- Australia

- /

- Diversified Financial

- /

- ASX:SPT

Splitit Payments (ASX:SPT) Is Using Debt Safely

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Splitit Payments Ltd (ASX:SPT) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Splitit Payments

What Is Splitit Payments's Net Debt?

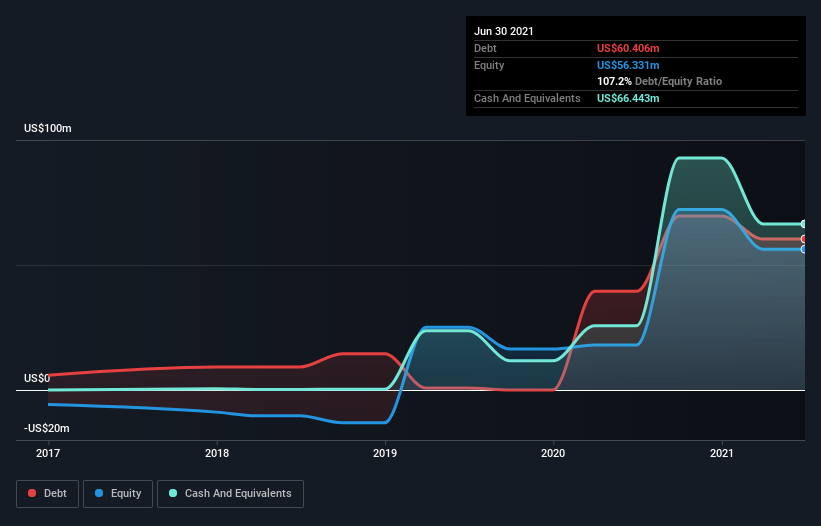

As you can see below, at the end of June 2021, Splitit Payments had US$60.4m of debt, up from US$39.5m a year ago. Click the image for more detail. However, its balance sheet shows it holds US$66.4m in cash, so it actually has US$6.04m net cash.

How Strong Is Splitit Payments' Balance Sheet?

The latest balance sheet data shows that Splitit Payments had liabilities of US$4.30m due within a year, and liabilities of US$60.4m falling due after that. Offsetting these obligations, it had cash of US$66.4m as well as receivables valued at US$52.9m due within 12 months. So it actually has US$54.6m more liquid assets than total liabilities.

This surplus strongly suggests that Splitit Payments has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Splitit Payments boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Splitit Payments can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Splitit Payments reported revenue of US$9.2m, which is a gain of 170%, although it did not report any earnings before interest and tax. So its pretty obvious shareholders are hoping for more growth!

So How Risky Is Splitit Payments?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Splitit Payments had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$49m of cash and made a loss of US$35m. With only US$6.04m on the balance sheet, it would appear that its going to need to raise capital again soon. The good news for shareholders is that Splitit Payments has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. High growth pre-profit companies may well be risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Splitit Payments you should be aware of, and 1 of them makes us a bit uncomfortable.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Splitit Payments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SPT

Splitit Payments

Provides payment solution services in North America, the United Kingdom, Europe, and Australia.

Excellent balance sheet low.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Lynas Rare Earths Will Continue to Surge Alongside The Transition To a Green Future

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Adobe (ADBE): Record Q1 AI-Revenue and the End of the Shantanu Narayen Era

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks