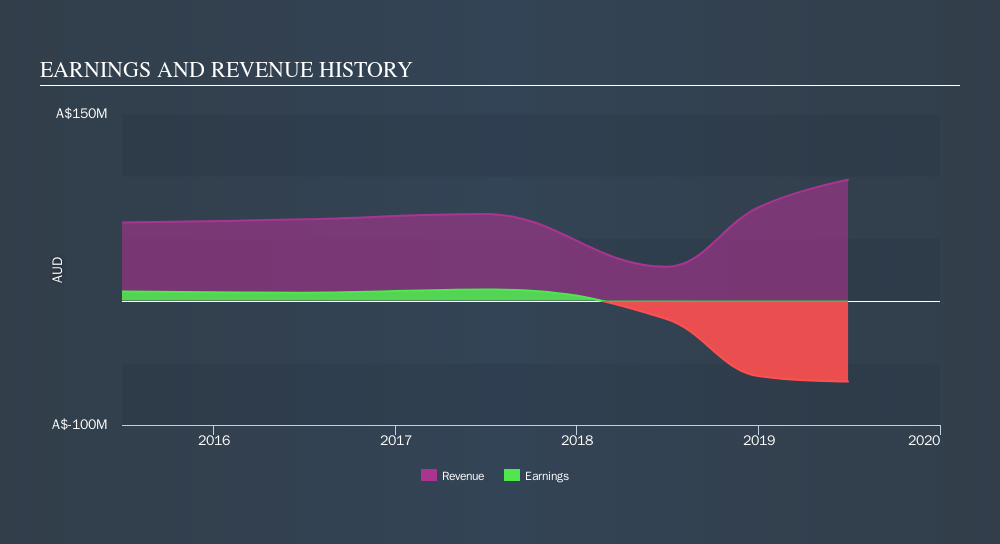

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Trimantium GrowthOps's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 12% in the last year, Trimantium GrowthOps shareholders might be miffed that they lost 79%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 58% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives